After slightly more than two years, the yield curve has returned to its typical shape. This means that the interest rates on long-term bonds are once again greater than the interest rates on short-term bonds such as two-year Treasuries.

Yields on 10-year Treasury bonds dropped below those of two-year bonds for the first time. Treasury Interest rates were raised in July 2022 due to concerns among investors about high inflation potentially causing a recession. To protect themselves, investors purchased long-term bonds with lower interest rates as a safeguard, as other investment options were expected to decrease in value. However, this situation has now changed as of this week.

However, the recent flattening of the previously inverted yield curve is not as straightforward as it appears. The curve has flattened mainly due to the market anticipating more significant interest rate cuts than initially projected, resulting in long-term interest rates dropping significantly below shorter-term rates. Despite the reversal of the inversion, it does not guarantee that potential challenges have been averted. recessions Economic downturns that are frequently anticipated by an inverted yield curve usually do not begin until after the curve returns to its normal state.

Put differently, it is advisable to consider taking defensive measures at this moment.

What exactly is the yield curve and why is it important to me?

There is no need to panic in this situation. Making decisions out of panic can lead to poor outcomes. Even if the outcome turns out to be the worst-case scenario, it is unlikely to have a significant impact in the bigger picture. It may just be an inconvenience for serious long-term investors.

However, it is important to understand what is probable (and the reasons behind it) in order to make appropriate plans.

The term ” yield curve Yield curve is a graphical representation illustrating the relationship between interest rates on bonds and similar securities with varying lengths of time until maturity. Generally, bonds with longer maturities, such as 20 or 30 years, tend to provide higher returns compared to shorter-term bonds like 10-year Treasuries, which in turn offer better yields than very short-term securities like three-month T-bills. Interest rates fluctuate but typically show an upward trend in relation to the time to maturity, meaning that longer-term bonds usually have higher interest rates in a stable market environment.

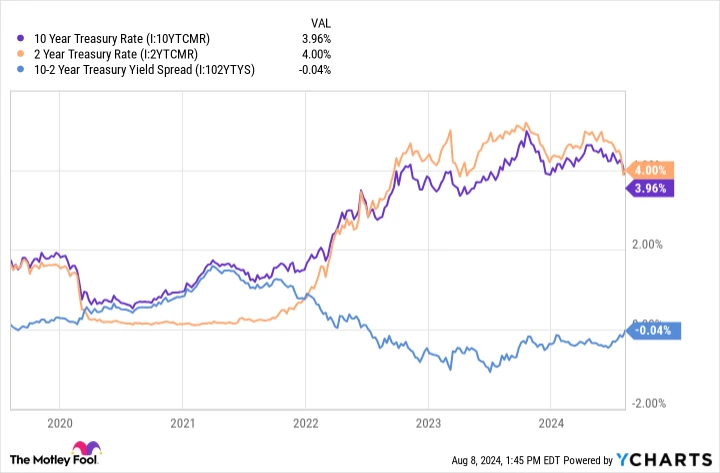

However, this connection starts to weaken when investors notice concerning signs that first appeared in mid-2022. Illustrated in the graph below, this is evidenced by the moment when the returns on two-year Treasuries surpassed the interest rates on 10-year government bonds. Another way to interpret this is through the blue line at the bottom of the chart, which represents the numerical variance between the 10-year and two-year Treasury returns. This line eventually dipped into negative territory in July 2022, marking the occurrence of the yield curve inversion that has been widely discussed.

The interest rate on the 10-year Treasury bond. data by YCharts

However, the reason for this occurrence was the concern about potential market downturn. To secure low interest rates on long-term bonds, individuals chose to invest in them, despite the possibility of earning higher returns through short-term options such as three-month Treasuries and specific money market funds.

Having a small amount now and more later is preferable to having nothing for an extended period. This is why inverted yield curves are commonly regarded as a signal of an upcoming recession. Investors tend to intuitively feel that there is trouble ahead, even if they are not consciously aware of it.

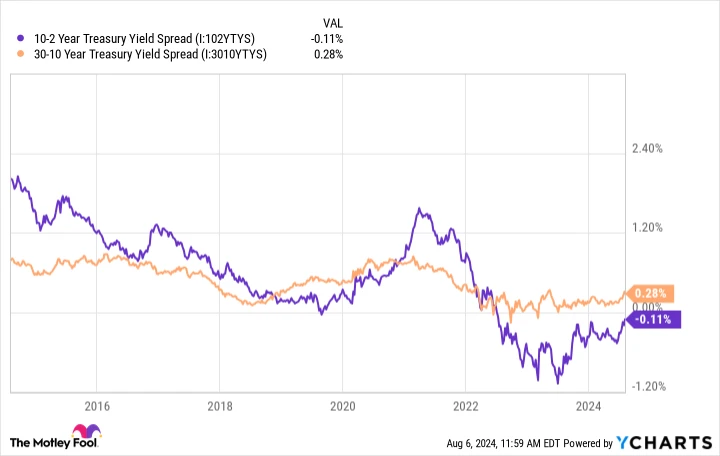

As depicted in the chart above, the yield curve has been gradually moving towards a non-inverted state since the middle of the previous year. The comparison between the 10-year and two-year yields finally surpassed that point (albeit temporarily) on Monday this week due to recent news. Additionally, the difference between the 30-year and 10-year Treasury yields has also expanded to levels not observed since the turbulent first six months of 2023.

The difference in yield between the 10-year and 2-year Treasury bonds. data by YCharts

Has the crisis been prevented? Not quite.

This is typically the point when problems begin to arise.

Inverting yield curves are typically a dependable indicator of an upcoming recession. However, with the yield curve staying inverted for more than two years without an actual economic recession occurring, speculations of a “soft landing” started gaining credibility. It seemed possible that we might emerge from this situation with minimal negative impact.

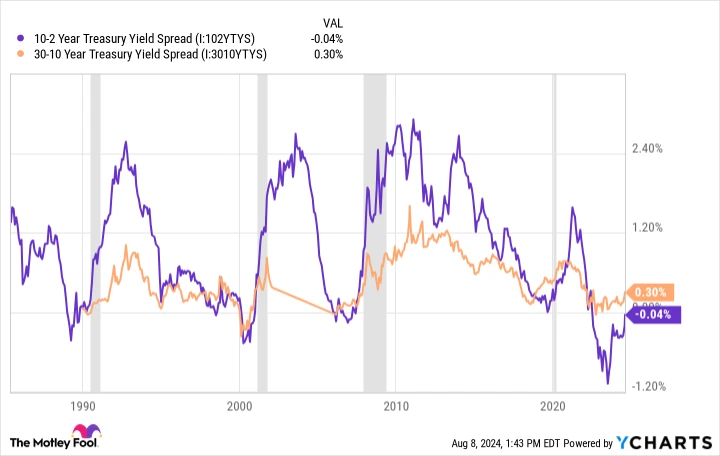

Nevertheless, the recessions indicated by yield curve inversions usually do not begin until after the curve has returned to normal, which has recently occurred.

The chart below illustrates the story; U.S. recessions are marked in gray. It is observed that the economic downturn typically occurs shortly after interest rates begin to move in their new, current direction.

Difference in yields between the 10-year and 2-year Treasury bonds. data by YCharts

There is a chance that the situation might change this time. This specific reversal has been established for a period. an unusually lengthy period , especially at its lowest point. This was largely due to the unique situation caused by the COVID-19 pandemic.

Looking at it from a betting standpoint, the near future appears to be worrisome, although it is expected to be a temporary issue.

When facing a recession, it’s important not to panic. Recessions are a natural occurrence that will eventually pass. They can also present good opportunities to make investments. If you feel the need to take defensive measures, consider selling off any risky assets you might have. During economic downturns, all stocks are affected, but not equally. Some companies may struggle so much that they may not recover from the recession.

Regarding your second question, stocks that are more resistant However, your wisest option is to continue with them and endure any challenges, trusting that they will rebound when the opportunity arises.

According to data from Hartford, a mutual fund company, it was found that 50% of the largest increases in the market since 1994 occurred during a bear market. Additionally, over 25% of these significant market gains took place in the initial two months of a bull market when a considerable number of investors are not actively participating.

Put simply, remain calm for now. You have the opportunity to gradually prepare yourself for any defensiveness you may want to strengthen before facing significant challenges ahead.