Despite the impressive surge in the overall market last week, large-cap growth stocks have continued to suffer losses over the last month. Microsoft , Alphabet , Amazon , Nvidia , and Tesla Stock prices have decreased by 13% to 28% from their highest points in the past year, which were mainly reached earlier in the summer.

Here is the reason why investors seeking a comprehensive strategy for purchasing growth stocks might want to take into account. ETFs (ETFs) — and certain considerations they need to keep in mind prior to investing in these cost-effective financial instruments.

Picture credit: Getty Images.

Placing a wager on the top choice.

The Vanguard Mega Cap Growth ETF can be rephrased as “ETF focused on large-cap growth stocks offered by Vanguard.” ( MGK 0.22% ) , Vanguard S&P 500 Growth ETF is a fund that tracks the performance of large-cap U.S. stocks with strong growth potential. The stock ticker symbol for the Vanguard S&P 500 Growth ETF listed on the New York Stock Exchange (NYSE) is VOOG. , and Vanguard Growth ETF can be rewritten as Vanguard’s ETF that focuses on growth. (NYSEMKT: VUG) Vanguard’s low-cost funds have been among the top performers in recent years. However, due to their heavy focus on leading growth companies, all three funds have experienced significant losses in the last month.

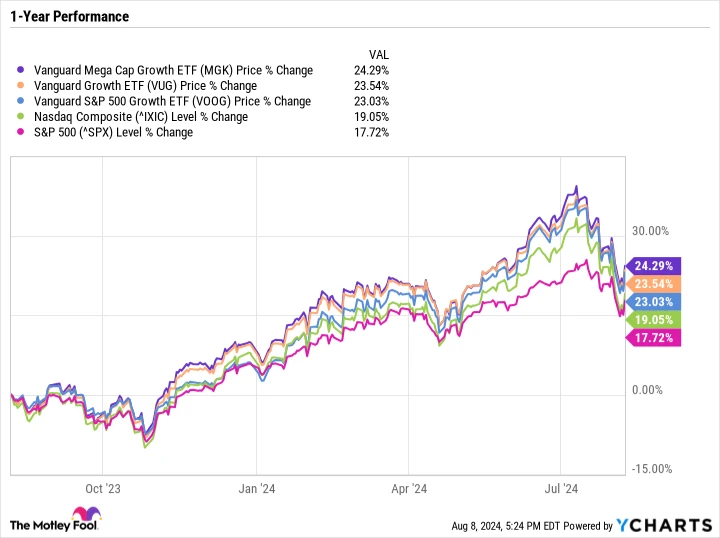

Even with the recent decrease in value, the performance of all three Vanguard ETFs has been better than expected. The Nasdaq Composite index and S&P 500 In the past year.

The chart illustrates that the funds have very similar performance levels. They also share comparable expense ratios, which fall between 0.03% and 0.1%. The primary distinction lies in the quantity of stocks held within each fund.

The Vanguard Mega Cap Growth ETF contains 71 different investments, while the Vanguard Growth ETF holds 188, and the Vanguard S&P 500 Growth ETF includes 232 holdings. A higher number of holdings indicates greater diversification within the fund and reduces the focus on the largest companies.

Although there is a slight variation in the overall context, as all three funds have a significant emphasis on their largest investments and minimal emphasis on their smallest ones, one fund might be more suitable for you depending on your investment goals.

Large technology-focused companies with high market capitalization have played a significant role in pushing the overall market to record levels. The substantial exposure to stocks such as Nvidia, which is almost twice as much as the S&P 500, has greatly benefited three Vanguard funds. However, this heavy reliance on such stocks also exposes them to significant risk of sudden declines.

The disadvantages of investing in growth stocks

The recent decrease in the value of many large-cap growth stocks serves as a good example of how diversified investment options such as ETFs can still experience high levels of volatility.

For instance, the Vanguard Mega Cap Growth ETF has a significant focus on Nvidia, accounting for 11.7% of its holdings. Nevertheless, it also holds substantial positions in other semiconductor companies and firms heavily involved in utilizing Nvidia chips. Therefore, if Nvidia experiences a significant decline due to market or economic factors (rather than internal issues), it is likely that many other stocks will also experience a sell-off.

Similarly, a decline in a stock such as Microsoft has the potential to initiate a wider decline in other enterprise software companies. The same applies to Amazon, as its performance could also impact other companies in the cloud infrastructure sector.

Some of the major errors made in the stock market Portfolio mismatches happen when investors do not match their investments with their risk tolerance. It is simple to benefit from a strong market, but what occurs if a stock that you have strong faith in and a significant holding in experiences a substantial drop in a short timeframe?

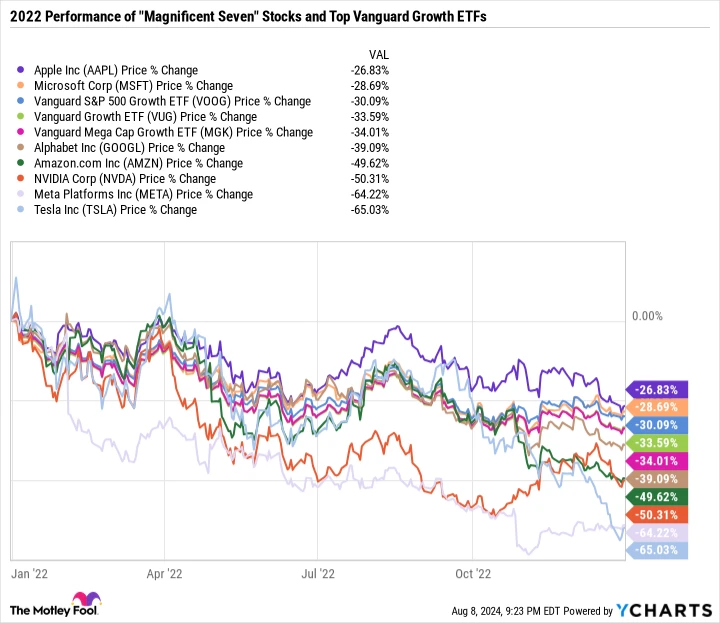

Growth stocks have the ability to achieve this; even the most reputable and valuable companies have demonstrated this in recent years. For example, in 2022, many leading growth stocks have shown significant growth. “Seven splendid individuals” — experienced significant financial setbacks. During autumn of 2022, Meta Platforms It dropped to less than $100 per share in the past. Currently, the price is approximately $500 per share.

The main point to learn from this is that growth stocks can experience rapid increases in value as well as significant drops. The important thing is to choose to invest in companies that can withstand a decrease in growth and remain invested during times of market instability. Opting for a growth-focused ETF can help guarantee that you do not overlook the opportunity to invest in a major market player such as Nvidia. ETFs are convenient investment tools that can be gradually added to over time.

One of the most important benefits of investing in a growth ETF is that it can prevent the self-doubt that often arises during a significant market decline.

In the case of Meta Platforms, the company was spending huge amounts of money each quarter on developing the metaverse through its Reality Labs division, all while facing a significant risk from TikTok potentially decreasing user activity on Instagram. Meta Platforms had numerous uncertainties, and the information provided by management during conference calls did not offer much comfort.

Deciding to focus on the negatives and sell the stock seemed reasonable at the time, but looking back, it turned out to be a significant error. Meta has successfully dealt with its obstacles and is now considered one of the top performers. Top growth stocks that are well-rounded and suitable for investment today Due to its profitable business model, enhancements to the product, and valuation.

An ideal beginning for investors comfortable with taking risks.

Owning any of the three Vanguard ETFs that were mentioned can help investors better handle times when a specific company is facing challenges. Additionally, a key advantage is that the minimum investment required for all three funds is only $1, allowing for diversification without needing to invest a large amount of money in the market. In contrast, purchasing a full share of most high-growth stocks would require a significantly larger investment.

Although Vanguard growth-focused ETFs have their benefits, they may not be suitable for individuals with a low tolerance for risk or those who prioritize preserving capital over accumulating it. Vanguard provides these ETFs. ETFs that prioritize value. , but it may be beneficial to take into account best performing stocks in terms of dividends having a history of withstanding fluctuations and increasing their dividends.