The text outlines Microsoft's recent 10.7% dividend increase and a $60 billion share buyback program, emphasizing the sustainability of these financial moves due to the company's strong earnings growth and robust balance sheet. It also highlights potential cash flow concerns from heavy AI investments, which may limit the extent of share repurchases. While the dividend increase benefits long-term shareholders, newer investors should consider Microsoft's growth potential driven by AI advancements. The Motley Fool suggests exploring other stocks with potentially higher returns.

Explore the investment opportunities arising from the Federal Reserve's recent interest rate cut, highlighting Dominion Energy, D.R. Horton, and Realty Income as promising stocks poised to benefit from this economic shift. Discover why these companies stand out and consider other top stock recommendations for potential high returns.

In 2024, the interplay of AI advancements and strategic stock splits has significantly influenced market dynamics, with billionaire investors shifting focus from high-profile companies like Nvidia to under-the-radar opportunities in Sony Group and Cintas, driven by concerns over market bubbles, insider actions, and increased competition.

Ally Financial, a digital banking leader, faces recent stock volatility due to unexpected financial updates, yet remains a promising investment with strong fundamentals, attractive valuation, and growth potential, drawing parallels to past successful stock recommendations.

The text examines the definitions of wealth through income and net worth, providing benchmarks for what constitutes being wealthy in America. It offers strategies for increasing wealth, emphasizing income growth, disciplined saving, and smart investing, suggesting that with consistent effort, affluence is attainable.

This text explores investment alternatives to Coca-Cola, suggesting PepsiCo and Archer-Daniels-Midland as promising options due to their strong dividend yields and potential for long-term gains, despite current market challenges.

The text discusses the importance of analyzing a company's fundamentals when investing in stocks, using Celsius Holdings as a case study. It highlights the company's rapid growth, partnership with PepsiCo, and international expansion, while also pointing out market volatility and dependency risks. The text concludes with a cautionary note on investing in Celsius while introducing a "Double Down" alert for other potentially profitable stocks.

JPMorgan Chase, a top-performing U.S. bank under CEO Jamie Dimon, leverages its size and diversified business operations to achieve robust financial growth, outpacing major competitors and the S&P 500. Despite future interest rate challenges, its valuation remains attractive for investors. Meanwhile, The Motley Fool Stock Advisor underscores the potential for significant returns through strategic investments in select stocks.

The text analyzes Warren Buffett's concentrated investment strategy at Berkshire Hathaway, emphasizing the significant impact of focusing on key holdings like Apple, American Express, and Bank of America. It highlights Buffett's criteria for "wonderful companies" and his strategic moves to maximize returns through sustainable advantages, strong management, and financial cyclicality.

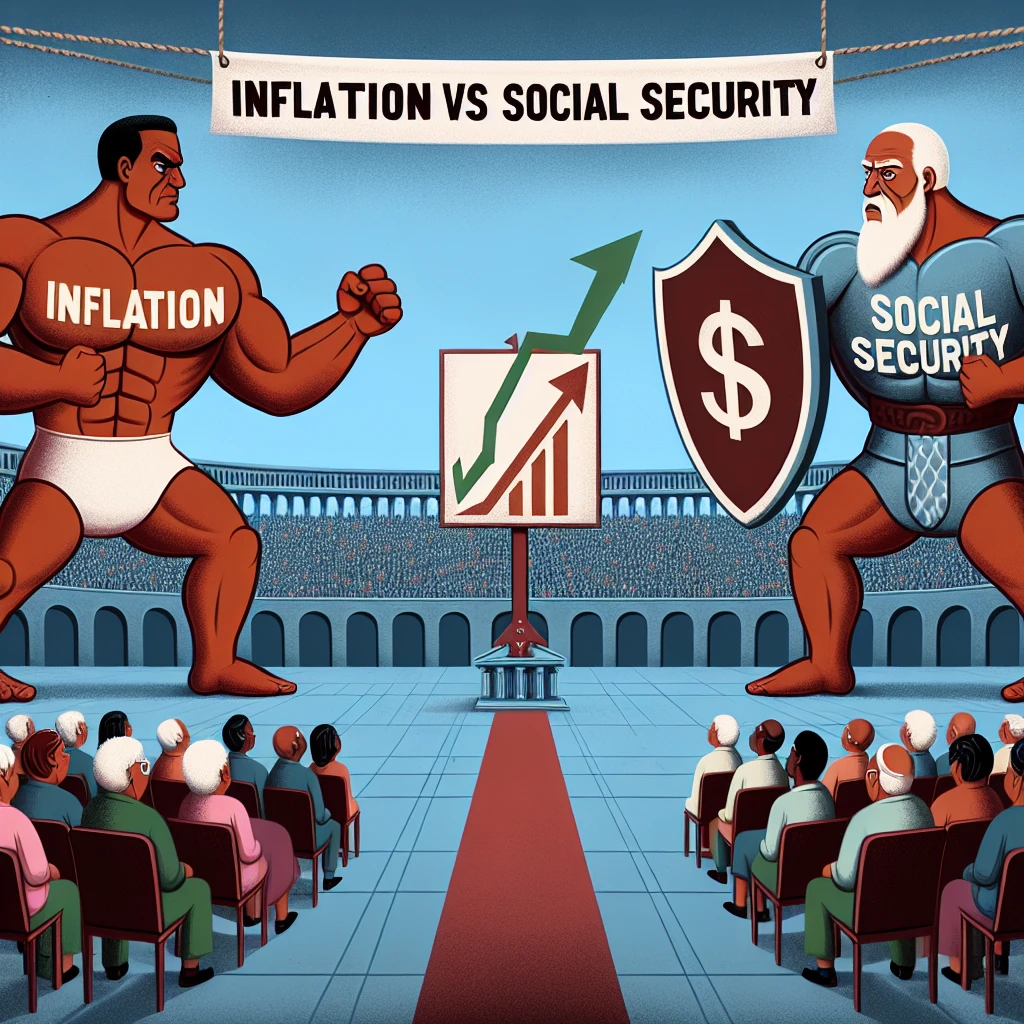

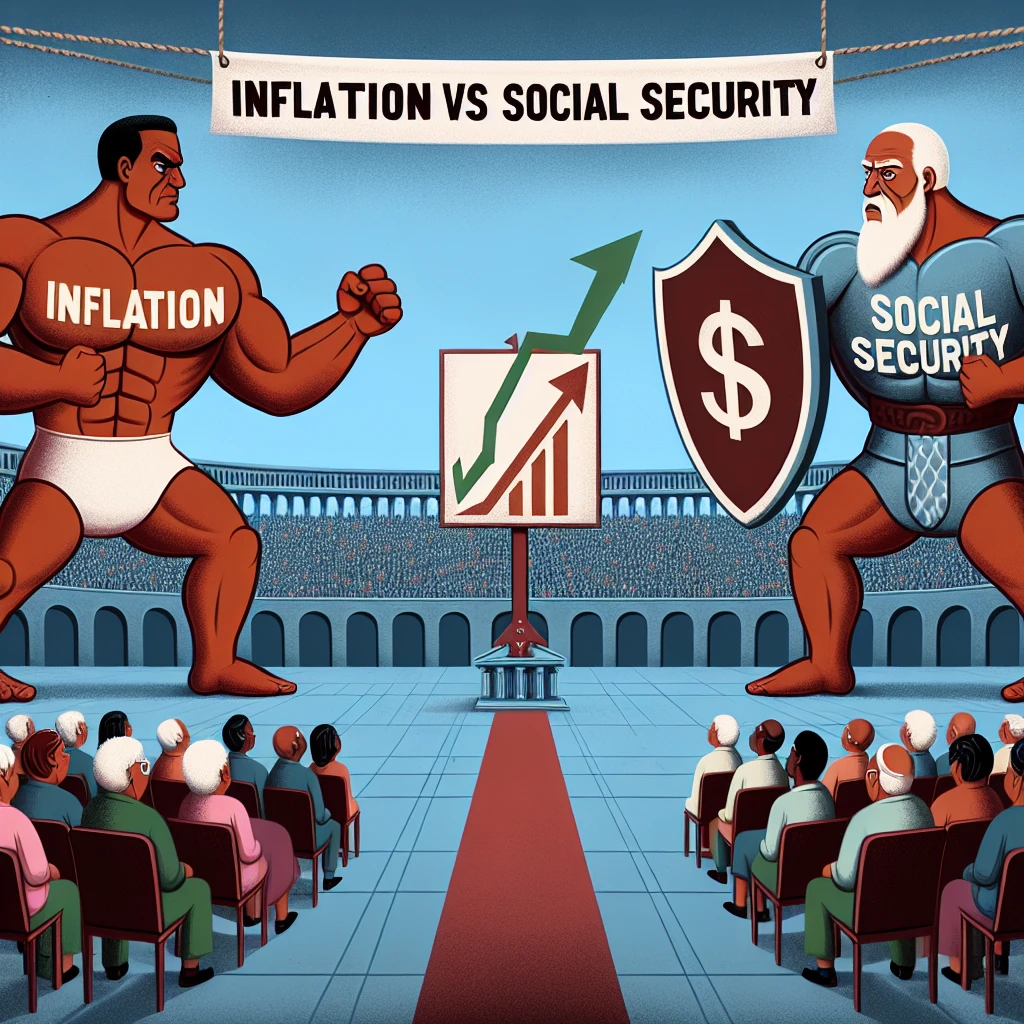

The text examines the inadequacy of Social Security's cost-of-living adjustments (COLAs) in keeping up with inflation, highlighting a 20% decline in purchasing power since 2010. It critiques the CPI-W's insufficiency in accurately representing retirees' expenses, particularly in housing and medical care. With a forecasted 2.5% COLA for 2025, retirees face financial strain, necessitating prudent budgeting and exploring additional income streams like high-yield savings and CDs. The text also hints at strategies to maximize Social Security benefits.

CrowdStrike Holdings navigates a significant July software glitch, maintaining strong financials and customer loyalty, while securing major contracts and showcasing growth potential, reassuring investors of its continued market leadership in cybersecurity.

The text analyzes recent 13F filings, revealing billionaire investors' strategic shifts from Nvidia to Amazon and Microsoft amid AI bubble concerns and competitive pressures. It highlights Amazon's cloud service and Microsoft's AI advancements as key investment attractions, while promoting a lucrative "Double Down" investment opportunity.

Ajit Jain, Berkshire Hathaway's Vice Chairman, recently sold over half of his stock holdings, a move possibly linked to retirement plans, Berkshire's high valuation, and potential tax changes. While this sale might raise concerns, long-term investors are advised not to panic. The text also highlights a promotional opportunity for investing in promising stocks through "Double Down" recommendations.