Following Warren Buffett can be a wise decision. As the iconic investor and head of Berkshire Hathaway, Buffett has proven to be the most successful investor of our era, delivering substantial returns for those who align their investments with his. His buy-and-hold philosophy is a reliable approach to wealth accumulation, even amidst the digital age and the surge of algorithmic trading.

Among Buffett’s enduring investments is American Express (-3.09%), a financial titan he has held for decades. As Buffett’s third-largest holding by market value, American Express has outperformed Visa and Mastercard over the last five years. Here are three compelling reasons to consider adding American Express to your investment portfolio and holding onto it indefinitely.

Robust Brand

American Express has maintained its brand prestige over the years. Since its inception in 1850, the company has transformed into one of the few vertically integrated credit card networks in the United States. It specializes in offering premium, high-fee credit cards to affluent customers who tend to spend more. By managing its own network, American Express can secure exclusive deals and benefits for its users, like airport lounge access, setting it apart from most other credit cards.

This brand strength has proven resilient, adapting to modern demands over the decades. With over 144 million cards in circulation and an addition of 3 million new cardholders each quarter, American Express continues to lead in the credit card industry due to its long-standing brand development as a premium global service.

Inherent Inflation Hedge

American Express is renowned for its high-fee offerings, such as the platinum card, which carries an annual fee near $700. Yet, these fees constitute only 13% of the company’s total revenue. More than half derives from interchange fees, which are a percentage of every dollar spent on its network, ranging from 2.5% to 3.5%. This is higher compared to Visa and Mastercard, thanks to American Express’s high-spending clientele. Merchants may opt out of accepting American Express, but they risk losing a lucrative customer base.

The beauty of this fee model is its scalability with inflation. For example, if a high-end restaurant meal that once cost $100 now costs $250, American Express earns a larger fee while doing little extra work. Should this meal cost $1,000 in 30 years, the company will gain an even larger share of the transaction. This applies similarly to hotel stays, airline tickets, and fuel purchases, making the credit card fee model one of the most robust business strategies globally.

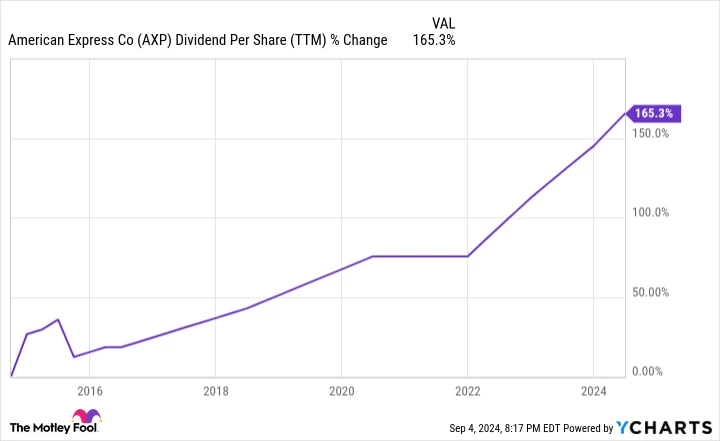

Growth in Dividends

In addition to its solid business foundation, American Express has a reliable management team that consistently returns capital to shareholders through dividends and stock buybacks. Over the last decade, the dividend-per-share payout has surged by 165% and shows no signs of slowing. Currently, the company distributes $2.60 per share annually. With Berkshire Hathaway holding 151.61 million shares of American Express, it brings in nearly $400 million in dividend income each year, a figure set to grow as dividends continue to rise in the future.

American Express is a fortress of a franchise. Its brand is resilient and appeals to high-income consumers who are less affected by economic downturns. The company’s business model offers a natural hedge against inflation, and management is committed to returning capital to shareholders. These are three outstanding reasons to invest in American Express stock and keep it in your portfolio for the long term.