Intel ‘s ( INTC -2.22% ) The process of turning things around was expected to take a long time. The company has been investing heavily in manufacturing in order to bridge the gap and exceed expectations. TSMC Regarding manufacturing technology, the upcoming Intel 18A process is projected to be completed by the end of this year and to ramp up in 2025 and 2026. It is anticipated to compete with TSMC’s most advanced process nodes.

Intel plans to leverage its latest manufacturing advancements to breathe new life into its PC and server chip divisions, which have been hindered by production setbacks and errors. Additionally, the company aims to expand its presence as the second-largest global foundry by 2030, necessitating over $15 billion in annual revenue from external foundry services by the end of the decade. Intel’s objectives are undeniably ambitious.

Things did not go as planned.

A drawback of Intel’s approach is that it can be a lengthy process for the investments in manufacturing to become profitable. The foundry sector is currently experiencing significant losses in the billions of dollars due to substantial expenditures and a lack of income from external sources. Intel has reserved a minimum of $15 billion in value. The external-foundry business is expected to generate revenue in 2025 or 2026, although a significant portion of it will not be realized until then.

Intel is investing a significant amount of money into production, but is struggling with a sluggish PC market and facing strong competition. AMD , and a change in focus among clients who use data centers towards AI chips Intel did not meet its second-quarter financial expectations and has a pessimistic near-future outlook, leading the company to implement a comprehensive cost reduction strategy. This strategy involves moving away from traditional CPUs.

In 2025, Intel plans to reduce its total operating costs and investments by a minimum of $10 billion and halt dividend payments to increase available cash. As part of this strategy, the company will also cut around 15% of its employees. It is crucial to note that Intel remains committed to its manufacturing objectives. Although there will be some decrease in capital expenses, the company’s long-term plans for its foundry operations remain unchanged.

The value of Intel’s stock plummeted following this announcement. According to one measure, it is currently more affordable than it has ever been.

An extremely negative outlook.

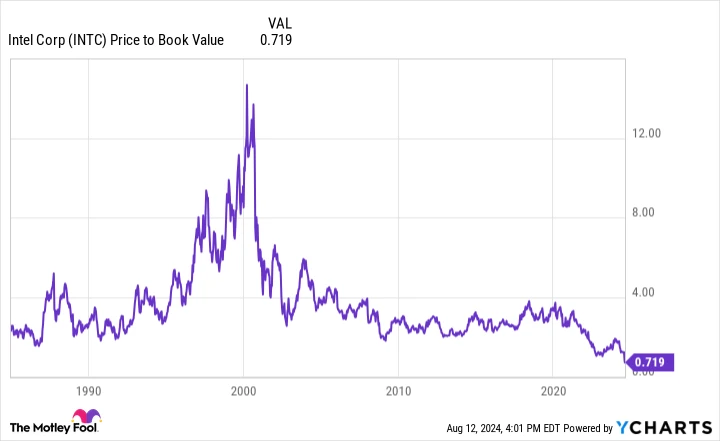

The ratio of the price of a stock to its book value The metric (P/B), which calculates a company’s market value relative to its net assets, is most applicable when a company generates its earnings primarily from tangible assets. This ratio is suitable for a manufacturing firm but may not be as relevant for a software company.

Intel is predominantly a manufacturing firm. By the conclusion of Q2, the company listed more than $100 billion in property, plant, and equipment on its financial statement, representing around half of its overall assets. The P/B ratio serves as a valuable measure for Intel.

This is how Intel’s price-to-book ratio appears at the moment:

The Price to Book Value ratio of INTC data by YCharts.

Here is the identical chart for price-to-tangible book value, which does not take into account intangible assets.

The price of INTC compared to its tangible book value. data by YCharts.

One would have to look back several decades to find a time when Intel was as inexpensive as it is now based on these two measures.

Determining the “appropriate” P/B ratio for Intel is subjective and can vary. In most cases, a higher P/B ratio is indicative of… Return on invested capital (ROIC) is a financial metric that measures the profitability of a company by analyzing how efficiently it generates profits from its capital investments. The P/B ratio should be higher for companies with more consistent profits, while a company that produces goods and experiences fluctuations in profitability should not be valued much above its book value.

Intel does not produce basic goods, and in the past, it has maintained a Return on Invested Capital (ROIC) ranging from 15% to 20%. However, this figure has declined recently due to increased investments and various obstacles. Nevertheless, the implementation of a cost reduction strategy is expected to improve the situation.

Currently, Intel’s stock is trading at slightly over 70% of its book value, indicating that the market believes Intel may not be able to bounce back. Although Intel may not regain its previous dominance in its main markets, completely dismissing its potential seems unwarranted.

Intel is expected to face challenges in the coming years, but if there is even a slight possibility of a positive change, now would be an opportune moment to invest in their stock.