Shares of Nvidia ( NVDA -1.52% ) The stock experienced a significant increase on Tuesday, rising by as much as 6.2%. By 1:33 p.m. ET, the stock was still showing a gain of 5.7%.

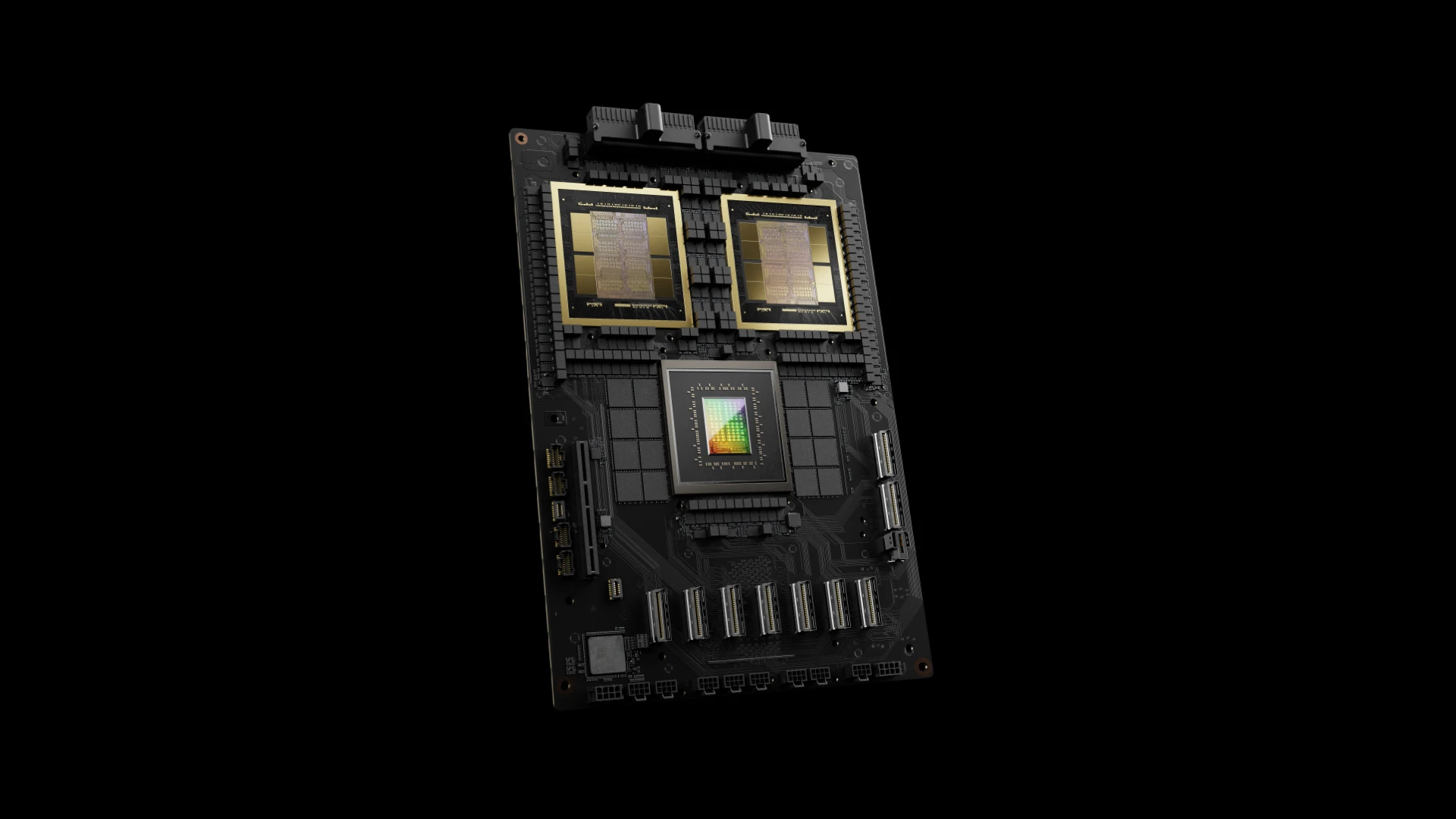

The factor that propelled the chip manufacturer and machine intelligence Experts have indicated that the anticipated delays of the Blackwell AI processor are not expected to be as severe as initially thought.

There are large sums of money involved.

At the beginning of this month, reports indicated The highly anticipated Blackwell B200 AI processor from Nvidia, expected to be released later this year, is facing a delay of up to three months due to a design issue, as reported by The Information website.

Investors became understandably worried about the significant sales potential of the upcoming AI processor, leading to a decrease in stock value following the report.

Nevertheless, the situation might not be as dire. Analysts at UBS After conducting research, it is argued that the Blackwell chip shipments are facing delays of approximately four to six weeks, which would push the delivery to late January 2025. Despite this setback, the demand for the chips is high, and it is anticipated that Nvidia’s H200 processor will meet the demand during this brief delay, as stated in a communication to clients by the analyst. UBS recommended that both research laboratories and corporate customers are actively investing in artificial intelligence, which are positive signs for the market.

A journey of considerable distance ahead.

Nvidia investors should remember that the company’s expansion, especially in the field of artificial intelligence, will not be consistent but rather occur intermittently. Examining Nvidia’s stock performance, it becomes evident that despite a remarkable 24,000% increase in the last ten years, there have been several instances where the stock value plummeted by 50%. or more .

Investors who can tolerate the sometimes intense fluctuations that accompany holding this fast-growing stock have reaped significant benefits. Furthermore, it is essential to overlook the daily movements of the stock market to enjoy these rewards.

Although Nvidia may appear to be expensive with a forward earnings multiple of 42, I believe it is a justifiable valuation for a company that is producing significant profits. growth that is in the hundreds of percentage points leading the way in the AI revolution.