This article explores the resurgence of stock splits, detailing three companies—Broadcom, Nvidia, and Super Micro Computer—with substantial growth potential post-split. It highlights each company's strengths and future prospects, while also introducing The Motley Fool Stock Advisor's "Double Down" alerts for seizing significant investment opportunities.

The article highlights strategic investment opportunities in SentinelOne, Netflix, and Sea Limited, each poised for significant growth amidst high market valuations. SentinelOne excels in cybersecurity and AI, Netflix strengthens its streaming dominance, and Sea Limited rebounds post-pandemic. It also emphasizes The Motley Fool Stock Advisor's success in doubling down on high-return stocks.

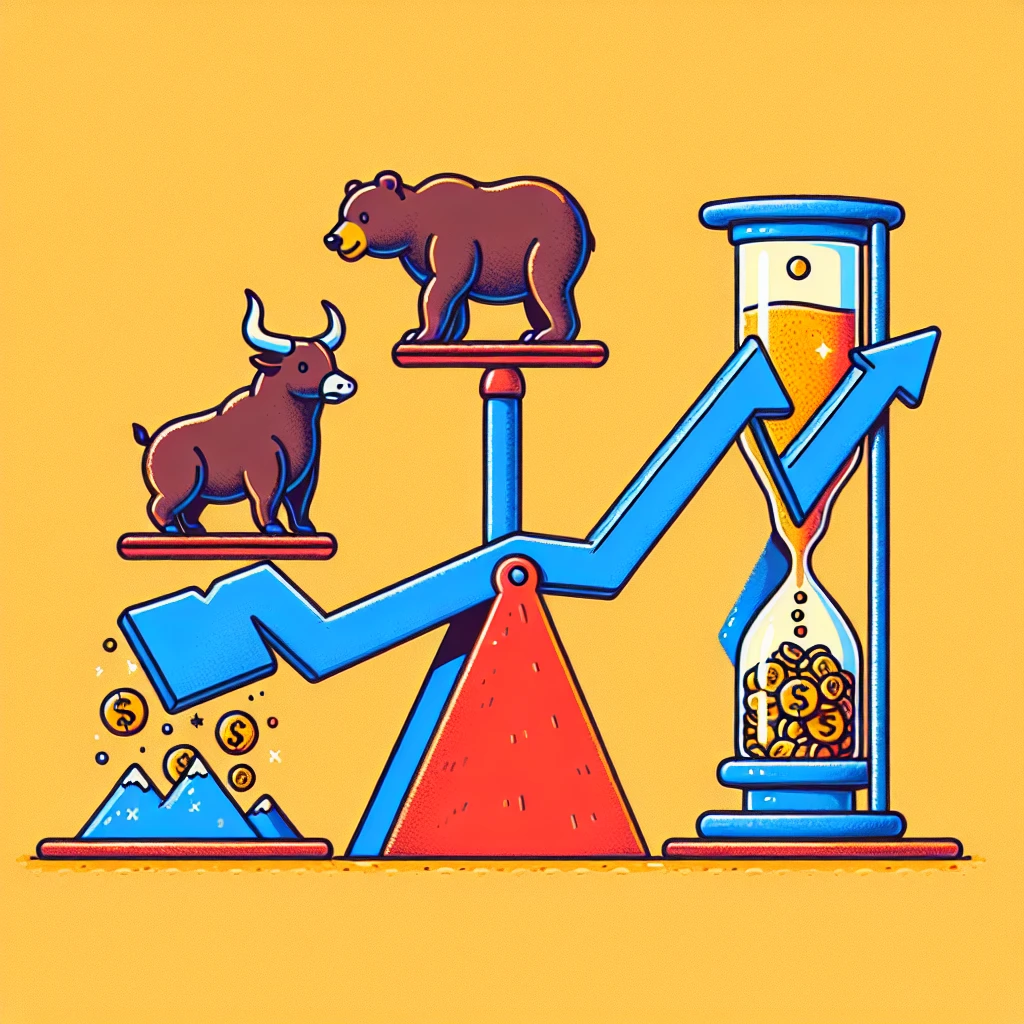

In this engaging episode of Rule Breaker Investing, past champions Matt Argersinger and Yasser El-Shimy face off in the "Market Cap Game Show," testing their market cap estimation skills across a range of industries. Listeners are invited to join the fun and challenge their own knowledge, gaining insights into investing strategies and corporate dynamics. Despite a competitive match, Argersinger emerges victorious, showcasing the importance of understanding market capitalization in investing.

In 2024, AI and stock splits have shaped the U.S. stock market, with key players like Nvidia and Broadcom completing significant forward splits. As they make way for Super Micro Computer and Lam Research, investors are urged to capitalize on emerging opportunities, given AI's transformative economic impact and the potential for substantial investment returns.

Stan Druckenmiller strategically shifts his investment focus from tech giants to high-yield dividend stocks, capitalizing on market conditions and Federal Reserve rate cuts, while highlighting potential high-growth investment opportunities through "Double Down" stock recommendations.

This text advocates for investing in Alphabet over Nvidia, citing Alphabet's strategic structure, long-standing AI expertise, and undervalued stock as compelling reasons. It underscores Alphabet's resilience and potential for growth in the AI sector, presenting it as a promising investment opportunity.

CrowdStrike remains resilient despite a recent software glitch, maintaining strong growth through customer acquisition and diverse security offerings. The financial impact appears minimal, presenting a potential investment opportunity as the company continues to lead in technology growth stocks. Consider a dollar-cost averaging strategy to capitalize on future growth amidst favorable interest rate trends.

Tesla's upcoming Cybercab robotaxi reveal is a pivotal moment for investors, offering potential growth and excitement despite current uncertainties. The event could positively impact Tesla's stock, especially given its strategic position in the robotaxi market and future growth prospects. Additionally, the text emphasizes seizing timely investment opportunities with proven "Double Down" stock recommendations.

The text explores the potential of Rocket Lab USA and Remitly Global as promising investment opportunities under $100, highlighting their impressive growth trajectories and market potential. It underscores the importance of durable growth for achieving significant investment returns and references the Motley Fool Stock Advisor's success in identifying high-performing stocks.

This article explores the impact of AI advancements, particularly through ChatGPT, on the stock market, highlighting key investment opportunities in Nvidia, Alphabet, Meta Platforms, and Amazon within the "Magnificent Seven" tech stocks. It underscores their strategic roles in AI development and potential for substantial returns, as identified by the Motley Fool Stock Advisor.

Explore four standout stocks—Costco, Cintas, Rollins, and Badger Meter—that showcase remarkable resilience and growth potential, making them compelling options for strategic investment.

Explore how the S&P 500's leading companies—Apple, Microsoft, Nvidia, Alphabet, and Amazon—are leveraging artificial intelligence to drive growth, significantly shaping the index's performance. Discover investment opportunities through "Double Down" stock recommendations for potential high returns.

The article makes a compelling case for investing in PepsiCo, highlighting its strong market positions in beverages and snacks, financial stability as a Dividend King, and attractive dividend yield. Despite being slightly below its stock peak, PepsiCo is potentially undervalued, offering a promising investment opportunity.

Palantir Technologies' stock surged in 2024, driven by its innovative AI tools and upcoming inclusion in the S&P 500, marking its growing market relevance. While tackling challenges like high stock-based compensation and competition from major tech players, Palantir's expansion into AI software for military and private sectors presents promising growth potential for investors.

The text analyzes Wall Street's impressive gains in 2023 while highlighting potential market vulnerabilities through historical valuation metrics, economic indicators, and money supply trends. It emphasizes the enduring power of time in market cycles and suggests strategic long-term investment opportunities despite current concerns.

The text explores the trend of stock splits among leading AI companies, highlighting potential candidates ASML and Equinix due to their growth in the AI market. It explains the investor appeal of stock splits and provides investment insights, including the potential returns of past Motley Fool recommendations.

The text explores Cathie Wood's optimistic vision for Tesla, highlighting its AI and self-driving technology as key growth drivers, while also addressing the challenges Tesla faces in the EV market and the ambitious nature of Ark Invest's future stock price projections.

The analysis highlights Dollar General's potential to outperform Dollar Tree in the coming years, driven by expected earnings recovery and strong shareholder returns, while debunking the myth of e-commerce overtaking traditional retailers. Despite current economic challenges, Dollar General's strategic adjustments and consistent capital returns position it as a compelling investment opportunity.

The text highlights investment opportunities in Rivian Automotive and Nio, two EV stocks poised for a rebound despite industry challenges, and explores their transformative strategies and potential catalysts for growth.

The text explores the strategic interplay between Realty Income and W.P. Carey, two major net lease REITs. Realty Income, a market leader, focuses on retail properties and offers stable dividends, while W.P. Carey, with a strong European presence and higher yield, is shifting its strategy to align more closely with Realty Income's successful model. The analysis highlights their growth trajectories, investment appeal, and the potential for W.P. Carey to complement or stand independently in an investor's portfolio.

E.l.f. Beauty is a rapidly growing cosmetics brand with a strong market presence, showcasing impressive sales increases and international expansion. Despite a recent stock dip, it remains an attractive investment opportunity due to its affordable, resonant branding and strategic growth initiatives.

The space tourism market sees Virgin Galactic and Blue Origin offering brief, expensive trips, while SpaceX positions itself as a potential game-changer with longer, more cost-effective missions, suggesting a shift in market dynamics and investment considerations.

Explore the potential of DraftKings and Palantir Technologies as promising growth stocks under $100, capitalizing on expanding markets in sports betting and AI-driven decision-making, while considering expert investment advice.

The text explores recent declines in the stock prices of Occidental Petroleum, ConocoPhillips, UPS, Toyota, and Estee Lauder, positioning them as promising investment opportunities despite current challenges. It highlights each company's strategies for overcoming obstacles, emphasizes the potential for recovery, and underscores the value of dividend income for patient investors.

Trex, a leader in the composite decking industry, offers a compelling investment opportunity despite recent stock declines. With a strong market position, sustainable products, and multiple growth catalysts, including lower interest rates and international expansion, Trex is well-positioned for future growth, presenting a potentially undervalued investment.

The Federal Reserve's interest rate cut poses challenges for Charles Schwab, a brokerage heavily reliant on interest income, despite attracting more customers. While Schwab remains a strong long-term investment, its short-term prospects are dimmed by the current economic climate, prompting investors to consider other potentially more rewarding opportunities.

Super Micro Computer faces significant stock declines due to financial disappointments, accounting allegations, and report delays, but remains optimistic about future growth driven by AI innovations.

The Federal Reserve's rate cut could intensify competition in the AI sector, challenging smaller companies like SoundHound AI, which struggles to match the aggressive innovation spending of larger tech giants.

Nvidia's stock performance, despite strong operational gains in the AI sector, faces challenges due to market skepticism about long-term momentum and monetization potential. The company's speculative nature and reliance on AI software sector growth impact its ability to reach higher stock prices.

The rewritten text explores Broadcom's substantial growth potential in the AI sector, highlighting its strategic positioning in networking components and custom AI chip design. Despite competition, Broadcom is poised for significant opportunities and growth, making it a compelling investment prospect, though other stocks may currently offer better returns according to The Motley Fool's recommendations.