Market instability is increasing once more, as there have been significant drops in the value of several leading stocks. Tesla ( TSLA 0.58% ) and Cognex ( CGNX -0.03% ) have dropped significantly in the past few weeks, while Plug Power ( PLUG -5.29% ) remains in a downward trend that has been ongoing for several years.

The reason behind the drop in sales of these products is as follows. growth stocks and determining if they are a good purchase opportunity when their value has decreased.

Credit: Getty Images.

From an emphasis on growth, to a focus on value, and then back to growth.

Daniel Foelber (Tesla): In the past few years, Tesla’s stock performance has been unpredictable. Traditionally considered a high-growth investment, Tesla’s value has typically been determined by its future earnings and cash flow prospects rather than its current performance. However, the situation shifted towards the end of 2022 when Tesla’s price-to-earnings (P/E) ratio fell below 35, and its forward P/E dropped below 30.

In 2023, Tesla’s stock price is expected to double, bringing its valuation to levels typical of growth stocks. The company seemed to be returning to its previous strong performance, with high operating margins and steady sales growth. Nonetheless, Tesla has been failing to meet investors’ expectations, which is negatively impacting its stock performance.

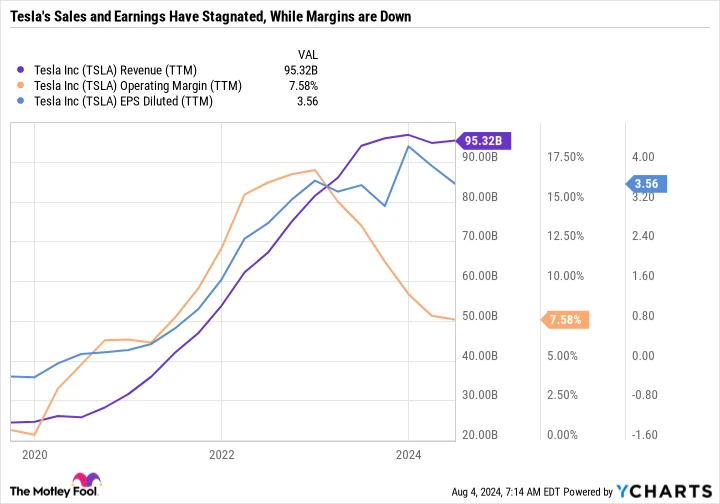

Tesla’s revenue over the trailing twelve months. data by YCharts

The chart clearly shows that revenue and earnings have remained flat, while margins have decreased significantly from their highest points. The rate of electric vehicle (EV) adoption is also evident. has slowed Tesla is shifting its focus from promoting affordable electric vehicles and the transition away from internal combustion engines to discussing more ambitious concepts such as robotaxis, robotics, artificial intelligence, and the Optimus robot in its recent earnings calls.

Morgan Stanley Adam Jonas is an analyst. placing importance on the primary automotive industry With each share priced at $59 and the entire company valued at $310 per share, Tesla bulls may not be concerned as the price target suggests a potential 50% increase in stock price. However, for those who are doubtful about Tesla’s capability to profit from its ambitious projects, there is a substantial risk of the auto business being valued at less than one-third of its current worth.

In the past, Tesla’s value was determined by its ability to sell electric vehicles to the mainstream market. As a result, the company has been a successful long-term investment and has made a significant impact on the worldwide automotive sector. However, the current rationale for investing in Tesla has evolved. While its growth is decelerating and it has a high P/E ratio of 58.5, purchasing Tesla shares at this point is essentially a wager on its innovative capabilities. Fortunately, Tesla possesses a strong financial position and is capable of generating sufficient free cash flow to support its visionary projects.

Tesla differs significantly from a new and growing startup that has the option to borrow money or reduce its ownership in order to finance projects. Tesla has the resources to make significant advancements, but if the success of these advances is the foundation of its investment strategy, it will require at least one major success.

If you are open to taking risks with Tesla, purchasing the stock at this time could be a good idea. However, if you prefer a more stable investment, exploring other options may be a wiser decision.

Short-term vulnerability is presenting a chance to purchase Cognex.

Lee Samaha (Cognex): The machine vision company generates its revenue from the capital spending plans of its customers. It is advantageous for the company when its customers’ industries are experiencing growth and increasing the production of smartphones and automobiles. EVs Nevertheless, it becomes quite difficult for companies like these to thrive when the demand for their products is low, leading them to prioritize scaling back their expansion strategies.

Regrettably, this year has been challenging, with management indicating a deteriorating situation during the second-quarter earnings call. The company’s logistics and semiconductor sectors are performing well, but its traditional automotive and electric vehicle battery divisions seem to be declining further instead of stabilizing. CEO Rob Willett expressed caution about investing in consumer electronics in 2024.

When purchasing a stock, you are essentially investing in its worth rather than expressing an opinion on its short-term future. deep discounts The rise in stock prices presents a chance to purchase, considering the company’s projected long-term expansion. It is widely believed that automation and machine vision will dominate the manufacturing industry in the future, with products becoming increasingly intricate. Manufacturers are seeking to enhance quality control and efficiency by implementing automated procedures that utilize machine vision.

Historically, Cognex has experienced fluctuating but consistently increasing revenue growth over the long term, making it a favorable investment opportunity during periods of investor pessimism, such as the current situation.

Plug Power has experienced consistent growth in revenue… however, there are additional factors to consider.

Scott Levine (Plug Power ): With a decline of over 81% in the last year, the Plug Power stock has caught the attention of investors seeking undervalued growth opportunities. Looking back at the performance of this hydrogen stock in the past three years, where it has decreased by more than 90%, it may appear even more attractive for potential buyers. Despite the opportunity to purchase shares at a lower price, investors are advised not to make hasty decisions.

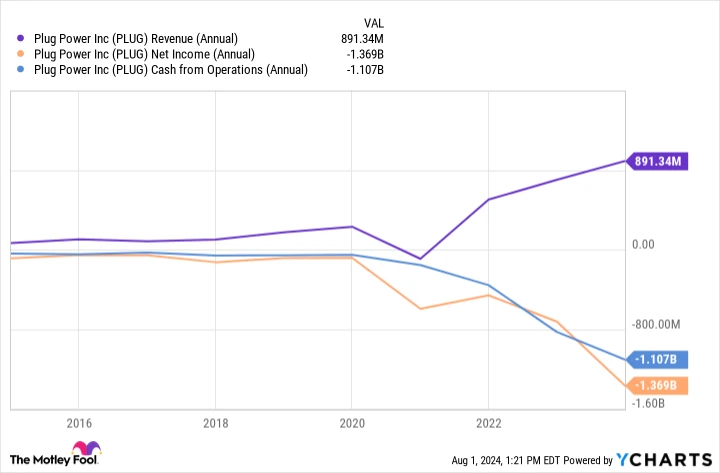

Plug Power has been successful in convincing more customers to purchase its fuel cell and hydrogen products, as evidenced by its revenue of $891.3 million in 2023, which was a 27% rise from the previous year. However, the company’s challenge lies in its profitability and cash flow, as it has not been able to achieve the same level of growth in these areas despite its revenue gains.

Annual revenue generated by PLUG. data by YCharts .

As a result, it has consistently depended on raising funds by issuing both debt and equity to ensure the company’s operations continue. This was most recently shown when the company made an official statement 78 million shares would be offered for sale in order to generate approximately $200 million.

Investors should seek opportunities elsewhere until the company demonstrates consistent and substantial progress in attaining profitability and generating positive cash flow. stocks of hydrogen or stocks that are expected to experience growth.