In the past month, Wall Street has served as a strong but important warning to investors that stocks have the potential to decrease in value as easily as they can increase.

In 2024, we observed the mature stock market performance. The Dow Jones Industrial Average ( ^DJI 0.13% ) , benchmark S&P 500 ( ^GSPC 0.47% ) , driven by creativity and innovation The Nasdaq Composite Index ( ^IXIC 0.51% ) Stock market indices frequently reach all-time highs. This pattern aligns with historical trends, indicating that major Wall Street indexes tend to appreciate over time and recover from corrections, bear markets, and crashes.

On the other hand, history has two sides.

Credit: Getty Images.

During a period of three days from August 1 to August 5, the Nasdaq index, which is driven by growth stocks, experienced the most significant decline among the three main stock indexes on Wall Street. This index played a crucial role in driving the overall market to reach new record levels. experienced a drop of 1,399 points This involved a decrease of 576 points on Monday, August 5, which was the eighth largest drop in terms of points in the Nasdaq’s history.

Most investors are likely hoping for a rapid recovery from this situation. speeding up the Nasdaq stock market decline Based on historical data, it is expected that there will be an even more significant decrease in the future.

An excessive valuation of stocks in the past sets up the Nasdaq for a substantial decrease in value.

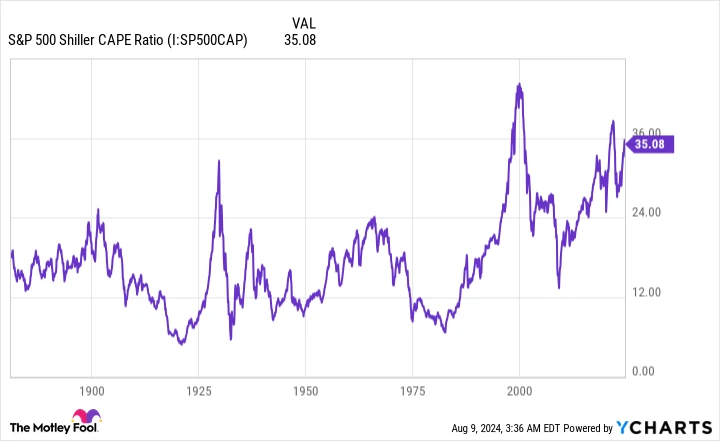

Although history may not exactly repeat itself on Wall Street, it often follows similar patterns. This can be seen in certain indicators. strongly Indicates that the ongoing decline in the Nasdaq Composite is only the beginning, as per the valuation metric known as the Shiller price-to-earnings (P/E) ratio, also known as the cyclically adjusted price-to-earnings ratio. CAPE ratio .

The The conventional price-to-earnings ratio. The P/E ratio, which compares a company’s stock price to its earnings per share over the last twelve months, is a widely used valuation metric among investors. In contrast, the Shiller P/E of the S&P 500 index is calculated based on the average inflation-adjusted earnings of the past ten years. Analyzing earnings data from a decade instead of just one year helps to minimize the impact of significant events, such as the COVID-19 pandemic, on conventional valuation methods.

Shiller CAPE Ratio for the S&P 500 data by YCharts .

At the end of trading on August 8, the Shiller P/E ratio of the S&P 500 was 34.30, which is almost exactly twice its historical average of 17.14 since 1871 when analyzed retrospectively.

Since the mid-1990s, it has been quite usual for the Shiller P/E ratio to exceed its typical level. The rise of the internet has made it more convenient for investors to access information. Additionally, prolonged periods of low interest rates encouraged investors to take on more risks, resulting in increases in stock valuations.

Nevertheless, when the Shiller P/E ratio of the S&P 500 exceeds 30 in a bullish market, it has historically indicated potential problems. This trend can be traced back to January 1871. There have only been six instances like this. In each of the five previous occurrences, including the current one, the Dow Jones, S&P 500, and/or Nasdaq Composite experienced a decline ranging from 20% to 89%. In simpler terms, High valuations are accepted on Wall Street, but only for a limited period of time. .

It is important to note that the Shiller P/E ratio should not be used as a timing indicator, as high valuations can persist for extended periods of time, similar to what happened before the dot-com bubble burst.

According to historical data, Shiller P/E ratios above 30 in the modern era have typically decreased to around 22 in the future. This suggests that the S&P 500 might decline by approximately one-third of its current value, with the Nasdaq Composite potentially experiencing even greater losses.

Credit: Getty Images.

A change in monetary policy is a concerning indicator for the financial markets.

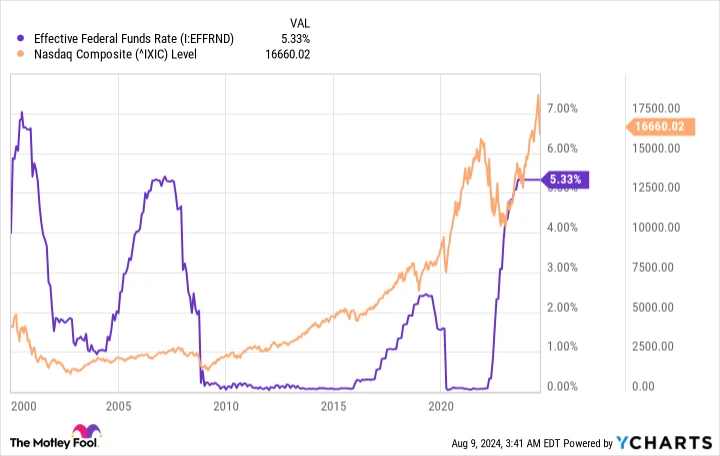

Although it is not a specific measurement like the Shiller P/E ratio, Federal Reserve monetary policy has traditionally had significance for Wall Street.

At first glance, one might assume that increasing interest rates would negatively impact stocks, whereas a cycle of decreasing rates would be beneficial. However, surprisingly, this is not the case for equities.

Usually, the Federal Open Market Committee increases its interest rate at which depository institutions lend reserve balances to other depository institutions overnight on an uncollateralized basis , it does In order to prevent the U.S. economy from becoming too hot, tightening cycles are typically implemented when the U.S. economy is performing well.

Conversely, periods of lowering interest rates usually begin when there are issues in the U.S. economy or when a negative event occurs. While the expectation of lower interest rates will eventually encourage individuals and companies to borrow more, it may take over a year for these impacts to be fully experienced across the economy.

The Federal Funds Rate that is successful in achieving its intended goals. data by YCharts .

Since the start of this century, The beginning of periods of lowering interest rates has historically indicated negative outcomes for the stock market. :

- Starting on January 3, 2001, the Federal Reserve initiated a series of interest rate cuts in response to the dot-com bubble bursting. This led to a decrease in the federal funds rate from 6.5% to 1.75% within a year. Despite this rapid reduction, it took 645 days for the stock market to reach its lowest point after the first rate cut.

- In September 18, 2007, as the financial crisis was unfolding, the Federal Reserve initiated a series of interest rate cuts that brought the federal funds target rate down from 5.25% to a range of 0%-0.25%. It is remarkable to note that the stock market did not reach its lowest point until 538 days later.

- The third and last round of interest rate cuts in this century started on July 31, 2019, bringing the federal funds rate back to the range of 0% to 0.25%. The stock market hit its lowest point 236 days after this initial cut, coinciding with the early stages of the COVID-19 outbreak.

Since the year 2000, the average duration has been 473 calendar days. It took over 15 months for the stock market to reach its lowest point. After the first interest rate reduction, it is anticipated that the country’s central bank will start lowering rates in September, indicating potential challenges ahead for the Nasdaq Composite and the overall stock market, based on historical trends.

Investors who have a long-term perspective tend to benefit from history.

Even though I previously emphasized that history has two perspectives, it is equally crucial to acknowledge that The U.S. economy and stock market experience fluctuations in a non-linear pattern known as boom-and-bust cycles. When given the option to be optimistic or pessimistic, history shows that it is better to have a positive outlook, particularly if you think in the long term.

History demonstrates that economic growth and downturns do not always correspond directly. In the United States, there have been 12 instances of economic expansions and contractions. recessions After World War II, only three recessions lasted for a year, with none extending beyond 18 months. In contrast, there were two instances of economic expansion lasting over a decade. The U.S. economy tends to spend a significant portion of time in a growth phase, indicating that businesses in America are likely to experience increases in sales and profits in the long term.

While the stock market and the U.S. economy may operate separately, the non-linear progressions and setbacks are reflected in Wall Street.

The researchers from Bespoke Investment Group published a data set last year that examined the average duration of bear and bull markets in the S&P 500 since the beginning of the Great Depression in September 1929. A total of 27 distinct bear and bull markets were reviewed.

The information presented in this dataset indicates that the mean value. bear market The bull market for the S&P 500 has only been ongoing for 286 days, which is equivalent to around 9.5 months. In comparison, the average bull market for the S&P 500 typically lasts longer. has been present for a duration that is 3.5 times longer In a total of 1,011 days on the calendar, it is evident that 13 out of the 27 bull markets have had a duration surpassing that of the longest bear market.

History clearly indicates that the Nasdaq Composite and stocks, overall, may be poised to move in a certain direction. meaningfully In the upcoming months, if the predicted decrease occurs, it will provide long-term investors with another chance to invest in top-notch companies at favorable prices. Having a long-term view and considering past trends can be very beneficial for investors who are patient.