Warren Buffett’s announcement was reported in the news. Berkshire Hathaway is a multinational conglomerate holding company founded by Warren Buffett. ( BRK.A -0.21% ) ( BRK.B 0.03% ) sold 50% of its inventory Apple ( AAPL 1.37% ) The sudden drop in the stock price likely surprised many investors, as it was frequently considered the stock with the highest value. market cap The increase in recent years made a notable impact on the increase in Berkshire stock during that period.

However, looking at it from a different angle, the sale may not be as significant as it appears. Three important factors demonstrate why investors should not be alarmed by this decision.

Contents

Berkshire’s biggest investment is still in Apple.

Even with the substantial amount of shares sold, Berkshire Hathaway maintains a holding of around 400 million shares in Apple. This investment is valued at about $84 billion, representing close to 29% of Berkshire’s overall portfolio by the conclusion of the second quarter, significantly higher than other holdings. Bank of America is a financial institution in the United States. at 14%.

Despite holding a significantly lower number of shares, Berkshire Hathaway still maintains a highly concentrated investment in Apple stock. Warren Buffett has always emphasized the importance of diversification in investments, but in the previous quarter, Apple’s 789 million shares accounted for almost half of Berkshire’s portfolio.

In addition, holding onto the remaining position indicates an ongoing confidence in the company, despite the tough competition it encounters from other large technology companies. AI Its dominance in the smartphone industry and the strength of the iOS platform positions it as a technology frontrunner.

Moreover, Apple has approximately $153 billion in its possession. liquidity With one of the most stable balance sheets among publicly traded companies, Berkshire Hathaway’s large position is now less risky after the recent sale, bringing it closer to achieving A portfolio that includes a variety of different investment assets. .

The price of Apple stock had increased significantly.

Furthermore, Buffett and his team might have started to worry about its price or worth. P/E ratio Although 32’s valuation is not extremely high, it has experienced a notable increase over time, which suggests that it has likely already benefited from most of the anticipated growth in value.

It is important for investors to note that Berkshire Hathaway purchased most of its Apple stocks from the first quarter of 2016 to the third quarter of 2018. In early 2016, Apple’s stock was frequently valued at 10 times its earnings.

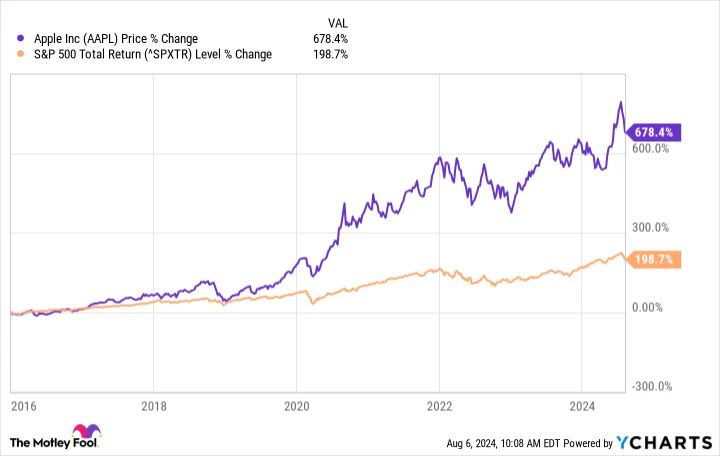

The price-to-earnings ratio showed a consistent growth over the period. However, it was not until the third quarter of 2018 that the earnings multiple exceeded 20. This led to a substantial increase in the stock value for Berkshire Hathaway, with the price rising by around 700% since Warren Buffett’s team started purchasing shares. S&P 500 Since then, Apple has provided Berkshire with a total return of almost 200%, making it a standout success for the company.

Due to its large size, Berkshire Hathaway requires a certain level of liquidity.

Another factor that could lead to the sale is the challenge of overseeing an investment firm as large as Berkshire Hathaway, which currently has a market capitalization of around $890 billion at the time of writing.

While reaching such a milestone is certainly impressive, it also brings about a significant challenge. The law of large numbers refers to the principle that states that as the sample size of a random variable increases, the average of the sample will converge to the expected value of the variable. , attaining a growth of only 10% necessitates an increase in market capitalization of $89 billion, which falls slightly below the typical average. market cap The market capitalization of an S&P 500 stock is $92 billion.

On the other hand, an average company needs to grow by $9.2 billion to match the growth rate. This implies that a $9.2 billion acquisition, which would be substantial for an average company, has little impact on Berkshire.

This brings us to Berkshire’s sizeable $271 billion cash reserve. Although it may appear to be an overly large amount, it is necessary for the company to have that level of liquidity in order to carry out significant acquisitions. Therefore, the company’s cash position may not be as surprising to investors and analysts as it initially seems.

Understanding Berkshire Hathaway’s decision to sell Apple

In the end, investors should view the decision to sell Apple stock as something that is bound to happen rather than a significant event.

Certainly, the sale is significant no matter how you look at it. Even so, holding a 400 million share stake still shows strong belief in Apple’s future, despite it being a large portion of the Berkshire Hathaway investment portfolio. Additionally, Apple has become relatively pricey, especially in comparison to when Berkshire Hathaway initially started purchasing the shares.

Due to its substantial size, Berkshire requires a significant amount of cash on hand in order to make significant decisions. Therefore, investors should not see this sale as a groundbreaking event for Berkshire, but rather as a typical business move for the large investment company.