Investors frequently opt for U.S. defense stocks due to their association with stable companies. The U.S. government is a dependable buyer, and there is a constant rise in demand for defense spending worldwide due to ongoing geopolitical tensions. Additionally, stocks in this sector Lockheed Martin is a global aerospace and defense company. ( LMT -0.01% ) have a tendency to increase the amount of dividends they pay out.

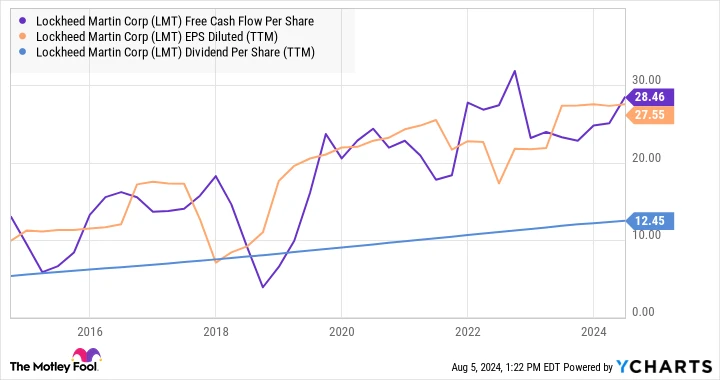

The table provided displays the dividend, earnings, and free cash flow per share ratios of the stock, illustrating the extent to which the dividend is supported.

The amount of cash available to the company after all expenses have been paid, on a per share basis. data by YCharts

Distribution of dividends in the year 2024

The health insurance will be maintained through 2024. A company that specializes in providing defense-related products or services. The dividend paid per share every quarter is $3.15, with a yield of approximately 2.3%. The projected earnings per share for 2024 is expected to be around $26.35, with a dividend per share of $12.60. The total payout for this year is estimated to be $3.04 billion, while the forecasted free cash flow for 2024 ranges from $6 billion to $6.3 billion according to management.

Put simply, Lockheed Martin intends to distribute just under half of its earnings and cash flow as dividends. This dividend payout ratio leaves space for expansion, especially if Lockheed Martin can sustain its historical trend of increasing earnings and cash flow.

It appears probable, but investors should refrain from hastily assuming that the rise in defense orders will directly lead to speedy growth in earnings and cash flow. as I mentioned earlier Numerous defense companies, such as Lockheed Martin, are facing challenges in increasing their profit margins because of fixed-price projects that were agreed upon in times of low inflation.

Lockheed Martin is expected to be a steady dividend grower rather than an exceptional one, which could be appealing to many investors.