Few individuals can capture the attention of Wall Street experts and everyday investors like Berkshire Hathaway’s CEO, Warren Buffett. The reason is straightforward: Over nearly six decades, he has consistently outperformed Wall Street’s benchmark indexes.

Since assuming leadership in the mid-1960s, the Oracle of Omaha has driven a staggering cumulative return of around 5,500,000% for his company’s Class A shares (BRK.A). His knack for spotting clear-cut value and leveraging time as an advantage has been his not-so-secret wealth-building strategy for decades.

However, Buffett’s actions over shorter periods sometimes diverge from the long-term philosophy he and his late partner, Charlie Munger, instilled at Berkshire Hathaway.

Warren Buffett has been actively selling Bank of America shares since mid-July

To preface this discussion, it’s essential to clarify that the Oracle of Omaha is a firm believer in the American economy and would never bet against it. Although he acknowledges that economic recessions are both normal and inevitable, he’s learned over the years that downturns are temporary. Investing in established companies with strong leadership has historically benefited Berkshire Hathaway’s shareholders.

Yet, a closer examination of Berkshire Hathaway’s recent Form 4 filings with the Securities and Exchange Commission (SEC) might leave you puzzled.

Starting on July 17, Buffett began systematically reducing his company’s over 1.03-billion-share stake in the financial giant Bank of America. Between July 17 and September 10, there have been 39 trading days (including the Labor Day holiday). Form 4 filings indicate that Buffett sold BofA stock on 27 of these days, including a 12-day consecutive selling streak from July 17 to August 1, and again from August 23 to September 10. In total, nearly 174 million shares have been offloaded, amounting to a market value approaching $7.2 billion.

Financials are Buffett’s favored sector for investing Berkshire’s capital, and Bank of America has been his preferred bank stock for years. So, why the sell-off?

One plausible and benign explanation is that this selling activity might be tax-driven. During Berkshire Hathaway’s annual shareholder meeting in early May, Buffett suggested that corporate tax rates might rise in the coming years. He believes investors will appreciate Berkshire’s investment team for securing some of the company’s unrealized gains at a lower tax rate.

When Buffett made this remark, he had already sold about 13% of his company’s stake in Apple during the quarter ending in March. In the second quarter, this remaining stake was effectively halved. Selling nearly 174 million shares of BofA could be a strategic move to lock in substantial unrealized gains at a lower tax rate.

It’s also feasible that Buffett, with his deep understanding of banking, is anticipating a change in the Federal Reserve’s monetary policy. All indicators suggest that the Federal Open Market Committee may initiate a rate-cutting cycle in its upcoming meeting. Historically, stocks have underperformed following the commencement of rate-easing cycles this century. Furthermore, Bank of America is the most interest-sensitive among America’s major banks, with rate cuts likely to impact its net interest income more than any other bank.

While these are reasonable explanations for selling a 17% stake in BofA, the real reason behind Buffett’s continued divestment from Bank of America stock might be more alarming for Wall Street.

Buffett is steering clear of “casino” mentality and a historically expensive stock market

Although Warren Buffett would never bet against America or short-sell securities, he’s under no obligation to buy or hold stocks when clear warning signs emerge.

For some time now, it’s been evident that the Oracle of Omaha is dissatisfied with equity valuations. In each of the past seven quarters (from October 1, 2022, to June 30, 2024), Buffett has been a net seller of stocks, totaling $131.6 billion. The aggressive selling of Bank of America stock in recent weeks positions Berkshire Hathaway for an eighth consecutive quarter of net-equity sales.

While Buffett hasn’t explicitly attributed this selling to unattractive stock valuations, he has harshly criticized the “casino-like behavior” he’s observed on Wall Street. In his most recent annual letter to shareholders, Buffett remarked:

Though the stock market is massively larger than it was in our early years, today’s active participants are neither more emotionally stable nor better taught than I was in school. For whatever reasons, markets now exhibit far more casino-like behavior than they did when I was young. The casino now resides in many homes and daily tempts the occupants.

Buffett isn’t wrong. The internet has democratized access to information, making buying and selling equities easier and cheaper than ever before. Additionally, historically low lending rates over much of the past decade have encouraged risk-taking by retail investors. It’s been a perfect storm of temptations.

The result is one of the most expensive stock markets on record.

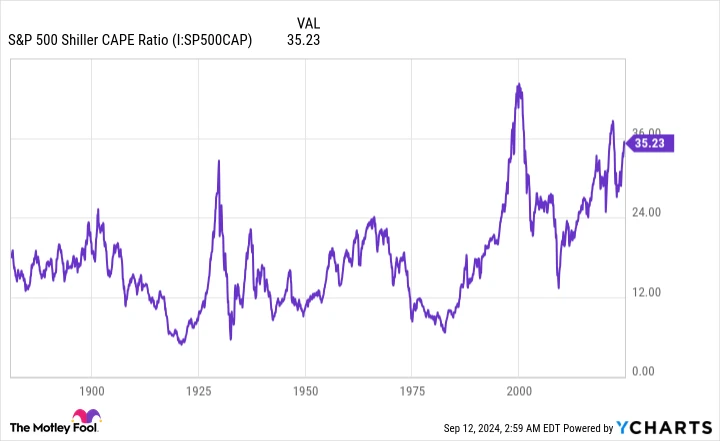

S&P 500 Shiller CAPE Ratio data by YCharts.

There are numerous ways to gauge “value” on Wall Street, but few are as comprehensive as the S&P 500’s Shiller price-to-earnings (P/E) ratio, also known as the cyclically adjusted price-to-earnings ratio or CAPE ratio.

The traditional P/E ratio is the most commonly used measure, dividing a company’s share price by its trailing-12-month earnings per share (EPS). However, the P/E ratio can be adversely affected by one-off events or economic shocks.

In contrast, the Shiller P/E is based on average inflation-adjusted earnings over the past 10 years. This decade-long analysis ensures that one-off events don’t distort the results.

As of the closing bell on September 11, the Shiller P/E was nearing 36 and had reached 37 earlier this year. Since 1871, there have only been two other instances where the S&P 500’s Shiller P/E ratio was higher—before the dot-com bubble burst and during late 2021/early 2022. Following both these periods, the benchmark S&P 500 lost 49% and 25% of its value, respectively.

The stock market is currently historically expensive. While Buffett’s extensive selling of Apple and Bank of America may partly be tax-related, it seems more likely that he’s preferring to have substantial cash reserves available in case of a market downturn driven by emotions.

Don’t miss out on a second chance at a potentially lucrative opportunity

Do you ever feel like you’ve missed the opportunity to invest in the most successful stocks? If so, you’ll want to pay attention.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies they believe are poised for significant growth. If you’re concerned about missing your chance to invest, now is the opportune moment to buy before it’s too late. The numbers speak for themselves:

Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $308,911!*

Apple: If you invested $1,000 when we doubled down in 2008, you’d have $42,142!*

Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $370,385!*

Currently, we’re issuing “Double Down” alerts for three remarkable companies, and there may not be another opportunity like this anytime soon.

See 3 “Double Down” stocks ›

*Stock Advisor returns as of 09/14/2024