The restaurant industry experienced a downturn this week, with Sweetgreen (-0.06%) bearing the brunt of the decline, as news emerged that consumers are reducing spending in multiple areas. Cava Group, another rapidly expanding chain, also saw a decline, but Sweetgreen’s drop was notably significant.

Based on data from S&P Global Market Intelligence, Sweetgreen’s shares plummeted by 17.4% this week as of 1 p.m. ET on Friday, and a rebound does not seem imminent.

Consumer Concerns

No major announcements specifically about Sweetgreen surfaced, yet it remains a highly valued company that continues to incur losses. A weakening macroeconomic environment could alter investors’ long-term perceptions of the stock, and this week’s economic indicators were not favorable.

Dollar General, Lululemon Athletica, and Ulta Beauty all reported weaker-than-expected earnings, highlighting a theme of consumer struggle. While spending hasn’t entirely stopped, consumers, particularly those on the lower end of the economic spectrum, are opting for cheaper alternatives and even foregoing some purchases as inflation and stagnant wages impact their spending habits.

Sweetgreen’s Financial Situation

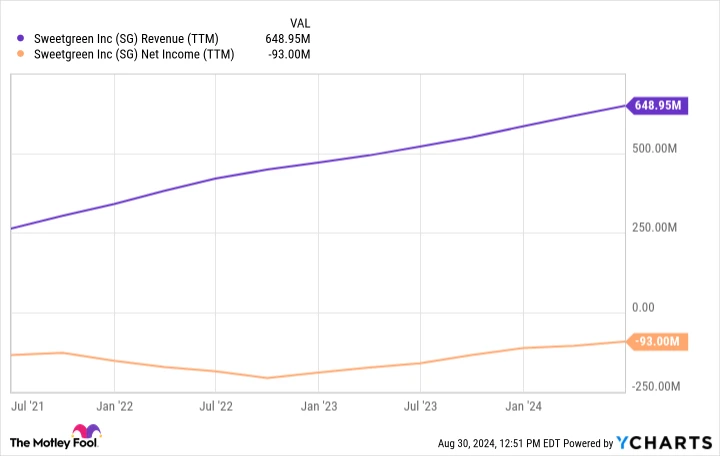

One of the easiest expenses to cut when tightening the budget is dining out, which concerns investors. Sweetgreen maintains a substantial $3.6 billion market capitalization but reported only $649 million in revenue over the last year, while still operating at a loss.

SG Revenue (TTM) data by YCharts

These financial figures suggest a risky investment in the current economic climate, and investors have responded accordingly. Personally, I am not inclined to purchase during this downturn and believe Sweetgreen has much to prove to regain investor confidence.