Stocks related to artificial intelligence (AI) They were doing well for a period of time, but recently encountered some doubtful market creators. Consequently, certain highly skilled AI professionals are now available at discounted prices, and I anticipate their resurgence in the future.

Continue reading to find out the reason behind the semiconductor company. Intel ( INTC -2.42% ) someone who specializes in voice recognition technology SoundHound AI ( SOUN 0.60% ) Appear to be obvious purchases at the moment.

Various important positions held by Intel in the field of artificial intelligence

Intel might have been expected to be a popular choice in the market currently, but that is not the case.

- Xeon processors are essential for overseeing the data transfer to AI accelerator chips, making them a common component in numerous supercomputers used for AI training.

- Intel provides its own AI accelerator chips that deliver high performance for their cost, competing with the top options available. Nvidia ( NVDA -0.99% ) .

- Simultaneously, the company produces artificial intelligence chips for other companies, including their long-standing computing partner. Microsoft ( MSFT 0.27% ) .

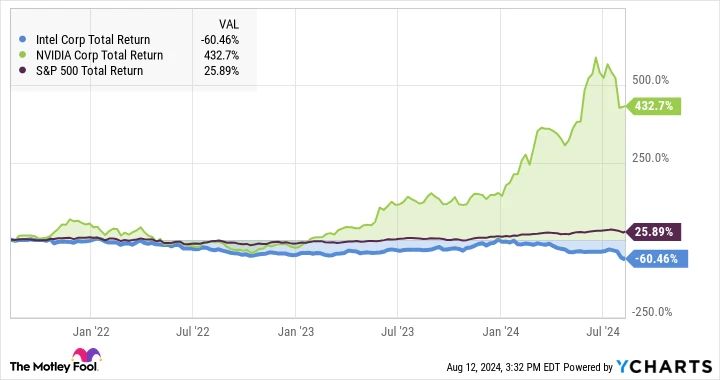

Intel is deeply involved in the AI industry from various perspectives. However, despite the AI boom, the company’s stock has been declining instead of rising. In contrast, Nvidia’s stock has increased significantly, more than five times in the last three years. S&P 500 ( ^GSPC -0.12% ) The market index increased by 26%, while Intel investors found themselves in a difficult situation. decline of 60%.

Level of total returns for INTC data by YCharts.

The downward pressure on Intel’s stock is starting to ease. Despite missing Wall Street’s expectations in the latest second-quarter report, the company revealed plans to reduce costs significantly and made timely advancements in their upcoming cutting-edge manufacturing technology, known as Intel 18A.

Despite being reasonably priced prior to this update, Intel’s stock experienced a further decline of 26% the following day. The company is currently in a phase of making costly investments in manufacturing equipment, which is expected to lead to impressive business outcomes in the future. With a stockholder equity of $120 billion, the stock is being traded at a the ratio of a company’s stock price to its book value per share of 0.69.

This is an unprecedentedly low point, a valuation typically associated with companies that are close to going bankrupt. On the other hand, Intel has numerous factors driving growth, many of which are linked to the artificial intelligence (AI) advancement. Due to this disparity between strong business opportunities and decreasing market worth, I perceive an excellent chance to purchase Intel at its reduced price .

The shift of SoundHound AI towards reaching a wider consumer market.

SoundHound AI is positioned as a company in its early stages of growth rather than one undergoing a turnaround. After operating a successful but not highly profitable song-identification service for almost twenty years, the company is now beginning to focus on developing a profitable business plan.

Earlier this year, the stock price of SoundHound AI experienced a surge when investors learned that Nvidia acquired $3.7 million worth of its stock. However, the increased value was short-lived, as the shares have been stagnant for the past three months after a significant decline in March and April.

Although the stock appears to be stagnant, the business narrative behind it is anything but dull. The recent second-quarter report surpassed the average predictions of analysts in all aspects. Following the acquisition of conversational AI expert Amelia, SoundHound AI has increased its projected annual revenue from around $71 million to a minimum of $80 million for this year, with expectations to exceed $150 million by 2025.

The company is beginning to turn its large number of pending orders into sales revenue. In addition to this, it continues to attract well-known brands as customers. Some recent additions to its customer list include Beef O’Brady’s, a sports grill chain, and Jersey Mike’s, a sandwich vendor.

Automotive collaborators include a variety of mass-market companies. Honda and Hyundai only premium and high-quality brands like Stellantis ( STLA 0.97% ) The Alfa Romeo brand is implementing SoundHound AI’s state-of-the-art voice commands in various Stellantis brands, beginning with markets outside the US like Europe and Japan. The technology will soon be available in the American market as well.

In brief, I have high hopes for the ambitious business strategies proposed by the management. Although the current stock price may seem high, it is a dynamic growth opportunity that could rapidly gain momentum. This applies to both the company’s performance and the stock’s trajectory.

Therefore, I suggest investing in some SoundHound AI stocks during this temporary slowdown in its expansion. This promising company is on the rise, and I believe it won’t remain a small entity for much longer.