Worries about the economic situation have caused a decline in the performance of numerous e-commerce companies’ stocks in the current year. Shopify ( SHOP -0.40% ) , Wayfair , and Etsy All have experienced a decrease of over 10% in the last half-year. Amazon has only just been able to remain profitable during that period.

Investors are concerned about a potential economic downturn next year, but Shopify’s management is optimistic about the company’s competitive position compared to its competitors.

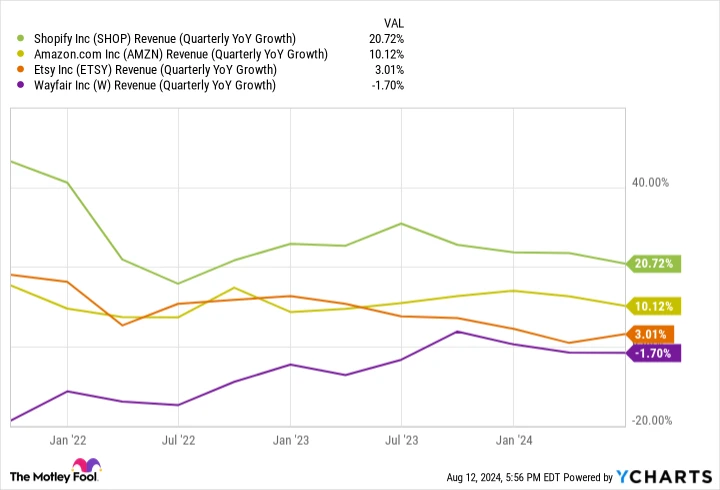

Shopify’s growth rate exceeds that of its competitors.

The company announced its second-quarter results on August 7, covering the period ending on June 30. Revenue for this quarter reached $2 billion, showing a 21% increase compared to the previous year. Excluding the impact of selling its logistics business, the growth rate was even higher at 25%. The company anticipates a revenue growth rate in the low to mid 20s percentages for the upcoming quarter.

In the realm of e-commerce, Shopify has consistently outperformed its competitors.

Increase in sales for online retail companies. data by YCharts is a platform that uses the abbreviation YoY to represent year over year.

What is the key to Shopify’s success?

On the latest financial report meeting, Harley Finkelstein, the president of Shopify, emphasized two main factors contributing to the company’s impressive achievements. Finkelstein pointed out that the diverse range of merchants across various industries and locations is a significant factor setting them apart from others.

In the end, the key factor is flexibility. While merchants have the option to sell on platforms like Amazon, Etsy, and Wayfair, they have greater autonomy and influence over their sales process when using Shopify. This platform enables them to set up a store efficiently and promptly, seamlessly integrating it with their current website. Alternatively, for those without an existing website, Shopify offers a simple solution to establish an online store.

Consequently, the procedure can easily be customized to suit different types of business structures, offering the versatility to cater to the requirements of sellers, irrespective of their field, merchandise, or service – or their geographical location. Shopify is capable of assisting anyone in the online selling process.

As Finkelstein hinted, it operates in over 175 countries. In contrast, Amazon has extensive worldwide coverage and can deliver items to over 100 countries, but it only has 21 marketplaces. Thanks to its ability to connect with a larger and more varied group of sellers and buyers, Shopify is less vulnerable to particular market or industry circumstances. This enables it to achieve stronger sales growth compared to its competitors.

Would investing in Shopify stock be a wise decision?

Although the company has seen positive results, its stock has decreased by 12% so far this year. The company is experiencing strong growth, but its profits remain modest, causing the stock to be valued at 70 times its past earnings. price/earnings-to-growth ratio Although the ratio is 1.1, there may still be attractive opportunities for investors looking to make a long-term investment.

However, in the near term, the stock may experience fluctuations depending on the economic conditions. The company’s performance is somewhat impacted by the economy, as demonstrated by Shopify’s slowed growth in 2022 following rising interest rates and consumer difficulties caused by inflation.

Although the stock is currently performing satisfactorily, investors should not believe that it is immune to economic recessions. It is probable that the stock will be impacted by a downturn, but its diversification can assist in maintaining growth at a more modest rate compared to other investments. stocks related to online commerce .

Investors may consider Shopify as a solid long-term investment, but they should be cautious as challenges may arise if the economy deteriorates in the coming year. Additionally, its inflated valuation could increase the risk of a significant decrease in its stock price.