The primary reason many income investors are likely to purchase Enbridge ( ENB 1.59% ) One of its significant attractions is the substantial dividend, presently offering a 6.9% yield. However, it’s essential to look beyond this figure to grasp why this stock is so appealing. The advantages include not only the dividend (for reasons beyond just the yield), but also the varied nature of the business and the company’s growth initiatives.

Contents

1. It offers an appealing dividend return

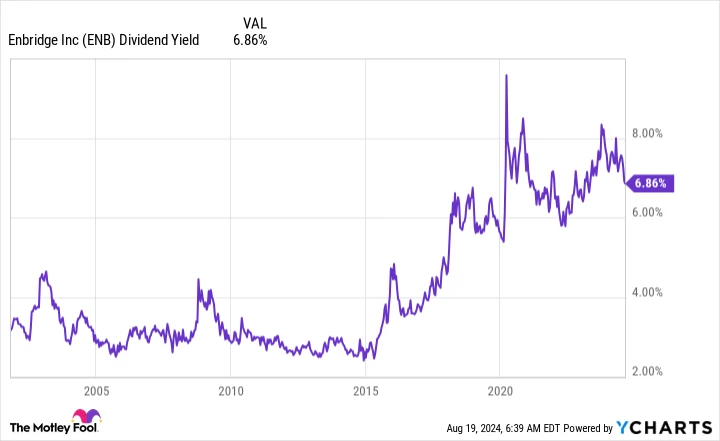

Enbridge’s dividend yield A yield of 6.9% stands out positively when compared to the overall market, which typically offers a modest 1.2%, and even when compared to the energy sector, where the average yield is about 3.1%. Therefore, income-focused investors are likely to find Enbridge’s yield appealing both in absolute terms and when compared to other choices. Additionally, another point worth noting is that this yield is near the upper limit of its historical range, making Enbridge’s dividend seem appealing when viewed against its own past performance as well.

Photo credit: Getty Images.

Additionally, Enbridge has consistently raised its payout every year for the past 29 years. Moreover, its distributable cash flow has also seen growth. payout ratio comfortably fits within management’s target range of 60% to 70%. The balance sheet is also in good shape: The leverage ratio falls comfortably within the management’s target range of 4.5 to 5 times the debt to EBITDA (earnings before interest, taxes, depreciation, and amortization). In simple terms, the dividend is backed by a solid financial base.

ENB’s Dividend Return Rate data by YCharts.

2. Enbridge functions as a fee collector.

What is equally intriguing about Enbridge is its fundamental business model. The company emphasizes producing dependable cash flows through fees, regulated assets, and contracts across its operations. It’s crucial to look at this list, though, because it highlights the distinctly varied segments that make up the portfolio.

The primary assets of the company, which contribute approximately 75% of EBITDA, are its oil and natural gas pipelines. These are toll-based assets, meaning customers pay to utilize the essential energy infrastructure owned by Enbridge. About 22% of EBITDA is generated from its natural gas utilities, which are regulated assets providing consistent cash flows. The rest of the EBITDA is sourced from its renewable power assets, with revenues secured through long-term contracts.

There are a few important points to note here. Firstly, each business owned by Enbridge operates as a toll collector, generating steady cash flows to maintain the dividend. Secondly, Enbridge is relatively diverse when compared to other companies in the midstream sector.

3. Enbridge is adapting to current trends.

The business’s diversification is intentional, but it goes beyond simply generating multiple revenue streams. Enbridge’s leadership recognizes the global transition from more polluting energy sources to cleaner alternatives. This understanding is why they’ve recently decided to acquire three natural gas utilities from Energy company called Dominion ( D 0.05% ) This action will decrease Enbridge’s reliance on oil, lowering it from 57% of EBITDA to 50%.

Although natural gas remains a hydrocarbon fuel, it burns more cleanly compared to oil and coal. It is anticipated to serve as a transitional energy source as the world increasingly adopts renewable energy, which currently constitutes a minor portion of the total energy mix. Enbridge, however, is not overlooking clean energy; it has a modest presence in this area, contributing about 3% to its EBITDA. The aim is not to completely transform the company, but rather to supply the essential energy needs of the world. The management is gradually moving in this direction by transitioning toward cleaner energy options.

Appealing in every aspect

If you’re in search of a reliable energy stock with high returns for the long haul, Enbridge is a strong candidate for your investment portfolio. Given its impressive yield, appealing business model, and strategically evolving asset portfolio, it might be wise to consider purchasing a significant amount. Currently, the stock is available at a good price, but this may change as more investors recognize its value as a dividend stock.