On August 14, the conglomerate owned by Warren Buffett Berkshire Hathaway is a multinational conglomerate holding company. ( BRK.A -0.45% ) ( BRK.B -0.50% ) disclosed its revised stock portfolio for the second quarter of 2024. The most notable actions included the complete sale of its shares in Snowflake ( SNOW 1.39% ) and initiated an approximately $260 million stake in Ulta Beauty ( ULTA 3.21% ) However, each of these decisions is perfectly logical for Berkshire.

Just to clarify, Berkshire Hathaway possesses a substantial amount of funds — it possessed $277 billion according to the most recent report. Essentially, it has the ability to purchase almost anything it desires; it wasn’t necessary to sell one stock to acquire another. Let me elaborate on Buffett’s investment philosophy and why it makes complete sense for him to replace Snowflake with Ulta Beauty in Berkshire’s portfolio at this time.

Here’s why, in my opinion, Snowflake stock is no longer favorable.

In 2020, Berkshire Hathaway made an investment in Snowflake’s stock. first sale of stock to the public (IPO), which might have been the sole instance of purchasing an IPO stock. Nonetheless, Todd Combs, one of Buffett’s mentees, was a Snowflake customer through Geico and was in discussions with Snowflake’s former CEO, Frank Slootman.

This aligns with two key elements of Buffett’s investment approach: having a personal connection with the management team and being well-acquainted with the product. Over the years, Buffett has aimed to acquire companies while keeping the management he trusts in place. Additionally, he is frequently quoted as advising, “Never invest in a business you cannot understand.”

This probably wasn’t the case for Buffett himself with Shares of Snowflake However, it’s probable that Combs was acquainted with Slootman and, as a customer, he had knowledge of the business.

Snowflake’s situation might be shifting, which probably influenced Berkshire’s decision to sell in the second quarter. The company is set to announce its financial outcomes for the second quarter of fiscal 2025 on August 21. However, by the end of the first quarter, the management anticipated only a 24% growth for fiscal 2025, a significant drop from the 38% growth seen in 2024. Additionally, the company’s expenses are rising as it allocates more funds towards investments in machine intelligence (AI).

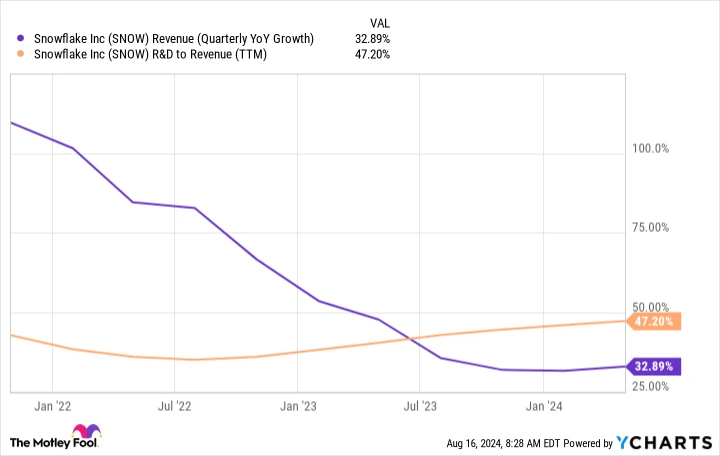

The chart indicates that research and development costs are increasing in proportion to revenue, demonstrating its funding towards artificial intelligence . However, this isn’t necessarily resulting in improved growth.

Quarterly Year-over-Year Revenue Growth for SNOW data by YCharts.

During Berkshire’s annual meeting in 2018, Buffett mentioned that they favor businesses requiring minimal capital investment while yielding high returns, with steady growth and little need for extra capital. On the other hand, Snowflake is investing significantly to remain competitive in the AI sector, which does not align with Buffett’s preferences.

Additionally, Snowflake appointed Sridhar Ramaswamy as its CEO earlier this year. While he might be capable of handling the role, Combs shared a personal relationship with Slootman. This relationship might have influenced Berkshire’s choice to sell its Snowflake shares as well.

Here’s my perspective on why Ulta Beauty stock is currently experiencing growth.

Ulta Beauty runs approximately 1,400 physical retail locations where it sells cosmetics and provides beauty services. Similar to Snowflake, Ulta Beauty has experienced a slowdown in growth, anticipating only around a 3% increase in revenue this year. However, unlike Snowflake, Ulta Beauty doesn’t need to invest heavily to keep up with trends, as the industry remains relatively stable. This allows the company to have plenty of cash available to reward its shareholders.

Even in the anticipated sluggish year ahead, Ulta Beauty predicts a 14% increase. profit margin — that’s quite impressive for a retail business. The company plans to open approximately 60 new stores this year and renovate an additional 40, which will incur some expenses. However, these expenses are relatively small compared to its earnings. Additionally, the company is debt-free, so no creditors have any stake in its future earnings.

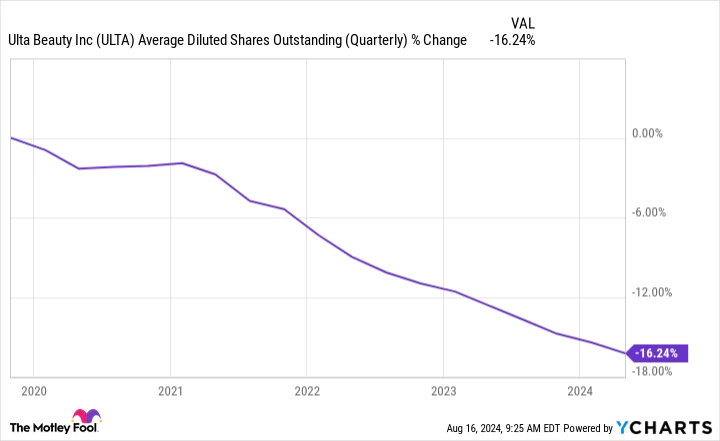

As a result, the majority of Ulta Beauty’s profits are allocated to shareholders. The management plans to allocate $1 billion to buy back shares just in 2024. To put this into context, its market cap as of now, it’s just $17 billion. In fact, the company has been consistently buying back its shares over the years, as illustrated in the chart below.

Quarterly Average Diluted Shares Outstanding for ULTA data by YCharts.

Buffett probably views Ulta Beauty as a straightforward business that’s easy to grasp, needs minimal additional investment to remain competitive, and generates a solid profit while returning capital to its shareholders. This uncomplicated situation could make Ulta Beauty stock a successful investment in the long run.

To top it all off, Ulta Beauty’s stock has fallen roughly 35% from its peak and is currently trading at one of its lowest valuations ever, at just 14. a multiple of its profits . That’s inexpensive — and more affordable than most other similar companies. This attractive valuation increases the likelihood that the stock will generate positive returns moving forward, making it a perfect addition to Berkshire Hathaway’s portfolio.

Is it a good idea to invest $1,000 in Ulta Beauty at the moment?

Prior to purchasing shares in Ulta Beauty let’s think about this:

The Motley Fool is a financial services company that provides investment advice and analysis. Stock Advisor the analyst team has just pinpointed what they consider to be the 10 best stocks for investors to purchase at this time… and Ulta Beauty wasn’t included in the list. The 10 stocks that were selected have the potential to yield significant returns in the years ahead.

Consider when Nvidia created this list onIf you had invested $1,000 on April 15, 2005, when we suggested it, you would possess $779,735 !*

It’s important to mention Stock Advisor the overall average return is762% — a market-beating performance when compared to 164% for the S&P 500. Make sure you check out the newest top 10 list.

*Stock Advisor performance as of August 12, 2024