Describing the past year as challenging for investors. Ginkgo Bioworks is a company specializing in biological engineering. ( DNA -13.85% ) Describing the situation as an understatement would not do it justice. By August 14, the synthetic-biology company’s shares had plummeted by 86% in 2024.

The stock market has indicated low expectations in ways other than just a decreased price. Ginkgo stock has been consistently trading at a significantly low value. The total value of a company’s equity and debt, representing the overall worth of the business. .

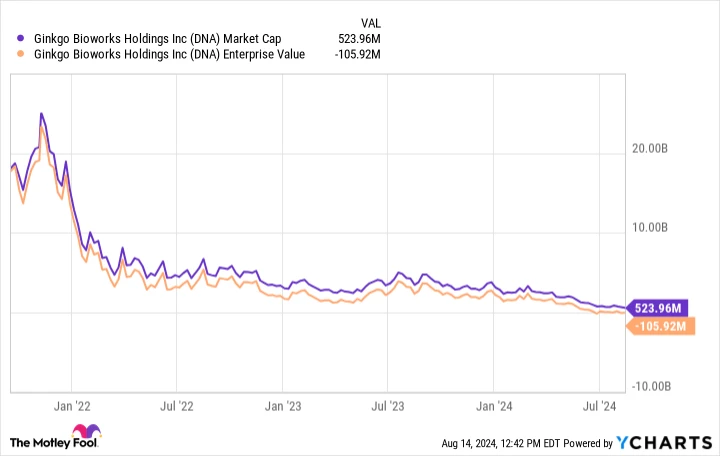

The company has no debt and ended June with $730 million in cash and cash equivalents. However, the stock price has dropped significantly, allowing you to purchase all outstanding shares for only $524 million at current prices.

DNA market cap data by YCharts.

Buying a modern life science company for less than its cash value may appear to be a great deal. However, stocks typically do not have negative enterprise values unless there is a strong belief that significant losses are imminent.

We should compare the factors that make Ginkgo a good purchase with the reasons to stay away from the stock, in order to determine if it is a good deal at its reduced price.

Ways in which Ginkgo stock could exceed expectations

Ginkgo Bioworks is a leading company in the growing synthetic biology industry. It is contracted by other businesses to engineer new microorganisms like yeast and bacteria that can create valuable substances like innovative medicines, food additives, and chemicals that are typically sourced from petroleum.

The automated foundry of the company is reducing expenses related to designing new organisms. Ginkgo has more benefits compared to its competitors beyond just the reduced foundry costs. It gathers data each time it uses its foundry, allowing it to analyze the data in the future to improve its operations further.

Despite not being profitable yet, the company plans to cut costs by reducing its staff. In June, the company initiated a layoff of 35% of its employees, which is expected to decrease annual operating expenses by approximately $85 million by the end of 2026.

In the second quarter, Ginkgo initiated 18 new cell-engineering projects. While the terms of these contracts differ, many offer potential for future revenue. Although not all projects may be successful, achieving milestones and receiving royalties from a select few could significantly boost total revenue.

What is causing the decline in the stock price?

Ginkgo Bioworks’ stock prices have been plummeting due to the company’s significant financial losses, resembling those of a young, rapidly expanding startup striving to increase its market presence. The situation would be more manageable if the company’s revenue was surging, but in reality, it is experiencing the opposite trend.

During the first six months of 2024, Ginkgo’s total revenue dropped by 42% compared to the previous year. Although total operating expenses went down, the reduction was insufficient, resulting in a significant loss of $383 million for the company in the first half of the year.

Reducing the number of employees is a necessary decision, but it is only a temporary solution to a much larger problem. With the current rate of spending, Ginkgo will have to seek additional funding from investors well before the anticipated $85 million in annual savings from the recent staff cuts are realized.

A bargain now?

The stock’s value has declined to a point where the enterprise is in a negative position, but it will only be a good deal if you anticipate it to stop losing money and start making a profit in the near future. However, it appears improbable that this will happen.

Established in 2008, Ginkgo had finished 129 projects and had 140 ongoing programs by June 30. Significant payments and royalties would be expected to be disclosed if its services were highly appreciated by its clients.

Unfortunately, royalties continue to make up an insignificant portion of the overall revenue. Additionally, there have been no milestone payments reported by the company this year.

Lately, the management has started eliminating the downstream value share from specific program categories. While this seems like a positive move towards achieving stable cash flows, it does not necessarily make the business a prudent investment choice at this time.

Although Ginkgo Bioworks stock may appear undervalued with a negative enterprise value, it is not recommended as an investment. It is advisable to steer clear of this stock until it starts showing positive financial results.