Breaking news has emerged from Omaha, Nebraska, revealing that Warren Buffett has sold fifty percent of his holdings. Warren Buffett’s conglomerate company large ownership in Apple ( AAPL 1.37% ) , contributing billions of dollars to the company’s cash reserves. As of the last quarter, Berkshire Hathaway held $277 billion. money and assets that can be quickly converted into cash , assigning it one of the — if not the — the greatest amount of money held in reserve by a single company.

By the end of the second quarter, Berkshire Hathaway’s investment in Apple had decreased in value to $84 billion from its peak of $150 billion in previous years. What are Warren Buffett’s intentions for the significant cash position held by Berkshire? What factors have led to his declining enthusiasm for Apple? Should investors consider following suit and adjusting their portfolios accordingly? Let’s delve deeper to understand the situation.

Lack of growth in sales

On August 1, Apple released their financial results for the second quarter of 2024. The company has seen consistent performance in recent quarters, with hardware revenue remaining flat. Sales of iPhone, iPad, and Wearables have decreased in the first nine months of the current fiscal year compared to the same period last year. The only positive aspect was a small rise in Mac sales.

Apple’s services revenue has shown a positive trend, increasing from $63 billion to $71 billion in the last nine months. This growth is attributed to higher-margin services like App Store fees, ads, Apple TV, and software sales. While hardware sales for Apple may not be growing significantly, the company’s focus on developing new software products is expected to fuel its growth.

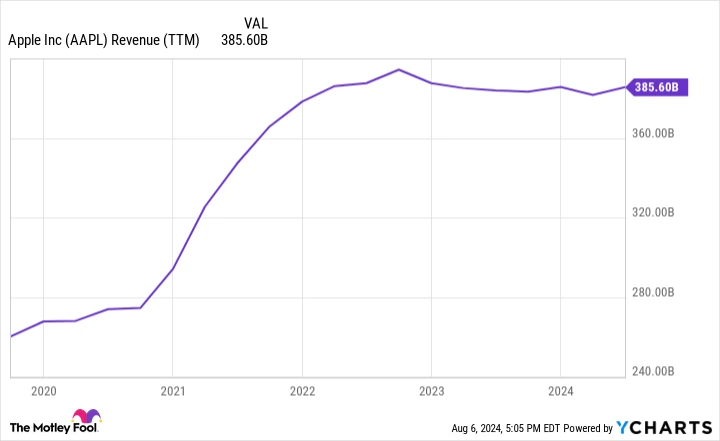

When considering the overall picture, Apple has experienced stagnant sales recently. Despite a surge in revenue due to the COVID-19 pandemic, the company has seen consistent flat revenue over the past few years. Notably, the revenue is lower than its previous peak in late 2022. China plays a significant role in this situation, as it is a crucial market for Apple, but currently faces economic challenges. Apple’s revenue in China for the first nine months of the fiscal year was $52 billion, a decline from $57.5 billion in the previous year.

Apple’s revenue over the trailing twelve months. data by YCharts

Apple’s revenue from services facing an unpredictable future.

Apple’s services division appears to be thriving, boosting profits steadily. Nevertheless, a significant portion of Apple’s services income comes from a fee paid by Google Search for being the default search engine on Safari. It is estimated that Apple receives more than $20 billion annually from this arrangement. Alphabet This distribution agreement is nearly at 100%. profit margins Analysts predict that this payment could represent 15% of Apple’s total earnings.

Currently, there is a possibility that the payment agreement might fall through. A judge has recently decided that Google Search’s standard distribution contracts are monopolistic, supporting the U.S. government in its legal battle against Alphabet. This situation could spell trouble for Alphabet, but it would be even more detrimental for Apple. If Apple loses this profitable distribution agreement, it could witness a sudden disappearance of around 15% of its earnings. Additionally, with revenue growth slowing down, the services sector, which is a key aspect of Apple’s business, may lose its appeal in the future if the courts rule unfavorably for Apple.

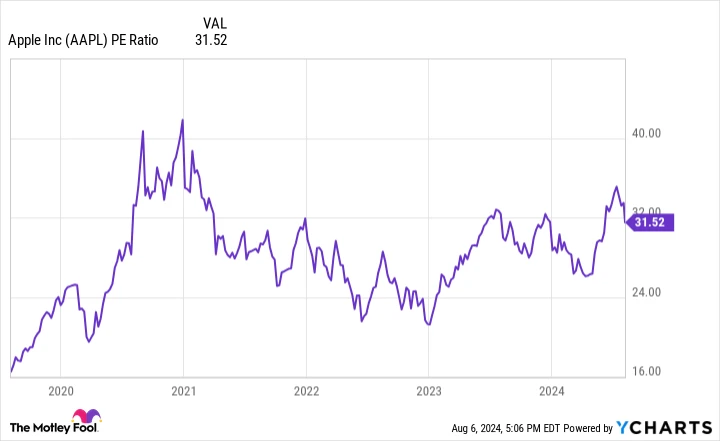

AAPL PE Ratio data by YCharts

The stock appears to be overpriced.

Despite Apple experiencing stagnant revenue and the possibility of its high-profit Google distribution payment collapsing, the stock reached its highest value ever by the end of the second quarter. Therefore, it is not unexpected that Warren Buffett decided to sell some of his shares.

Today, the stock price has slightly decreased because of the overall market decline. Nonetheless, it is still being traded at a high price-to-earnings ratio. P/E The value is significantly greater than 31.5. S&P 500 The typical valuation for a company experiencing stagnant sales is preferred by Buffett. He prefers to invest in companies with a price-to-earnings ratio of around 10, which was the case when he first purchased Apple stocks eight years ago.

He continues to have a strong interest in the business as it remains the biggest stock holding of Berkshire Hathaway. However, the current high stock prices make it unaffordable. The company, being a slow-growing one with uncertainties related to a significant portion of its earnings and cash flow due to the Google antitrust case, should not be valued at more than 30 times its earnings. Even Apple is in the same boat. Buffett acknowledges this situation, which is why he is reducing his investment in the company. He prefers to invest in short-term U.S. treasury bills that offer a guaranteed 5% annual interest rate.

Having Apple stock in your portfolio doesn’t necessarily indicate that you should sell it right away. However, if Apple represents a significant portion of your investments, similar to Berkshire Hathaway’s situation, it may be wise to follow Buffett’s lead and diversify your holdings.