The space tourism market sees Virgin Galactic and Blue Origin offering brief, expensive trips, while SpaceX positions itself as a potential game-changer with longer, more cost-effective missions, suggesting a shift in market dynamics and investment considerations.

Explore the potential of DraftKings and Palantir Technologies as promising growth stocks under $100, capitalizing on expanding markets in sports betting and AI-driven decision-making, while considering expert investment advice.

Costco has achieved remarkable shareholder returns by leveraging its effective business model and offering both regular and special dividends, making it a compelling long-term investment for dividend-seeking investors.

The text explores recent declines in the stock prices of Occidental Petroleum, ConocoPhillips, UPS, Toyota, and Estee Lauder, positioning them as promising investment opportunities despite current challenges. It highlights each company's strategies for overcoming obstacles, emphasizes the potential for recovery, and underscores the value of dividend income for patient investors.

Trex, a leader in the composite decking industry, offers a compelling investment opportunity despite recent stock declines. With a strong market position, sustainable products, and multiple growth catalysts, including lower interest rates and international expansion, Trex is well-positioned for future growth, presenting a potentially undervalued investment.

The Federal Reserve's interest rate cut poses challenges for Charles Schwab, a brokerage heavily reliant on interest income, despite attracting more customers. While Schwab remains a strong long-term investment, its short-term prospects are dimmed by the current economic climate, prompting investors to consider other potentially more rewarding opportunities.

Super Micro Computer faces significant stock declines due to financial disappointments, accounting allegations, and report delays, but remains optimistic about future growth driven by AI innovations.

The Federal Reserve's rate cut could intensify competition in the AI sector, challenging smaller companies like SoundHound AI, which struggles to match the aggressive innovation spending of larger tech giants.

Nvidia's stock performance, despite strong operational gains in the AI sector, faces challenges due to market skepticism about long-term momentum and monetization potential. The company's speculative nature and reliance on AI software sector growth impact its ability to reach higher stock prices.

The rewritten text explores Broadcom's substantial growth potential in the AI sector, highlighting its strategic positioning in networking components and custom AI chip design. Despite competition, Broadcom is poised for significant opportunities and growth, making it a compelling investment prospect, though other stocks may currently offer better returns according to The Motley Fool's recommendations.

Explore the strategic approaches of semiconductor giants Nvidia and Broadcom as they capitalize on the booming AI market, with a focus on their hardware and software innovations, financial performance, and investment potential.

Nio, despite significant financial losses, is showing promising growth through improved profit margins, record sales, and innovative battery technologies. Its new Onvo brand targets the mass market, potentially driving future success and investor interest.

The text highlights Tractor Supply as an appealing investment amidst inflated market valuations, noting its potential for long-term growth through store expansion and increasing dividends, despite recent growth challenges due to shifting consumer spending patterns post-COVID.

This article explores investment opportunities in two growth stocks: Amazon, which continues to thrive near all-time highs with potential for further expansion, and Celsius, an energy drink brand rebounding from a significant stock decline, offering promising market share growth. It emphasizes the importance of strategic investment choices even when the market is at historical peaks.

The article highlights the strong market performance of select stocks within Warren Buffett's Berkshire Hathaway portfolio in 2024, focusing on Amazon, T-Mobile US, and American Express, which have outperformed the S&P 500. The text also provides investment insights and considerations for potential investors.

Super Micro Computer has outpaced Nvidia in stock performance, achieving a 188% surge in the first half of the year. Despite recent challenges, its innovative direct liquid cooling technology for data centers positions it for significant growth. With a stock split on the horizon, analysts anticipate a 90% rise in its value within the year.

Explore the benefits of investing in high-yield dividend stocks like Altria Group, Realty Income, and Whirlpool amidst economic uncertainties. These stocks offer stability and solid returns by adapting to market changes, maintaining robust tenant bases, and sustaining demand for essential goods. Leverage insights from The Motley Fool's Stock Advisor to make informed investment decisions.

The text analyzes the contrasting stock performances of Shopify and Axon Enterprise, highlighting recent analyst upgrades and the companies' market positions. It discusses Shopify's leadership in digital commerce and Axon's innovation in public safety, offering investment insights and potential opportunities for patient investors.

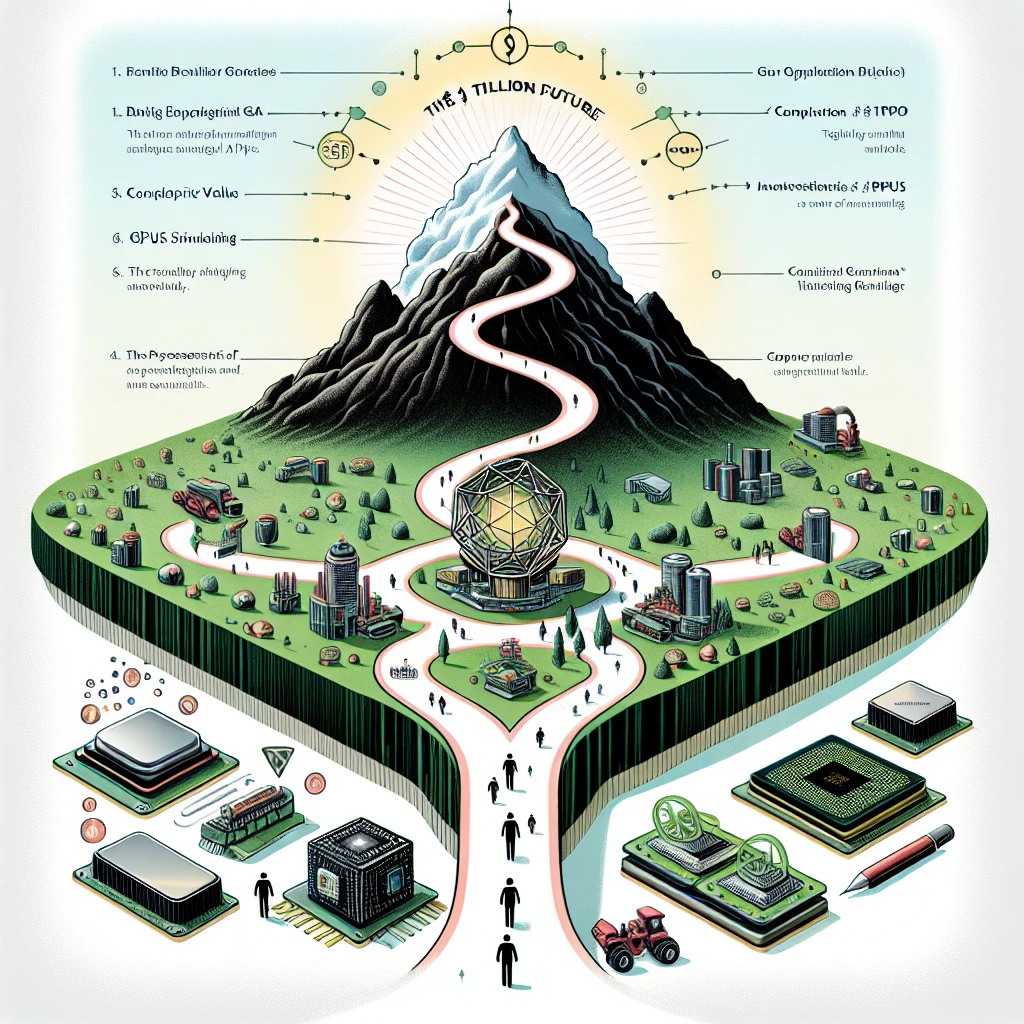

The text explores Nvidia's strategic positioning and growth potential in the AI and GPU markets, emphasizing its innovations and dominance in gaming, data centers, and cloud computing. It highlights the company's impressive financial performance and forecasts Nvidia's path to a potential $10 trillion market cap, underscoring the importance of market trends and investment insights.

Ally Financial, a digital banking leader, faces recent stock volatility due to unexpected financial updates, yet remains a promising investment with strong fundamentals, attractive valuation, and growth potential, drawing parallels to past successful stock recommendations.

The text examines the definitions of wealth through income and net worth, providing benchmarks for what constitutes being wealthy in America. It offers strategies for increasing wealth, emphasizing income growth, disciplined saving, and smart investing, suggesting that with consistent effort, affluence is attainable.

Sirius XM Holdings faces significant challenges with a 55% stock decline amid evolving media consumption trends favoring streaming services. Despite these hurdles, the company maintains a leading position with its vast audience and profitability, while recent restructuring aims to enhance strategic flexibility. Current shareholders may consider holding, while potential investors should await clearer signs of improvement. The Motley Fool highlights opportunities in other stocks with proven returns, such as Nvidia and Netflix, through strategic "Double Down" alerts.

CrowdStrike Holdings faces a temporary stock setback due to a software update issue but remains a strong investment opportunity, with optimistic Wall Street projections and a promising market outlook.

Intuitive Machines' stock soared following a $4.8 billion NASA contract for lunar communication services, marking a significant expansion into space communications and promising new business opportunities.

Nvidia's strategic investment in SoundHound AI highlights its significant growth potential in the AI sound technology sector, despite challenges like unprofitability and competition. With Nvidia's backing and a promising market, SoundHound AI represents a speculative yet potentially rewarding opportunity for risk-tolerant investors.

Terns Pharmaceuticals emerges as a promising player in the burgeoning $100 billion anti-obesity market, driven by positive trial results of its GLP-1 weight-loss pill, TERN-601. Despite the high-risk investment landscape and market volatility, the potential for significant returns makes it a noteworthy consideration for investors.

The text discusses the banking industry's response to the anticipated Basel III Endgame (BE3) framework following the collapse of three significant regional banks. Initially, BE3 proposed stringent capital requirements, but industry pushback has led regulators to consider a more favorable approach, offering clarity and potential relief for mid-sized banks. The Motley Fool Stock Advisor sees this as a prime investment opportunity, issuing "Double Down" alerts for select companies.

SoundHound AI is an emerging investment opportunity, leveraging its innovative voice control technology and strategic growth plans to expand in the automotive and food service sectors. With a strong backlog of contracts and a clear vision for profitability, the company is well-positioned for long-term success.

The text explores Alphabet's strategic positioning to dominate the AI industry with its comprehensive ecosystem, including proprietary hardware, data resources, and unmatched talent, presenting an attractive investment opportunity despite recent market downturns.

JPMorgan Chase, a top-performing U.S. bank under CEO Jamie Dimon, leverages its size and diversified business operations to achieve robust financial growth, outpacing major competitors and the S&P 500. Despite future interest rate challenges, its valuation remains attractive for investors. Meanwhile, The Motley Fool Stock Advisor underscores the potential for significant returns through strategic investments in select stocks.