Contents

The Quest for Durable Growth

Durable growth is the cornerstone of a successful investment strategy, particularly when aiming to discover stocks that might multiply tenfold—often called “10-baggers.” Legendary investor Peter Lynch, who achieved remarkable success managing the Fidelity Magellan Fund, emphasized the importance of companies that can sustain double-digit growth in sales and earnings over many years. While valuations play a role, they can only take you so far without enduring growth.

Discovering Rare Growth Opportunities

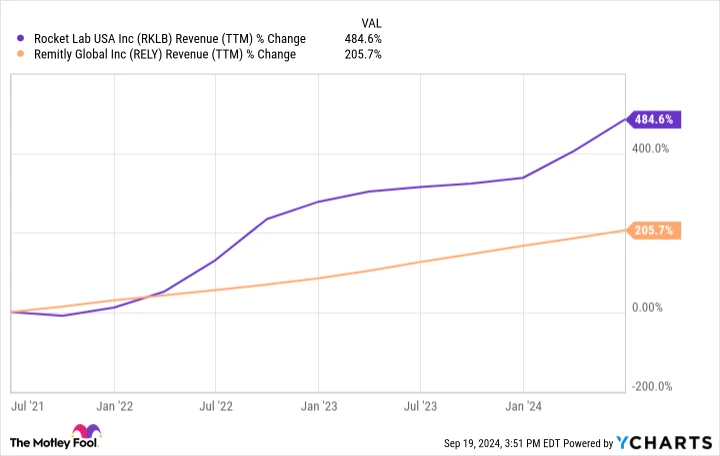

Finding companies that can maintain robust growth over a decade is a rarity. Despite experiencing short-term volatility since becoming public, both Rocket Lab USA and Remitly Global have demonstrated impressive growth trajectories in recent years. What’s more, both stocks are currently available for under $100, making them attractive options for growth-focused investors.

Rocket Lab: Reaching for the Stars

Rocket Lab is an innovative space flight company, distinguished alongside SpaceX as one of the few private entities consistently launching commercial payloads into orbit. Their ambition extends beyond rocket launches; they aim to offer comprehensive space services, including spacecraft equipment, materials, and data/software services to enhance customer value.

Although Rocket Lab’s vision is still a work in progress, they have achieved significant milestones. Their small Electron rocket recently completed its 50th launch, and their spacecraft business is expanding rapidly. In an industry where many startups have faltered, Rocket Lab stands out for its exceptional execution, boasting a customer backlog exceeding $1 billion.

Since July 2021, Rocket Lab’s revenue has increased by nearly 500%, with a remarkable 71% year-on-year growth in the last quarter. The Electron rocket business has ample room for expansion, and the data/software services division is yet to launch. The development of the larger Neutron rocket further positions Rocket Lab to potentially elevate its revenue from over $300 million today to several billion dollars this decade.

With a market capitalization of $3.5 billion and a share price of just $7 at present, Rocket Lab presents a compelling opportunity for those willing to invest long-term. This stock offers significant growth potential.

Remitly Global: Revolutionizing Cross-Border Transfers

Remitly is making waves in the financial and software sectors, particularly in the remittance market for cross-border money transfers. With traditional competitors like Western Union lagging in innovation, Remitly identified opportunities to enhance customer experiences and reduce fees.

The company’s mobile app boasts nearly 7 million active users, enabling money transfers from regions such as the United States to India. Last quarter, Remitly processed $13.2 billion in transfer volume, capturing an estimated 2.5% market share. Given its superior value proposition, Remitly is well-positioned to continue increasing its market presence over the next five to ten years.

Remitly’s revenue growth has been impressive, fueled by rising active user numbers and total transfer volume. Revenue surged by 31% year over year last quarter, reaching $306 million, and has exceeded $1 billion over the trailing 12 months. With a market capitalization of approximately $2.8 billion and a share price of $14, investors can acquire shares of both Remitly and Rocket Lab for as low as $21 combined.

As Remitly continues to expand its market share, revenue is expected to grow at a consistent double-digit rate. Now profitable, the company anticipates generating around $100 million in adjusted earnings before interest, taxes, depreciation, and amortization this year. Collectively, Remitly and Rocket Lab represent excellent growth stocks for any portfolio.

Seizing the Opportunity: A Second Chance to Invest

The Motley Fool Stock Advisor has consistently outperformed the market, achieving a total average return of 762% compared to the S&P 500’s 167% since 2002. Their analyst team has a keen sense of when to double down on promising stocks, with past recommendations leading to tremendous gains.

– Nvidia: A $1,000 investment when doubled down in 2009 would now be worth $301,443!

– Netflix: A $1,000 investment when doubled down in 2004 would now be worth $380,400!

– Apple: A $1,000 investment when doubled down in 2008 would now be worth $42,842!

Currently, “Double Down” alerts are being issued for three remarkable companies, presenting a potentially fleeting opportunity.

See the stocks ›

Stock Advisor returns as of 09/25/2024