Taiwan Semiconductor (1.08%) may currently stand as one of the premier investment opportunities in the tech sector. Although it has historically been a strong performer, the company is poised to benefit from some of the most significant growth drivers it has seen in years. But what can investors realistically anticipate from this leading chip manufacturer?

Taiwan Semi Positioned for Major Growth

Taiwan Semiconductor occupies a unique niche among technology companies. As a contract chip manufacturer, it serves as a fabrication partner for a variety of competing companies. For instance, it produces chips for both Nvidia and Advanced Micro Devices (AMD). While Nvidia currently leads the data center GPU market, driven by skyrocketing demand for artificial intelligence (AI), AMD has the potential to reclaim some market share in the future. Regardless of these shifts, TSMC stands to gain from the overall market expansion.

Unlike companies that compete directly in the open market, Taiwan Semi offers a more stable investment, avoiding extreme fluctuations. As technology becomes increasingly integrated into daily life, TSMC is well-positioned for continued success, making it an attractive investment option.

Several factors are poised to propel the company forward.

Firstly, Apple is TSMC’s largest client, accounting for about a quarter of its annual revenue. Recently, iPhone sales have not been as robust as in the past. However, with Apple’s introduction of its own AI initiative—Apple Intelligence, exclusive to the latest phones—there’s potential for TSMC’s smartphone segment to experience a revival.

Secondly, TSMC is optimistic about the future of AI-related chips, predicting a compound annual growth rate of 50% through 2027. By that year, it is anticipated that AI chips will constitute over 20% of TSMC’s total revenue, marking significant growth for this emerging segment.

Moreover, Taiwan Semi is set to release a groundbreaking chip design in 2025: the 2-nanometer (nm) chip, succeeding last year’s 3nm chip. Reducing the chip node by 1nm can lead to substantial performance gains. Management asserts that the 2nm chip can achieve a 10% to 15% speed increase at the same power level as its predecessor.

However, the primary draw is expected to be its energy efficiency. When operated at the same speed as a 3nm chip, the 2nm version will use 25% to 30% less power. This improvement is likely to be highly sought after, especially given the significant energy costs associated with large-scale AI services. Customer interest in this new technology already surpasses that seen with previous 3nm and 5nm architectures.

With these promising developments on the horizon, it’s clear why TSMC is considered one of the top tech stocks to invest in now.

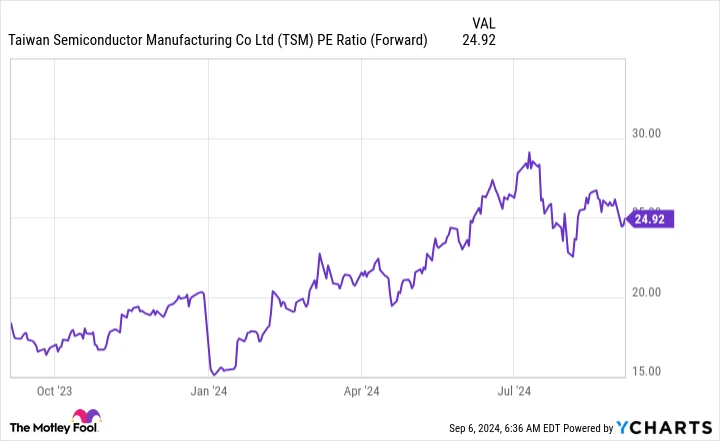

Attractive Valuation Compared to the S&P 500

Even top companies can become poor investments if purchased at the wrong price. Fortunately, TSMC is available at a relatively attractive valuation.

According to YCharts, TSMC trades at 25 times forward earnings, slightly above the S&P 500 index’s 23 times forward earnings. Given TSMC’s strategic market position and substantial growth drivers, it’s arguably a more compelling investment than the average S&P 500 company.

In conclusion, Taiwan Semiconductor could be one of the top tech investments currently available, offering a balanced approach to capitalizing on AI-driven growth.

Should You Invest $1,000 in Taiwan Semiconductor Manufacturing Now?

Before investing in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor team recently identified what they believe to be the 10 best stocks to buy right now, and Taiwan Semiconductor Manufacturing wasn’t among them. The selected stocks have the potential for substantial returns in the coming years.

Consider when Nvidia made the list on April 15, 2005; if you had invested $1,000 at that time, your investment would be worth $716,375 today!*

It’s worth noting that the Stock Advisor’s total average return is 741%, significantly outperforming the S&P 500’s 162%. Don’t miss out on the latest top 10 list.

See the 10 stocks

*Stock Advisor returns as of September 9, 2024