Interested in making profits in the stock market? One strategy is to keep an eye on the stocks included in Berkshire Hathaway’s portfolio. With Warren Buffett at the helm of Berkshire for many years, he has established himself as a legendary investor. Observing the investments he oversees can potentially give your portfolio an advantage.

If you’re keen on tracking Buffett’s most promising ideas, consider the two stocks highlighted below.

A Standout Stock Pick by Buffett

In 2011, Warren Buffett made what turned out to be one of his most brilliant stock acquisitions. The company? Visa (0.77%). While you’re likely familiar with Visa’s brand, you might not realize why it stands as a remarkable investment.

When Buffett initially acquired shares of Visa, the stock price was between $30 and $40. Today, those shares are nearing $300 each. The company’s market capitalization is approximately $550 billion, and there is speculation that it could one day surpass the $1 trillion mark. What has fueled Visa’s impressive success, and why does it seem poised for continued growth in the coming years and decades? It boils down to a robust competitive edge that only strengthens over time.

Most readers of this article have heard of Visa, and many probably have a Visa card in their wallet right now. Why? Because Visa dominates the U.S. credit and debit card market. According to data from Statista, the company holds a 61% share of the domestic market, leaving just three other firms to compete for the remaining 39%. This market is highly consolidated, and it’s easy to see why. Payment networks like Visa benefit from network effects, where the service increases in value as more people use it. Since these networks must connect customers, merchants, and financial institutions, the one that can seamlessly link the most participants will prevail. This dynamic inherently favors large-scale operations, leading to a few major competitors such as Visa and Mastercard.

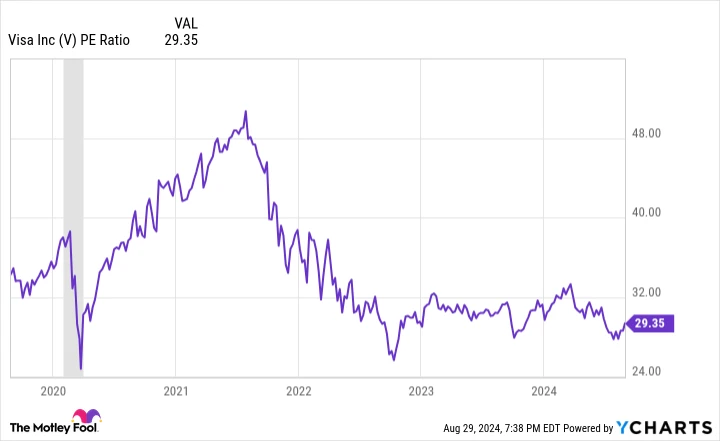

Visa’s vast scale not only provides a lasting competitive advantage but also results in impressive profitability. The company boasts nearly 50% returns on equity with minimal leverage, and its profit margins reached 55% last quarter. Yet, its shares are valued at just 28 times earnings, slightly below the S&P 500 average. Buffett continues to hold $2.2 billion in Visa stock. Both growth and value investors might consider following his lead.

V PE Ratio data by YCharts

Seeking Maximum Growth? Consider This Company

Buffett may not typically be associated with growth investing, but in recent years, Berkshire Hathaway has invested in several firms demonstrating strong growth potential. One such company is Nu Holdings (-3.47%). Berkshire has amassed a stake in this fintech enterprise worth over $1 billion, and it’s easy to see what attracts Buffett to this company.

Nu operates as a bank, but with a twist. It provides its services exclusively via smartphones in Latin American countries like Brazil, Mexico, and Colombia. This approach marks a significant departure from traditional banking, where a few dominant banks charged high fees for basic services through physical branches. Nu revolutionized the industry by offering services and prices that competitors couldn’t match. In less than ten years, the company grew from virtually no customers to over 100 million, with more than half of Brazil’s adult population now using Nu’s services. Despite a $70 billion market cap, Nu continues to grow its sales by 50% to 100% year-over-year each quarter.

While the stock might seem expensive at 45 times earnings, few companies exhibit such a growth trajectory. Over time, this current valuation may appear to be a bargain. Since acquiring its stake, Berkshire has not sold a single share. Investors seeking maximum growth potential should take a closer look at Nu Holdings.