Contents

Warren Buffett’s Routine and Recent Moves

Warren Buffett’s daily life is governed by routine. He ensures a good night’s sleep, wakes up at a consistent hour each morning, and starts his day with a can of Coca-Cola. A voracious reader, Buffett immerses himself in newspapers and financial reports of companies. However, for the first time in two decades, Buffett is breaking from his usual pattern, a move that could alarm many investors.

Unprecedented Cash Hoarding

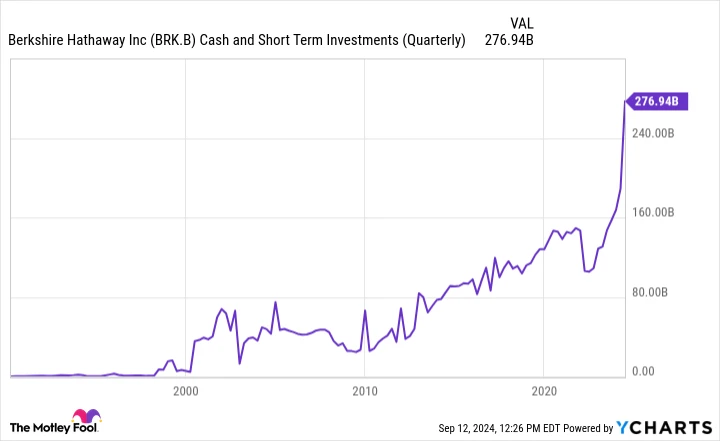

Buffett’s strategy of maintaining a significant cash reserve for Berkshire Hathaway is not new. The company typically holds at least $30 billion in cash, cash equivalents, and U.S. Treasuries. Yet, Buffett’s current behavior is extraordinary. As of June 30, Berkshire’s cash reserves, including cash equivalents and short-term investments, soared to nearly $277 billion, marking an unprecedented level.

Berkshire’s Cash Surge

Berkshire Hathaway’s increased earnings contribute to this substantial cash reserve, allowing more savings. Additionally, the depreciating buying power of the U.S. dollar due to inflation partly justifies this expanded cash position. However, the exceptional nature of this cash accumulation is evident from the fact that Berkshire’s cash reserves have surged over 65% in 2024, following a 30% increase in 2023. The last comparable rise occurred between 2003 and 2004.

Should Investors Be Concerned?

Buffett’s preference is to invest heavily in stocks, but only when he perceives them as attractively priced. The substantial cash buildup indicates his belief that the current stock valuations are generally not appealing. Supporting his perspective, the “Buffett indicator,” which measures the ratio of the total U.S. stock market value to GDP, hovers near its peak. In a 2001 essay for Fortune, Buffett noted that a similar high ratio served as a strong warning signal.

Evaluating the Situation

While the term “worry” might be an overstatement, it is essential to consider this situation thoughtfully. Buffett’s cash increase in the early 2000s did not result in an immediate market downturn, with the S&P 500 climbing in subsequent years. Moreover, the Buffett indicator’s relevance may have waned due to technological advancements complicating valuation assessments. Importantly, Buffett continues to invest in select stocks, indicating that he still sees opportunities.

Emulating Buffett’s Strategy

Investors would do well to take a page from Buffett’s playbook. When stocks of well-managed companies are available at reasonable prices, consider purchasing them. Building a robust cash reserve is also wise, as it positions you to capitalize on discounted stocks when the market eventually retreats. Above all, adopting a long-term investment perspective is crucial, mirroring a core element of Buffett’s success.

Investment Opportunities: Doubling Down

The Motley Fool Stock Advisor service has outperformed the S&P 500 by more than fourfold since 2002*, demonstrating their knack for identifying when to double down on investments. Recommending certain stocks multiple times has yielded significant returns.

– Nvidia: A $1,000 investment in 2009 would now be $308,807!*

– Netflix: A $1,000 investment in 2004 would now be $375,918!*

– Apple: A $1,000 investment in 2008 would now be $42,091!*

Seize the Opportunity

The door to opportunity is open again. Will you step through?

Discover 3 “Double Down” stocks ›

Stock Advisor returns as of 09/16/2024