For nearly sixty years, Warren Buffett, the CEO of Berkshire Hathaway (-0.99%)(-1.18%), has been one of the most esteemed investors on Wall Street. Under his leadership, Berkshire’s Class A shares (BRK.A) have experienced a staggering cumulative return of over 5,650,000%, earning him a devoted following and the moniker “Oracle of Omaha.”

Both professional and amateur investors eagerly anticipate Berkshire Hathaway’s quarterly Form 13F filing. This document offers insights into the sectors, industries, trends, and individual stocks that Buffett, along with his key associates Todd Combs and Ted Weschler, have engaged with, whether through buying or selling in the most recent quarter.

However, Berkshire’s quarterly operating results or Form 4 filings with the Securities and Exchange Commission occasionally provide a more comprehensive narrative—sometimes revealing unwelcome truths.

Warren Buffett has been selling more equities than buying for the past two years

One of Warren Buffett’s most admirable traits is his transparency. Although there have been instances where he and his team have built significant positions in stocks under confidential treatment—Chubb being a recent example—Buffett generally shares his views on the U.S. economy and stock market openly.

Buffett has repeatedly advised investors against betting against America. He, along with Combs and Weschler, understands that recessions are normal and unavoidable, but they also recognize that periods of economic expansion and bull markets tend to outlast recessions and bear markets.

Despite this outlook, Buffett’s short-term actions don’t always align with the long-term philosophy he and his former right-hand man, Charlie Munger, instilled at Berkshire Hathaway. Munger passed away at the age of 99 in late November.

Lately, Buffett has been actively selling Bank of America (-2.81%) stock. Between July 17 and August 30, Berkshire reduced its stake in BofA by approximately 150 million shares, equivalent to around $5.4 billion.

This $5.4 billion divestiture sends a clear signal of caution to Wall Street and investors.

To start, Buffett has a well-known affinity for financials, and no financial stock has been more favored by him over the past seven years than Bank of America. BofA’s sensitivity to interest rates, combined with CEO Brian Moynihan’s commitment to returning capital to shareholders through dividends and buybacks, has kept Buffett pleased.

Buffett’s decision to offload nearly 15% of Berkshire’s position in Bank of America in just over six weeks indicates significant concerns about the U.S. economy and stock market. Similar to most bank stocks, BofA is cyclical.

Additionally, this marks the eighth consecutive quarter where Berkshire Hathaway has sold more securities than it has purchased.

Since October 1, 2022, Warren Buffett has overseen the sale of $131.6 billion more in securities than has been bought by Berkshire Hathaway through June 30, 2024.

The logical explanation is that stocks are historically expensive, and Buffett wants to avoid the “casino.”

The stock market is historically expensive

As a reminder, Warren Buffett advises against betting against America. He and his team refrain from purchasing put options or short-selling securities.

However, being a long-term optimist and expecting the U.S. economy to grow over time doesn’t mean Buffett will overpay for stocks. If he can’t obtain a “fair price” for outstanding companies, he’ll wait patiently until valuations become reasonable or evident price discrepancies surface.

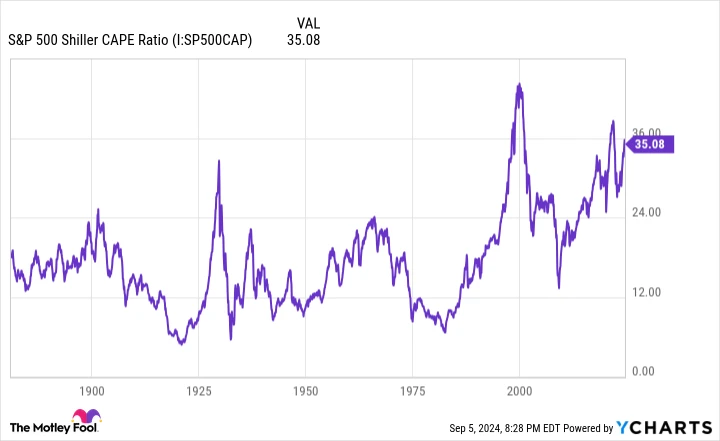

According to the S&P 500’s (-1.73%) Shiller price-to-earnings (P/E) ratio, also known as the cyclically adjusted price-to-earnings ratio (CAPE ratio), stocks have only been more expensive during two other bull markets over the last 153 years.

S&P 500 Shiller CAPE Ratio data by YCharts.

While the traditional P/E ratio looks at a company’s trailing 12-month earnings per share (EPS) relative to its share price, the S&P 500’s Shiller P/E considers 10 years of inflation-adjusted EPS. The advantage of this method is that it smooths out the impact of one-off events and shocks, offering a more accurate valuation metric.

Historical data since January 1871 shows that the S&P 500’s Shiller P/E has ranged from a low of 4.78 in December 1920 to a high of 44.19 during the dot-com boom in December 1999. As of the market close on September 5, the Shiller P/E was at 35.38, more than double its 153-year average of 17.16.

The greater concern arises from the previous five occasions when the S&P 500’s Shiller P/E exceeded 30. Although the Shiller P/E isn’t a timing tool, history shows that following each instance of inflated stock valuations, the S&P 500 and/or Dow Jones Industrial Average experienced declines ranging from 20% to 89%.

In essence, it is only a matter of time before investment euphoria wanes and traditional valuation metrics regain importance. Historical evidence suggests this will happen sooner rather than later.

Buffett’s best investments often occur during market turmoil

The decision to sell nearly $132 billion more in securities than purchased since October 2022 has boosted Berkshire Hathaway’s cash reserves, including cash, cash equivalents, and U.S. Treasuries, to a record $276.9 billion. This cash pile is likely to grow further in the current quarter, given the ongoing sale of Bank of America shares.

While the $5.4 billion sell-off signals Buffett’s expectation of market or economic turbulence, it’s precisely what he hopes for with such a substantial war chest at his disposal.

One near certainty is that Warren Buffett will continue to buy shares of his favorite stock, Berkshire Hathaway. Over 24 consecutive quarters, or six years, he’s overseen the repurchase of nearly $78 billion worth of his company’s stock.

However, the key question is which price dislocation will capture Buffett’s interest next. Following the financial crisis, Buffett invested $5 billion in Bank of America preferred stock, stabilizing BofA’s balance sheet when banks were largely undervalued. More importantly, this investment granted him warrants to purchase 700 million BofA shares at $7.14 each, which he exercised for Berkshire Hathaway in mid-2017.

Historically, periods of emotionally driven selling have been Warren Buffett’s prime opportunity. With stocks currently at some of their highest valuations ever, Buffett’s selling activity hints at both potential challenges and opportunities ahead.

Buy alert: Double down on these stocks today

The Motley Fool Stock Advisor service has more than quadrupled the S&P 500’s performance since it launched in 2002*, and the analyst team knows when to double down. They have recommended certain stocks multiple times, leading to outstanding returns.

Nvidia: If you’d invested $1,000 when we doubled down in 2009, you would now have $266,599!*

Netflix: A $1,000 investment when we doubled down in 2004 would now be worth $359,044!*

Apple: A $1,000 investment when we doubled down in 2008 would have grown to $41,774!*

Opportunity is knocking once again. Are you ready to open the door?

See 3 “Double Down” stocks ›

*Stock Advisor returns as of 09/09/2024