During the initial financial update with Matt Bromberg as the recently appointed CEO, Unity Software ( U -2.80% ) The company reduced its projected earnings for the year and aimed to readjust the anticipated outcomes. This is part of the strategy to improve the company’s performance, as its stock has dropped by more than 60% in 2024.

We should carefully examine Unity’s latest financial report and consider the possibility of a positive change in direction.

Cutting advice

Unity encountered difficulties last autumn when it attempted to implement a new pricing model including a “Runtime Fee” linked to the quantity of users installing games created with its software. This decision faced backlash from customers, leading the company to retract the plan. However, the incident resulted in numerous game developers feeling upset and hesitant to rely on the company.

Unity attempted to reorganize by downsizing its staff by approximately 25% while discontinuing unprofitable ventures. Following this, the company aimed to concentrate on business sectors that would generate the greatest value for its clients and ensure profitability.

Unity’s recent announcement of reduced guidance represents another reevaluation of the company’s business strategy.

The company reported a 16% decline in revenue to $449 million in the second quarter compared to the previous year. It stated that revenue from its main strategic operations decreased by 6% to $426 million.

Income generated from the Create Solutions division, utilized by developers to design games and applications, increased by 4% to reach $128 million. Notably, the industries sector within this segment showed the highest growth with a 59% increase in revenue. This particular sector focuses on serving customers outside the gaming industry who are interested in developing augmented and virtual reality experiences and applications. Additionally, there was a 14% increase in gaming subscriptions.

On the other hand, the Grow Solutions division experienced a 9% decrease in revenue. This sector focuses on providing advertising services to assist gaming app companies in both acquiring and generating revenue from customers.

In the future, the company revised its annual revenue projection to be between $1.68 million and $1.69 million, down from the previous estimate of $1.76 million to $1.8 million. It also adjusted its earnings before interest, taxes, depreciation, and amortization. (EBITDA) The company has revised its forecast to be between $340 million and $350 million, down from the earlier estimate of $400 million to $425 million. This adjustment is due to a more conservative approach to the expected growth of its Grow Solutions division.

Source of the image: Getty Images.

Is the company capable of undergoing a turnaround?

Under the leadership of the newly appointed CEO, Matt Bromberg, Unity has made changes to its guidance to allow for the execution of its strategy to enhance its products and regain customer trust. Nevertheless, this undertaking will be challenging. Despite facing backlash from customers due to the controversial “Runtime Fee” incident last year, Unity’s game engine, Create Solutions, has demonstrated resilience.

One of the major issues lies in its advertising business, Grow Solutions, as it is facing tough competition and losing market share. AppLovin ( APP 1.74% ) AppLovin’s software platform business has experienced significant expansion in the last year, in sharp contrast to Unity’s declining business. Despite contributing to the growth of gaming expenditure, AppLovin seems to be capturing market share from Unity.

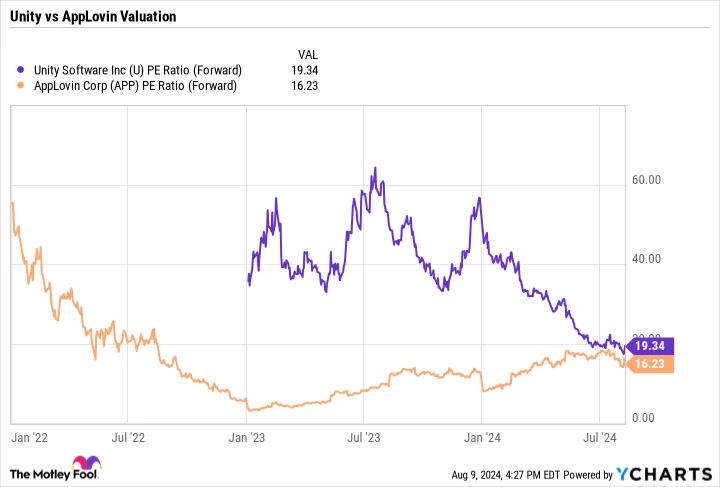

Trading at a price-to-earnings ratio (P/E) calculated based on the future expected earnings of a company Unity’s stock is considered reasonably priced if the company can successfully turn around its performance. On the other hand, AppLovin is trading at a lower valuation and is expected to achieve about 30% revenue growth in the next quarter, while Unity is projecting a 4%-6% decline in core business revenue for Q3.

Forward Price-to-Earnings (PE) Ratio data by YCharts

Establishing modest goals and surpassing them can potentially boost a company’s stock value in the short to medium run. Therefore, Unity may experience some price increases if it can consistently outperform these modest expectations. However, currently, I lean towards AppLovin as a preferable investment option due to its recent robust growth, effective execution, and more attractive valuation.