Despite the fact that the company’s second-quarter performance was robust and it increased its projections, the stock prices of Health services for him and her ( HIMS 0.69% ) The stock dropped right after its earnings report was released. However, it has shown strong performance throughout the year, with an increase of more than 80%.

We should review the latest performance of the telehealth company and determine if it is a good idea to purchase the stock given its recent decline in price.

Increasing income

Hims & Hers is experiencing robust expansion, as its revenue increased significantly by 53% to reach $315.6 million. This exceeded the company’s projected revenue range of $292 million to $297 million. The number of net orders rose by 20% to 2.53 million, and the average order value (AOV) increased by 27% to $121.

Apart from the recent introduction of the new GLP-1 weight loss product in the middle of the second quarter, sales from the current products surged by 46% to exceed $300 million. Even prior to the launch of the GLP-1 product, the weight loss segment had been experiencing high demand: Within a span of seven months, the segment attracted over 100,000 subscribers, generating a revenue of $100 million annually.

In order to keep up with the growing need, the company plans to purchase a 503B outsourcing facility. This new facility will improve its ability to create compound medications and enable it to explore new areas that involve the use of sterile compounded drugs, like hormonal treatment. Additionally, the company will also focus on upgrading its technology by investing in robotics and tailored software in the upcoming years.

The number of subscribers increased by 43% compared to the previous year, reaching 1.86 million, with a net addition of 155,000 new subscribers. Personalized subscriptions experienced a significant surge of 164%, reaching 785,000 subscribers. These customers are more likely to remain loyal to the service for an extended period, resulting in higher lifetime value.

Hims & Hers experienced a positive impact on marketing efforts during the quarter, as the percentage of revenue allocated to marketing decreased from 52% to 46% compared to the previous year. Despite this, the company intends to boost marketing spending in the latter part of the year.

Adjusted profit before interest, taxes, depreciation, and amortization The revenue saw a significant annual growth of 270%, rising from $10.6 million to $39.3 million. The company’s net income also experienced a turnaround, shifting from a loss of $7.2 million ($0.03 per share) to a profit of $13.3 million ($0.06 per share). Operating cash flow jumped by 219% to $53.6 million compared to $16.8 million in the previous year, with free cash flow reaching $47.6 million, marking a 377% increase.

Hims & Hers has raised its annual forecast once more. The company now predicts that its revenue for the year will fall within the range of $1.37 billion to $1.40 billion, which is higher than its earlier projection of $1.20 billion to $1.23 billion. Initially, the company had anticipated full-year revenue to be in the range of $1.17 billion to $1.20 billion.

The company increased its projected adjusted EBITDA outlook to a new range of $140 million to $155 million, surpassing its previous estimate of $120 million to $135 million. Initially, the company had forecasted adjusted EBITDA for 2024 to fall between $100 million and $120 million.

Hims & Her projects that revenue for the third quarter will fall within the range of $375 million to $380 million, indicating a growth rate of 65% to 68%. The company aims to achieve adjusted EBITDA in the range of $35 million to $40 million.

Credit: Getty Images.

Has the opportunity to purchase the stock passed?

Hims & Hers has experienced significant growth, and the introduction of customized GLP-1 treatments is expected to further boost this growth, as indicated by its strong revenue forecast for the third quarter. This represents a substantial opportunity, with the company only beginning to tap into its full potential.

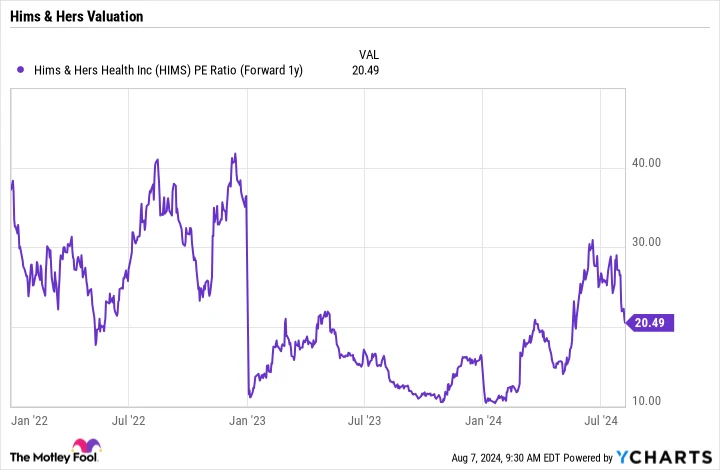

Even though the stock has performed well so far this year, its valuation remains very low. future price-to-earnings (P/E) ratio A ratio of 20.5 has been calculated using analyst projections for the year 2025. This company is experiencing revenue growth of more than 50% with a customer base exceeding 80%. gross margin , that’s a great deal.

HIMS Price-to-Earnings Ratio (Estimated for the Next 12 Months) data by YCharts .

A criticism of Hims & Hers was its lack of a competitive advantage, but this is changing due to its use of personalized compound formulations. By offering personalized compound GLP-1 weight loss solutions at reduced prices, the company made a daring move that seems to be successful. It’s important to mention that the personalized GLP-1 offering is carried out under the compound exemption of the Food and Drug Administration, which poses a risk if challenged. Nonetheless, the company argues that compounding personalized medications is clinically necessary.

I am willing to purchase the stock despite the potential risks because of its valuation and future prospects.