Discover how the Global X SuperDividend ETF can boost your passive income with its high-yield dividends and diversified global exposure. Despite the ETF's enticing 10.9% yield, be mindful of associated risks, as high-yield stocks may face dividend cuts during economic downturns. Consider your risk tolerance when weighing this investment option for maximizing monthly income. Stay informed with "Breakfast News," a free daily newsletter for market insights.

The text highlights three standout dividend stocks—Coca-Cola, Southern Company, and Sun Communities—that offer yields around double the S&P 500 average, emphasizing their strong histories of stable and increasing dividends. Additionally, it introduces an investment opportunity from The Motley Fool Stock Advisor, known for its impressive returns and strategic stock recommendations.

This text examines the current U.S. economic landscape, highlighting challenges faced by low-income consumers and contrasting them with the stable spending habits of higher-income individuals. It underscores the importance of a long-term investment approach amidst economic uncertainty and suggests opportunities through "Double Down" stock recommendations.

This text evaluates the investment prospects of AGNC Investment and EPR Properties, two REITs with high dividend yields. AGNC offers stable dividends but limited growth, while EPR combines attractive dividends with growth potential through strategic investments. It also highlights The Motley Fool's successful stock recommendations, encouraging investors to seize high-return opportunities.

Explore the potential of dividend stocks to build passive income with high-yield options like Kinder Morgan, Verizon, Brookfield Infrastructure Partners, and Agree Realty. These companies offer robust dividends backed by strong financials and growth prospects. Additionally, seize unique investment opportunities with "Double Down" stock recommendations, capitalizing on companies poised for substantial growth.

The text explores the strategic selection of dividend-paying stocks with low payout ratios for a robust passive income portfolio, focusing on Northrop Grumman and Howmet Aerospace as prime candidates due to their financial stability and growth potential in the aerospace and defense sectors.

The text explores the strategic interplay between Realty Income and W.P. Carey, two major net lease REITs. Realty Income, a market leader, focuses on retail properties and offers stable dividends, while W.P. Carey, with a strong European presence and higher yield, is shifting its strategy to align more closely with Realty Income's successful model. The analysis highlights their growth trajectories, investment appeal, and the potential for W.P. Carey to complement or stand independently in an investor's portfolio.

This guide outlines essential steps for managing Required Minimum Distributions (RMDs) as 2025 nears, highlighting new rules, penalties, and strategic options like qualified charitable distributions to minimize tax burdens and maximize retirement income.

Enterprise Products Partners offers a robust 7% yield, driven by its essential midstream infrastructure, stable cash flows, and conservative financial management. Despite past challenges, it's an attractive option for income-focused investors seeking consistent returns.

This article provides strategies for maximizing Social Security benefits in light of potential future reductions, emphasizing the importance of a 35-year work history, strategic timing of benefit claims, and coordinated planning with a spouse. It also highlights lesser-known methods to enhance retirement income.

Explore the benefits of investing in high-yield dividend stocks like Altria Group, Realty Income, and Whirlpool amidst economic uncertainties. These stocks offer stability and solid returns by adapting to market changes, maintaining robust tenant bases, and sustaining demand for essential goods. Leverage insights from The Motley Fool's Stock Advisor to make informed investment decisions.

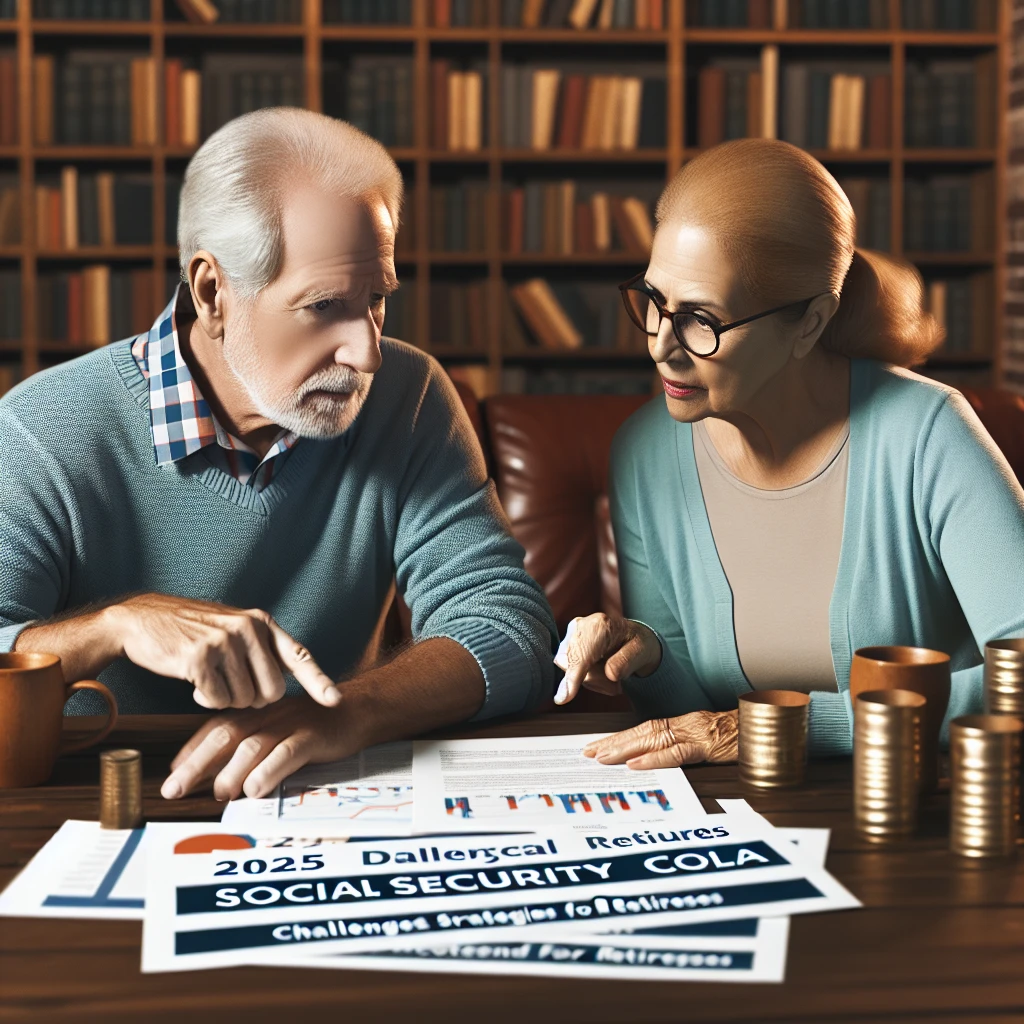

The article explores the impact of the upcoming 2025 Social Security COLA, projected at 2.5%, on seniors' finances. It highlights the potential for adjustments based on inflation trends and offers strategies for managing expenses amid smaller increases. Additionally, it introduces lesser-known methods to maximize Social Security income.

The text discusses the upcoming 2025 Social Security cost-of-living adjustment, highlighting its importance amid inflation and potential challenges it poses for retirees relying heavily on these benefits. It also emphasizes the need for retirees to explore additional income strategies and better manage their finances to offset the limitations of COLAs.

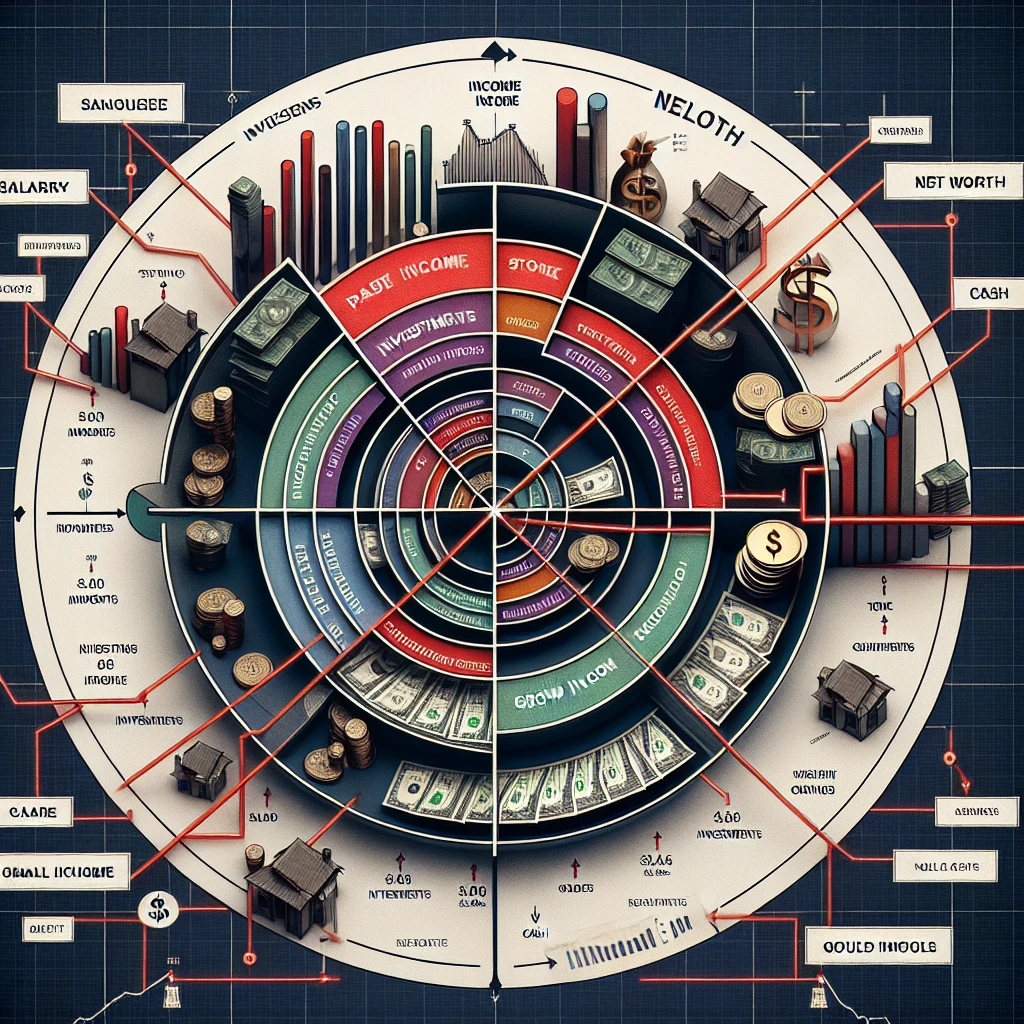

The text examines the definitions of wealth through income and net worth, providing benchmarks for what constitutes being wealthy in America. It offers strategies for increasing wealth, emphasizing income growth, disciplined saving, and smart investing, suggesting that with consistent effort, affluence is attainable.

This text highlights the benefits of investing in Coca-Cola for dividend income, emphasizing its long history of increasing payouts, solid financial health, and attractive dividend yield, making it an appealing choice for dividend investors.