Unexpectedly, Warren Buffett included beauty product seller Ulta Beauty ( ULTA -0.04% ) to Berkshire Hathaway is a multinational conglomerate holding company. Buffett’s investment holdings in the second quarter included retailers, demonstrating his lack of hesitation in owning such companies in his portfolio. Walmart He held onto the shares for more than two decades before selling them in 2018, but it hasn’t been a significant priority for him in the past few years.

The only other retailers Berkshire currently holds e-commerce giant in its portfolio. Amazon seller of floor coverings and tiles Floor & Decor Buffett had ownership of a home furnishings retailer in the past. RH , however, all the stock was sold by the end of 2022.

Let’s examine the reasons why Buffett may have been drawn to Ulta’s stock.

Contents

Underpriced value

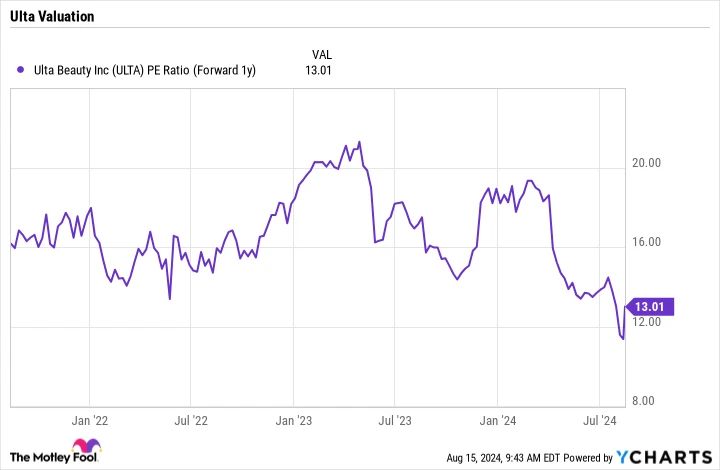

In the second quarter, Berkshire Hathaway bought Ulta shares at a discounted price as the stock had dropped by 33% year to date. Following Berkshire’s investment, Ulta’s stock price slightly increased, but it is still down by approximately 20% for the year and is currently trading at a lower value. future price-to-earnings (P/E) ratio ratio of 13.

ULTA’s forward price-to-earnings ratio for the next year. data by YCharts

This represents a significant reduction from the price-to-earnings ratio that the beauty retailer has historically traded at. Buffett and his team are known for their affinity for good deals, and they evidently believed that Ulta’s stock was now being sold at a discounted price.

This year, the stock has faced challenges mainly because high-end brands have expanded their distribution through both physical stores and online platforms. As a result, Ulta had to lower its sales and operating margin forecast for the year. Despite this, the investment experts at Berkshire Hathaway seem to believe that they can handle these difficulties effectively.

A strong and expanding group

The beauty industry is experiencing steady growth overall. There has been significant expansion in the category over the last three years, and although growth is projected to continue, it will likely be at a slower rate. Ulta, being the leading specialty beauty retailer in the nation, anticipates the category to grow around mid-single-digits this year. Ulta is well-positioned to benefit from this growth in the beauty sector.

Simultaneously, beauty has consistently shown resilience during economic downturns throughout history. This trend is commonly referred to as the “lipstick effect,” a concept initially introduced by Juliet Schor, an expert in economics and sociology, in her 1998 book. The American who spends more money than they have available. Schor observed that in times of economic hardship, women tend to indulge in affordable luxuries like lipstick. This idea has been proven true in various economic downturns, such as the Great Recession, where cosmetic purchases rose while sales in other sectors like clothing declined.

During the pandemic, there was a change in consumer spending habits towards moisturizers and perfumes due to the increased usage of masks. However, the overall spending remained focused on beauty products. As there are indications of a potential decrease in consumer spending, purchases of perfumes and lipsticks have increased significantly. Adobe From January to May of this year, there was a significant increase of over 19% in online fragrance sales and a remarkable surge of over 37% in online lipstick sales.

The top performer in the category

Ulta stands out for its business strategy of selling beauty products at various price points, including high-end, well-known, and more affordable brands all under one roof. This diverse selection allows Ulta to cater to a wide range of customers, regardless of their income levels, making it a top choice for shoppers looking for a variety of options.

It appeals to a younger demographic by drawing them into its stores and giving them the opportunity to upgrade to luxury brands as they start making more money. Additionally, it enables customers to combine products from both affordable and high-end categories. For instance, it is common for a customer to purchase a premium skincare item along with their go-to lipstick. e.l.f. Beauty Circana reports that more than 90% of consumers who buy luxury beauty brands also buy products from mass-market brands, and 35% of mass-market brand buyers are willing to spend more on luxury brands. Ulta offers the convenience of catering to both segments of customers under one roof.

Increasing the rate of growth

Although facing some challenges in the short run, Ulta has various strategies available to boost its growth. The company possesses a robust loyalty program that is among the most powerful in the retail sector, as 95% of its sales are generated by loyal customers. This provides Ulta with a wealth of information to effectively target its customer base with more advertising and promotional activities.

Simultaneously, although the distribution of prestigious products has grown, no other store can match Ulta’s wide range of beauty products. Ulta is constantly introducing trendy new brands and aims to include at least 25 new brands in its collection this year. Additionally, the company intends to boost its social media engagement and enhance partnerships to attract more customers to its physical and online stores.

Even though the company is not expanding its number of stores quickly, it aims to open 60 to 65 new locations this fiscal year. This represents a growth of 4% to 5% in its store count, which is considered steady.

Credit: Getty Images

In general, it is clear why Buffett and his team found Ulta appealing. As the stock is still reasonably priced, there is still an opportunity for investors to purchase shares.