Shares in Taiwan Semiconductor (down 2.23%) saw a decline today following the company’s August revenue update, which indicated a slowdown in growth.

Although the growth rate remained robust, it showed a deceleration from July’s figures, which was sufficient to cause the stock to drop.

By 10:46 a.m. ET, the stock had decreased by 2.6%.

TSMC applies the brakes

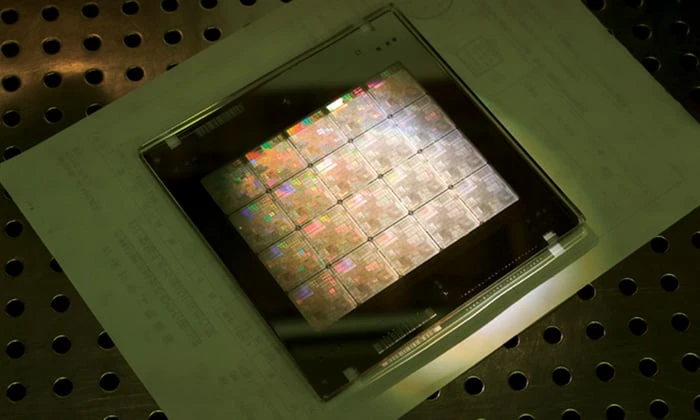

Taiwan Semiconductor has been a major beneficiary of the ongoing artificial intelligence (AI) surge. As the largest contract chip manufacturer globally, it supplies tech giants such as Apple, Nvidia, Broadcom, and AMD. Consequently, its performance is closely monitored as an indicator for both AI and the wider semiconductor industry.

In August, the company reported revenues of $7.8 billion, a 33% increase from the previous year but a 2.4% decline from July’s figures. Year-to-date revenue through August rose by 31% to $55.1 billion, indicating that August’s growth aligned largely with the year’s overall trend.

While management does not comment on monthly reports, it’s notable that not only did revenue drop sequentially, but the growth rate, although still impressive, significantly slowed from 45% in July.

Should investors be concerned?

Most companies refrain from releasing monthly data due to its often volatile nature, which may not accurately depict underlying business trends. The slowdown observed in TSMC’s August figures might simply be a temporary fluctuation rather than an emerging trend.

Currently, there is no immediate cause for alarm, but it would be prudent to monitor the company’s monthly revenue updates, particularly as some investors express concerns about a potential AI bubble.

If TSMC experiences further deceleration in September, it might warrant some concern. However, investors should also consider that the evolution of generative AI will unfold over several years.

Under these conditions, a slight decrease in TSMC’s stock price seems reasonable, but this report shouldn’t alter your investment thesis on the stock.

Don’t miss out on a potentially lucrative opportunity

Ever feel like you’ve missed out on purchasing the most successful stocks? If so, this is for you.

Occasionally, our expert team of analysts issues a “Double Down” stock recommendation for companies they believe are poised for significant growth. If you’re worried about missing your chance to invest, now is the optimal time to buy before it’s too late. The numbers speak for themselves:

Nvidia: A $1,000 investment when we doubled down in 2009 would have grown to $276,036!*

Apple: A $1,000 investment when we doubled down in 2008 would be worth $41,791!*

Netflix: A $1,000 investment when we doubled down in 2004 would now be $364,248!*

Currently, we’re issuing “Double Down” alerts for three remarkable companies, and opportunities like this may not come around often.

Discover the 3 “Double Down” stocks ›

*Stock Advisor returns as of 09/10/2024