Tech stocks have seen a decrease in value in the past month due to concerns about a potential recession following recent economic indicators. The latest employment data showed that the U.S. added 114,000 jobs in July, a notable drop from the previous month’s 179,000. This news led to a sell-off in the market, particularly affecting tech firms which recorded significant declines.

Nevertheless, historical data indicates that a market decline should not be a cause for alarm. Instead, it presents an opportunity to enhance your investment portfolio by adding shares of high-growth companies. The top 20 technology firms have a combined value exceeding $20 trillion, and they continue to have significant growth prospects due to emerging sectors such as artificial intelligence (AI) and cloud computing.

This particular stock is considered one of the top choices for investing $1,000 at the moment. Nevertheless, even a modest investment has the potential to yield significant returns when put into the hands of this leading technology company.

Advanced Micro Devices is making a strong comeback that you wouldn’t want to overlook.

AMD ( AMD 4.70% ) The company’s stock has experienced a 24% decline over the past month, resulting in a 9% decrease in its share value for the year so far. This puts it at a much lower level compared to its main competitor. Nvidia , resulting in a stock growth of 112%.

AMD faced difficulties at the beginning of 2024 due to lagging in artificial intelligence in the previous year and struggling to make up for lost ground. allocating funds towards artificial intelligence Despite the decrease in sales in its gaming sector, the company has not impressed shareholders. Nevertheless, the latest financial results for the quarter indicate that the company is on the path to recovery, which could lead to significant gains in the future. Additionally, the recent drop in stock prices presents a chance to invest at a lower cost relative to its potential.

On July 30, AMD announced its financial results for the second quarter of 2024. The company’s revenue increased by 9% compared to the previous year, reaching $6 billion, surpassing the expectations of analysts by $120 million. The data center division experienced exceptional growth during the quarter, with a revenue surge of 115% driven by the increasing demand for AI technology. sales of graphical processing units An increase in the sales of central processing units (CPUs) led to a 49% year-on-year growth in revenue in the client segment.

The gaming sector showed significant weakness in the quarter, experiencing a 59% decline in revenue. Despite this, AMD’s focus on Artificial Intelligence appeared to offset the impact of this decline. Although gaming performance was poor, the company’s overall operating income for the period surged by 647%, and gross margins also increased to 49%.

In the past year, AMD has put in significant effort to enhance its AI technology and compete with Nvidia. The latest earnings report indicates that these efforts have been successful, as AMD’s AI chips are now gaining attention from major organizations. Microsoft ‘s Azure, Amazon Services provided over the internet, and Alphabet Google Cloud serves clients.

AMD’s current market capitalization stands at approximately $217 billion. With Nvidia’s market cap starting at $359 billion in 2023 and soaring to $2.5 trillion, AMD has the potential to experience significant growth in the upcoming year, even if it falls short of reaching Nvidia’s peak.

An enhanced assessment of worth

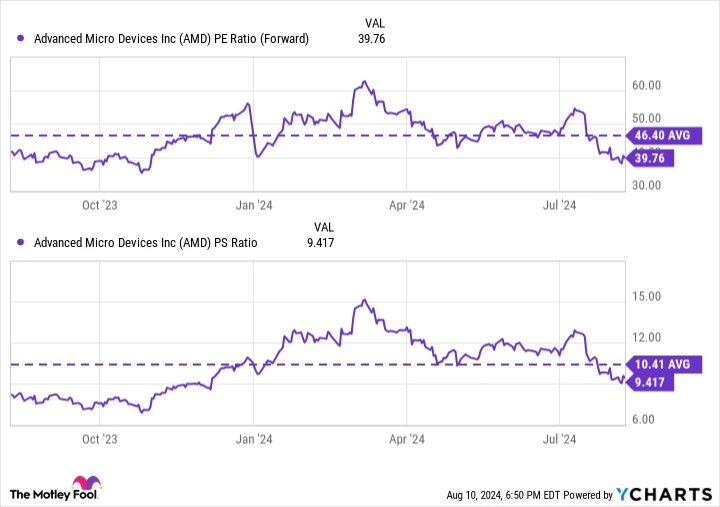

Throughout a significant portion of the year, AMD’s stock price seemed overvalued in relation to its earnings. Nevertheless, a strong performance in the second quarter of 2024 has enhanced its worth and rendered its stock a viable option once more.

Data by YCharts

AMD’s recent financial results and a decrease in its stock price have garnered attention. The P/E ratio for future earnings. ratio and The price-to-sales ratio (P/S) The ratio is currently lower than its average over the past 12 months for the metrics, indicating that this is one of the most favorable times in months to make an investment.

Additionally, AMD’s forward price-to-earnings ratio of approximately 40 is similar to Nvidia’s forward P/E of 39. AMD’s price-to-sales ratio is also lower than Nvidia’s ratio of 33, indicating that AMD may offer better value compared to its main competitor in the chip industry.

AMD’s cash flow that occurs every three months Since January 1st, there has been an 81% increase, emphasizing the favorable direction of the company’s performance. Therefore, investing $1,000 in AMD’s stock at present and holding onto it for the long term is a clear choice.