Brad Jacobs may not be widely recognized by everyday investors, but he boasts one of the most impressive track records among current CEOs.

Jacobs initially established United Waste Systems in the U.S., achieving a 55% average annual growth rate between its inception in 1989 and its sale in 1997 to the corporation that later evolved into another entity. Handling and Disposal of Waste At that point, it ranked as the fifth biggest solid waste management company in North America.

Afterward, Jacobs helped establish United Rentals and employed a comparable consolidation approach to achieve returns that outperformed the market, ultimately becoming the top company in the equipment rental industry.

In 2011, Jacobs purchased a truck brokerage, which later transformed into XPO Logistics, for $150 million. Over the decade, XPO emerged as the seventh top-performing stock on the Fortune 500, experiencing an increase of over 3,000%. XPO separated two additional companies, the RXO truck brokering, and GXO Logistics a contract logistics company, collectively producing over $20 billion in yearly revenue.

Throughout his career, Jacobs has completed over 500 tasks. acquisitions , providing him with extensive experience to utilize as QXO aims to secure its inaugural deal.

Photo credit: Getty Images.

Jacobs’ upcoming project

In December of last year, Jacobs revealed his upcoming project, which he has called QXO ( QXO -0.71% ) he plans to apply the same roll-up strategy to the building products distribution sector that has proven successful in other industries.

Similar to the other sectors he has focused on, the building products distribution industry is large and divided, with a potential market size of around $800 billion. In North America, there are 7,000 building supply firms, while Europe has 13,000. QXO plans to establish a top-tier company in this industry, aiming for $50 billion in revenue within the next ten years. The industry has been consistently expanding, with a compound annual growth rate (CAGR) of 7% over the past five years, and is expected to gain from a shortage of approximately 4 million homes in the U.S. as well as an aging housing inventory.

The company has secured $5 billion to initiate one or two significant acquisitions, yet QXO has not made any moves yet. It did acquire SilverSun Technologies to transform into a publicly traded company. Although QXO initially intended to spin off SilverSun, it later chose to retain it.

The QXO strategy guide

Building supply distribution aligns well with Jacobs and his team’s expertise because it’s essentially a logistics and transportation business. The main challenge involves efficiently and promptly moving products, capitalizing on cross-selling opportunities, and developing a network of warehouses and a transportation fleet to support these operations.

Similar to Jacobs’ previous projects, the distribution of building materials presents QXO with a chance to shake up the market and enhance value via technology. As Chief Investment Officer Mark Manduca mentioned to The Motley Fool, “It’s definitely ready for technological innovation.”

Is QXO a buy?

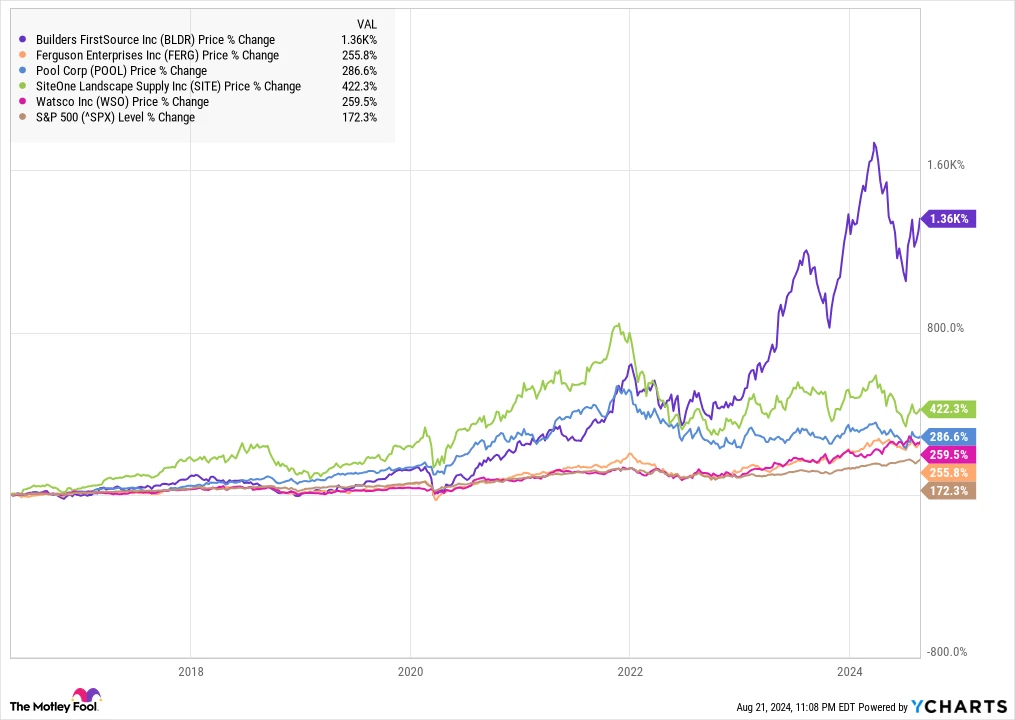

The building supply distribution sector has already seen several successful companies on the stock market, although these stocks don’t receive as much attention as those in other sectors. As illustrated in the chart below, five stocks, typically regarded as industry frontrunners, have all surpassed the S&P 500 over the past few years.

As QXO has not yet made any acquisitions, it’s challenging to evaluate the company’s future outlook. However, Jacobs has a proven history of success, and the chart above highlights that this sector has consistently outperformed the S&P 500 in the past.

With $5 billion at its disposal, QXO seems poised to make one or two acquisitions that could instantly position the company as a significant force in the industry. This approach contrasts with previous efforts under Jacobs, who began on a smaller scale.

Currently, the stock carries some risk, but it might surge if an acquisition is positively received. In the long run, Jacobs’ skill in roll-ups and the prospects in building supply are promising for the company. Investing in the stock now could provide significant potential gains in the future.