AMD ( AMD -0.27% ) In the first half of 2024, there was a decline in Wall Street’s interest in the company, as its stock had decreased by 8% since the beginning of the year. Comparatively, its competitor in the chip industry was doing better. Nvidia During the same time frame, the company’s stock rose by 113%. Despite average earnings, it indicated that AMD had not made substantial progress in the field of artificial intelligence (AI). The overall decrease in technology stocks also contributed to the drop in AMD’s stock value.

On July 30, AMD released its financial results for the second quarter of 2024, showing a positive performance in the growing market. The company experienced significant growth in its AI-focused data center sector and increased sales in its CPU division during this period.

Consequently, AMD’s stock has become more appealing for investors. The company has a significant track record of growth, with its stocks rising by almost 5,000% in the past ten years. Additionally, revenue and operating income have experienced a remarkable increase of 312% and 169% correspondingly. AMD is still in the early stages of its AI ventures and has the potential to achieve substantial profits as it expands in the future.

Here is the top choice for a growth stock to purchase with $10,000 at this moment.

AMD might have greater potential for growth compared to Nvidia.

AMD and Nvidia are commonly pitted against each other as they are key players in the chip industry. Together, these two companies dominate the majority of the discrete market share. GPU industry Both AMD and Nvidia are leading players in AI GPUs, but they are at significantly different points in their business growth. This is evident from AMD’s market capitalization standing at $221 billion, while Nvidia’s is currently at $2.6 trillion.

The contrast in performance could signal significant opportunities for AMD as it progresses in the field of artificial intelligence, a sector valued at $197 billion in 2023 and projected to approach nearly $2 trillion by the conclusion of the decade. With the AI industry growing at a compounded annual rate of 37%, it implies that Nvidia has the potential to maintain its leading market position while AMD has the chance to establish a profitable presence.

AMD has demonstrated strong performance in its recent earnings report. In the second quarter of 2024, the data center segment of the company experienced a significant increase in revenue, with a 115% growth compared to the previous year. Additionally, the operating income surged by 405% to reach $743 million. Although there was a notable decrease of 59% in gaming revenue, the overall revenue for the quarter rose by 9%. These results indicate a favorable development in AMD’s business, showcasing how its substantial investment in AI has helped to offset losses in other areas.

Possibilities for gaming

Before interest in AI Before its recent surge in popularity, AMD was mainly recognized for its involvement in the gaming industry. The company has been thriving for years by selling its graphics processing units (GPUs) and central processing units (CPUs) to individuals who utilize these components to assemble top-of-the-line gaming computers or robust systems tailored for video editing purposes.

The company is benefiting from growth in the CPU sales, as shown by a 49% increase in the client segment compared to the previous year. However, the gaming division, which encompasses revenue from GPU and semi-custom chip sales, is experiencing a decline. The company attributes this decrease primarily to lower revenue from semi-custom products.

Among AMD’s major clients for semi-custom products are Sony and Microsoft These chips are utilized to operate gaming systems like the PlayStation 5 and Xbox Series X|S. The sales of these consoles typically follow a cycle, beginning with high demand and then tapering off until the next iteration is released. The PlayStation 5 and Xbox Series X|S were both introduced in 2020, which may account for the decreased chip sales for AMD.

A potential mid-generation upgrade for consoles may be on the horizon, as Sony is said to be developing a PlayStation 5 Pro and Microsoft is expected to do the same. The introduction of new consoles is likely to enhance AMD’s sales of custom chips and its gaming sector. In addition to the growth in AI and CPUs, AMD has evolved into a diversified company that appears to be a promising investment opportunity.

The value of AMD stock is higher than one may realize.

Throughout the year, AMD faced challenges in attracting investors due to its efforts to compete in the field of artificial intelligence. The company’s significant investment in AI technology and moderate profits led to its stock being perceived as overpriced. Nevertheless, the company’s recent quarterly performance has enhanced its worth in the eyes of investors.

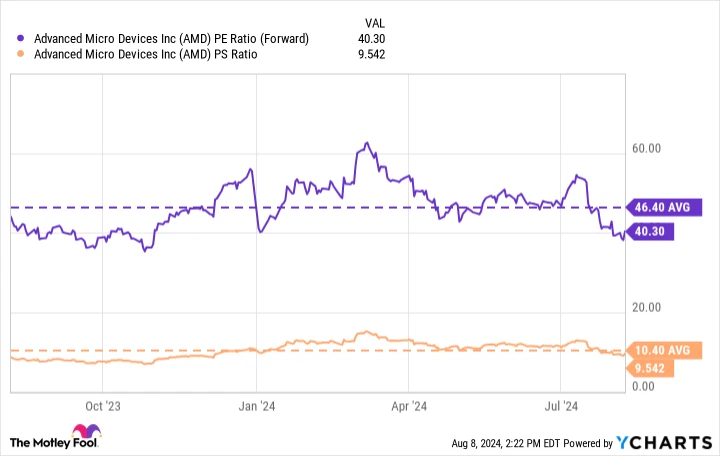

Data by YCharts

This diagram illustrates AMD’s. price-to-earnings ratio (P/E) that is expected in the future and the ratio of a company’s market capitalization to its total revenue The current ratios for both metrics are lower than the company’s 12-month averages. This indicates that AMD’s stock is currently being traded at a very attractive value compared to previous months.

Aside from the significant potential in artificial intelligence and promising profits, AMD is a compelling investment option for purchasing $10,000 worth of stock and holding onto it for the long run.