The performance of the “Magnificent Seven” has been varied this year, with some companies doing well while others have not performed as strongly. This group consists of prominent tech companies. Alphabet , Apple , Amazon , Microsoft , Meta Platforms ( META 0.66% ) , Nvidia , and Tesla .

Meta Platforms, the parent company of Facebook, has been performing well in the stock market, with a strong 42% increase since the beginning of the year. Despite this, the company has experienced a recent decline, with shares dropping by 6% in the last month. It is uncertain how long this downward trend will continue, but Meta Platforms is expected to recover and achieve positive outcomes in the long term.

Numerous avenues for growth

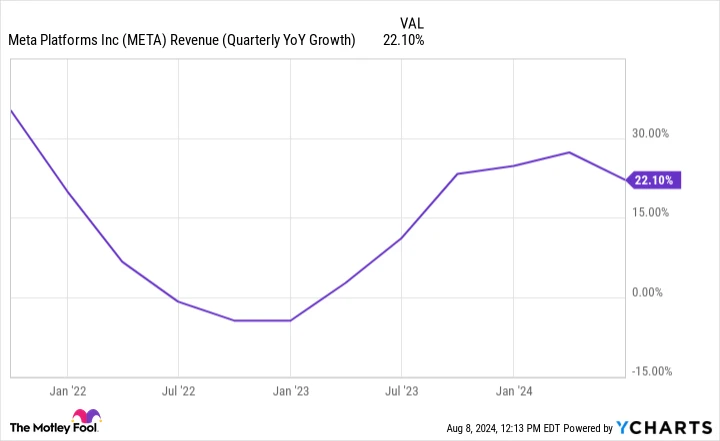

As of now, Meta Platforms has a market value of nearly $1.3 trillion. The company has shown strong performance in the stock market over the last ten years. Despite this success, there are still many chances for growth ahead, particularly in its main revenue source of advertising. In the last quarter, Meta Platforms earned a total revenue of $39.1 billion, marking a 22% increase compared to the previous year, with advertising accounting for $38.3 billion of that revenue.

It feels like a distant memory when the online advertising industry faced a decline, resulting in Meta Platforms experiencing disappointing financial outcomes and minimal year-on-year revenue growth. However, the tech giant has since made a remarkable recovery.

Quarterly Year-over-Year Growth in META Revenue data by YCharts

Similar problems are expected to arise in the future. When the economy is struggling, consumers tend to spend less and businesses cut back on advertising expenses. Despite this, analysts predict that the online advertising industry will continue to grow steadily over time.

Meta Platforms has enhanced the efficiency of its business by leveraging artificial intelligence technology. The AI algorithm employed by the company assists in suggesting Reels, which are short-form videos, to viewers on its social media platforms, Facebook and Instagram. As a result, viewers tend to spend more time watching Reels, which ultimately boosts engagement levels and makes the platform more appealing to advertisers.

When it comes to AI, it presents another possible chance for the business. The Llama developed by Meta Platforms, is a prime example. a model of significant size designed for processing and generating language , is a top performer in the industry and plays a crucial role in supporting Meta AI, the AI-powered assistant. The company predicts that Meta AI will be the most popular AI assistant by the end of the year.

Although Meta AI is currently offered for free, Meta Platforms will seek to generate revenue from its AI projects in the future. The company is also exploring additional revenue streams, such as introducing paid messaging on WhatsApp and pursuing its ambitious goals. metaverse initiatives.

A wide moat

Meta Platforms is not the sole company aiming to benefit from online advertising, AI, or the metaverse. Regardless of the other main revenue streams it pursues, it is likely to face significant competition. tech giant Despite this, it should still be able to excel due to its competitive edge.

Meta Platforms’ popular brands, Facebook and Instagram, are widely recognized and highly valued globally, particularly within the realm of social media companies. They consistently rank as some of the most frequently visited websites on a global scale.

Afterwards, Meta Platforms gains advantages from the situation. network effect The more people use websites and apps, the more valuable they become. This is beneficial for both advertisers and consumers. Advertisers find Facebook more appealing for running ad campaigns due to its large user base. Likewise, private users seeking to connect with loved ones are more likely to succeed on popular platforms. As these platforms become more popular, they become even more appealing for connecting with others.

In June, Meta Platforms had 3.27 billion users using its websites daily, which is nearly half of the world’s population accessing one of its applications each day. This vast user base provides Meta Platforms with the chance to generate revenue from them. While its endeavors may not always succeed, it is more feasible for a company with an extensive customer base to introduce new products to existing users than to draw in new customers who are not familiar with the company.

Threads, a platform introduced by Meta Platforms as a substitute for Twitter, has garnered 200 million monthly active users within a year of its launch. The extensive ecosystem of Meta Platforms could potentially contribute to the realization of its metaverse and AI aspirations.

An additional justification for purchasing the stock

Meta Platforms is unquestionably excellent. growth stock The company recently introduced a quarterly dividend, adding another incentive for investors to hold onto their shares. While it is still uncertain if Meta Platforms will become a strong dividend stock, reinvesting dividends over time can lead to higher returns. Despite a recent decline in the company’s performance, the new dividend offering could enhance the overall value of holding onto Meta Platforms’ stock.