The text discusses the benefits and risks of using multiple credit cards, highlighting that while they can maximize rewards and offer various perks, they also pose potential financial risks. It emphasizes tailoring credit card strategies to individual financial management skills and circumstances.

This text explores the advantages and challenges of achieving elite hotel status. It highlights the coveted benefits of top-tier status, the uncertainty of room upgrades, and the difficulty of reaching high status levels. It also discusses how loyalty to a hotel chain can limit travel flexibility, offering insights for frequent travelers considering elite status pursuit.

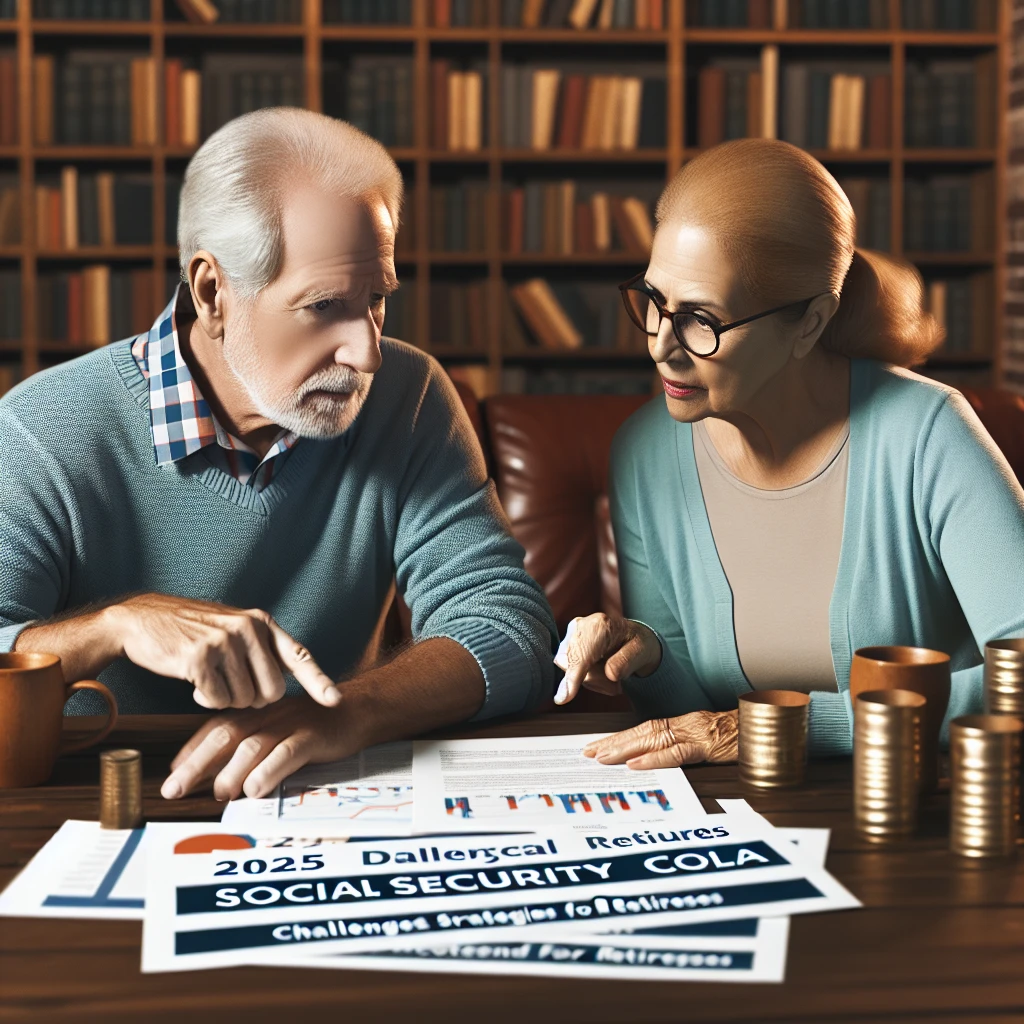

The text emphasizes the crucial role of Social Security for American retirees and explores the impact of cost-of-living adjustments (COLA) on maintaining purchasing power. It outlines the calculation of COLA using the CPI-W, reflects on recent inflation-driven increases, and predicts a modest 2.5% COLA for 2025 that may not suffice against rising shelter and healthcare costs. Additionally, it highlights the challenge of increasing Medicare premiums and encourages exploring strategies to enhance Social Security benefits for a secure retirement.

This article provides strategies for maximizing Social Security benefits in light of potential future reductions, emphasizing the importance of a 35-year work history, strategic timing of benefit claims, and coordinated planning with a spouse. It also highlights lesser-known methods to enhance retirement income.

The article explores the impact of the upcoming 2025 Social Security COLA, projected at 2.5%, on seniors' finances. It highlights the potential for adjustments based on inflation trends and offers strategies for managing expenses amid smaller increases. Additionally, it introduces lesser-known methods to maximize Social Security income.

The text discusses the upcoming 2025 Social Security cost-of-living adjustment, highlighting its importance amid inflation and potential challenges it poses for retirees relying heavily on these benefits. It also emphasizes the need for retirees to explore additional income strategies and better manage their finances to offset the limitations of COLAs.

The text examines the inadequacy of Social Security's cost-of-living adjustments (COLAs) in keeping up with inflation, highlighting a 20% decline in purchasing power since 2010. It critiques the CPI-W's insufficiency in accurately representing retirees' expenses, particularly in housing and medical care. With a forecasted 2.5% COLA for 2025, retirees face financial strain, necessitating prudent budgeting and exploring additional income streams like high-yield savings and CDs. The text also hints at strategies to maximize Social Security benefits.