On Aug. 13, Starbucks stunned investors worldwide by appointing the CEO of Chipotle Mexican Restaurant ( CMG 0.49% ) as its upcoming CEO. Brian Niccol has been at the helm of Chipotle since 2018, during which he managed significant enhancements throughout the company.

Certain investors may believe that this hiring is being exaggerated. However, it’s worth noting that Starbucks went to great lengths financially to attract Niccol from Chipotle. Business Insider reports that Niccol’s total compensation package could amount to as much as $113 million in the upcoming years. This is remarkable and demonstrates the high value some companies place on him.

Here’s what occurred at Chipotle during his leadership and what investors should consider doing now that he is departing.

Why Chipotle’s stock price surged under Niccol’s leadership

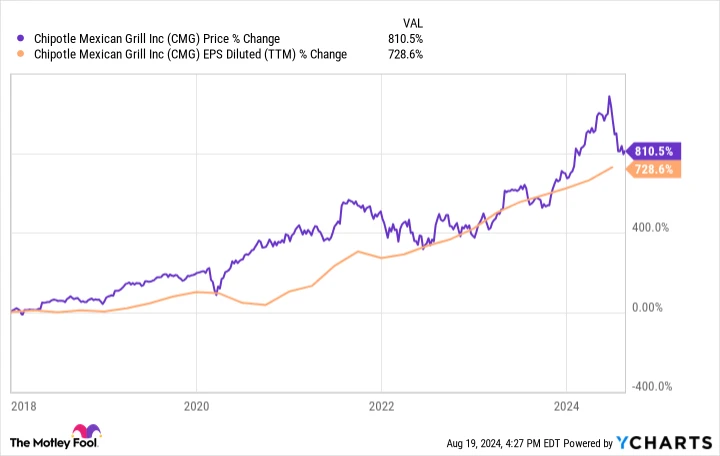

In its press release, Starbucks promptly pointed out that Chipotle’s stock had increased by approximately 800% during Niccol’s tenure as CEO. Although short-term fluctuations in stock prices can be attributed to various factors, however, a sustained increase in stock prices over an extended period like the one Starbucks emphasized, typically has a single reason: an increase in earnings.

Chipotle’s graph illustrates a distinct connection. Beginning in early 2018, the company’s profit per share Earnings per share (EPS) have increased by over 700%, which has unsurprisingly driven the significant rise in the stock’s value.

Data by YCharts .

Under Niccol’s leadership, Chipotle launched over 1,000 new outlets, contributing to the rise in the company’s profits. However, the more significant aspect is its profit margins. At the restaurant level, which does not account for corporate expenses, interest income, and other factors, Chipotle achieved a profit margin of almost 19% in 2018. By the second quarter of 2024, its operating margin at the restaurant level had increased to 29%.

Essentially, for every $100 in sales, Chipotle is now earning about $10 more in operating profit compared to when Niccol took over as CEO. This significant increase has greatly enhanced its earnings per share (EPS), contributing to the surge in the company’s stock price.

What should be done now that Niccol is leaving?

Leadership teams in companies often undergo changes, but sudden shifts like this are not the best scenario.

Chipotle is taking the most sensible step by appointing Chief Operating Officer Scott Boatwright as the interim CEO. Boatwright has been with the company for a longer period than Niccol, ensuring that operations are likely to remain stable throughout this transition.

So, if I were a Chipotle shareholder, I wouldn’t be too worried. Niccol definitely made important contributions to the company, but the business can continue to thrive without him and remain steady during this transition.

It’s worth mentioning that Niccol’s tenure at Chipotle wasn’t completely without controversy. While the increase in profit margins has been remarkable, some critics argue that the company has partly achieved this by reducing portion sizes. Niccol responded to this claim during the Q2 earnings call, stating that it’s incorrect. However, many consumers feel that Chipotle’s portions are becoming smaller.

Boatwright and the future permanent CEO who succeeds him will need to address and improve the unfavorable perception of the Chipotle brand. Niccol clarified that the company never directed employees to serve smaller portions, but they have already “focused on and reinforced the idea of generous portions” regardless.

Chipotle anticipates that the profit margin at its restaurant locations will drop to 25% during the third quarter, with the increased portion sizes playing a significant role.

This is something worth monitoring. Under Niccol’s leadership, restaurant-level margins improved, but they are now poised to decrease. Investors need to take into account that the stock’s substantial growth in recent years was driven by increased profits. If margins are likely to shrink, the stock might experience a slight decline in the short term.

In the long run, Chipotle has the potential to generate a significant amount of value for shareholders, it’s not the right moment to sell the stock. However, a lot will hinge on the direction set by the new CEO, so I wouldn’t necessarily begin investing in Chipotle stock today.