Contents

The Dollar Store Duel: Dollar General vs. Dollar Tree

The retail sector, particularly the dollar store niche, often appears homogeneous to investors. Over the past decade, the stock performance of Dollar General and Dollar Tree has mirrored each other closely. However, I am convinced that Dollar General will outshine Dollar Tree over the next five years, despite their similar trajectories.

The Power of Earnings Growth

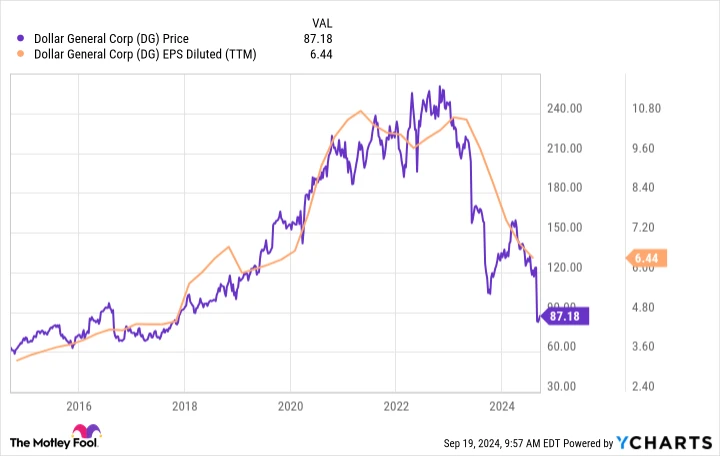

Skepticism abounds when it comes to predicting stock movements. While it’s true that the future is unpredictable, one reliable indicator stands tall: rising earnings tend to drive stock prices upward. This correlation is evident in Dollar General’s 10-year chart, where its earnings per share (EPS) and stock price have moved in tandem.

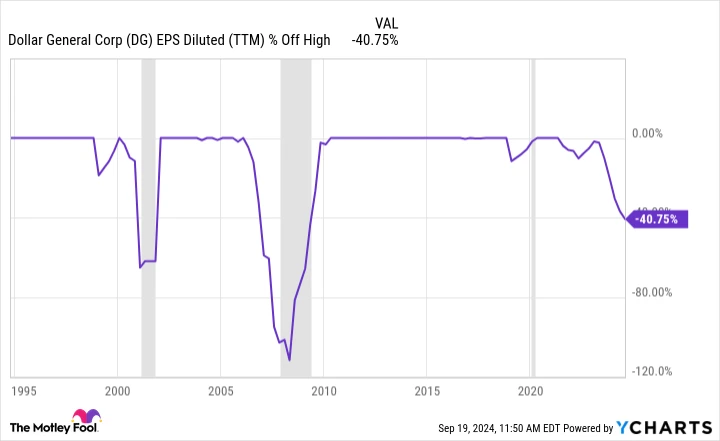

Currently, Dollar Tree and Dollar General stocks have plummeted 57% and 67%, respectively, from their peak values. Dollar Tree is grappling with a trailing 12-month net loss, while Dollar General’s EPS has nosedived by over 40%. The drop in stock prices aligns with the decline in profits, underscoring the significance of predicting earnings for these companies. I foresee Dollar General as the superior choice, with prospects of substantial earnings recovery and enhanced shareholder returns.

Debunking the E-commerce Myth

A pervasive narrative suggests that e-commerce is devouring the market share of traditional retailers like Dollar General and Dollar Tree. This belief is often backed by Amazon’s robust financial outcomes. However, the reality is different. According to Dollar Tree’s 2024 second-quarter report, the company has welcomed nearly 3 million new shoppers in the past year. Although Dollar General hasn’t released similar statistics, its growth in same-store sales contradicts the e-commerce threat.

Amazon’s retail segment is also witnessing a shift, with consumers opting for more affordable items—a trend mirrored by Dollar Tree and Dollar General. Both companies have observed that customers, constrained financially, are prioritizing essential purchases over discretionary ones. This behavior shift doesn’t equate to losing customers but rather adapting to their changing needs.

Projecting Profits: What’s Next?

Dollar General anticipates its full-year EPS to settle at a minimum of $5.50, a significant drop from previous forecasts. However, there are signs that the company’s earnings may have bottomed out. J.P. Morgan Research indicates a growing possibility of a recession before year’s end, with a 35% probability. Dollar General’s historical earnings trends align with this, often dipping right before a recession.

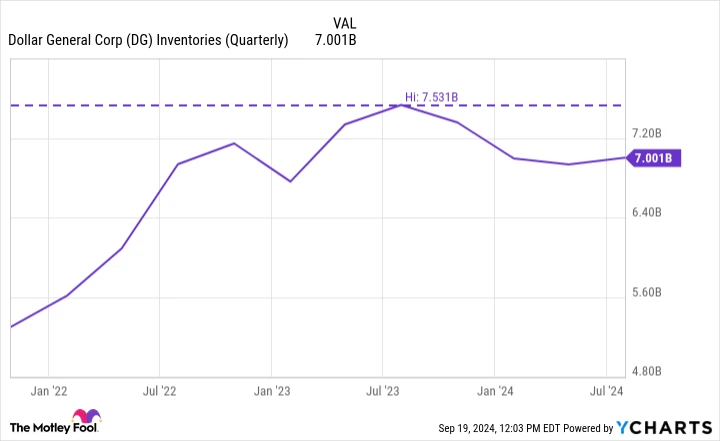

Economic data typically lags behind real-world changes, meaning consumer behavior shifts before official statistics capture the trend. Therefore, Dollar General’s financial recovery often precedes official recession conclusions. Furthermore, the company is tackling internal issues that have dented profits, such as excess inventory leading to markdowns and losses. The return of former CEO Todd Vasos is aimed at rectifying these challenges, with inventory levels gradually normalizing.

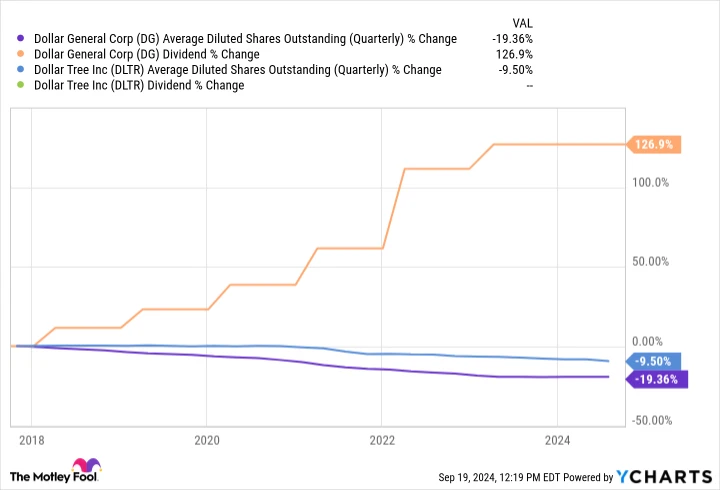

As consumer spending rebounds, both Dollar Tree and Dollar General are likely to see profit improvements. However, Dollar General may gain an additional edge from resolving its inventory problems. Additionally, Dollar General’s history of returning more capital to shareholders sets it apart. While both companies repurchase shares, Dollar General’s rapidly growing dividend offers an extra incentive.

Conclusion: A Promising Future for Dollar General

In summary, the core concept of dollar stores remains robust, with current consumer behavior shifts driven by economic conditions. As these trends potentially reverse, Dollar General may benefit significantly, especially by addressing its inventory challenges. While Dollar Tree is poised to experience similar advantages, Dollar General’s consistent shareholder returns position it as a more attractive investment today.

Investment Considerations

Before investing in Dollar General, it’s worth noting that The Motley Fool’s Stock Advisor team has identified ten stocks they believe are prime investments now, and Dollar General is not among them. The selected stocks have the potential for substantial returns, as evidenced by the inclusion of Nvidia in April 2005, which would have turned a $1,000 investment into $710,860.

Stock Advisor provides a comprehensive investment strategy, with regular updates and new stock recommendations, offering a return more than four times that of the S&P 500 since 2002.

Explore the top 10 stocks ›

Stock Advisor returns as of September 17, 2024