Contents

Super Micro Computer’s Tumultuous Year: A Closer Look

After a promising start to the year, Super Micro Computer has experienced a significant downturn in its stock performance over the past six months. The stock has plummeted nearly 60% from its peak, and recent events have further shaken investor confidence.

Recent Challenges and Investor Concerns

Disappointing Financial Results and Guidance

The company released its fiscal 2024 fourth-quarter results on August 6, which failed to meet Wall Street’s expectations. Additionally, the guidance provided by management was not well-received, dampening investor enthusiasm.

Allegations and Delays

Compounding the issue, short-seller Hindenburg Research published a report accusing Supermicro of accounting irregularities. This was followed by an announcement from Supermicro’s management regarding a delay in filing its annual report, which only fueled negative sentiment.

Analyst Downgrades

In light of these developments, several Wall Street analysts have downgraded the stock. Despite this, the stock’s current valuation—trading at 22 times trailing earnings and 13 times forward earnings—may appear attractive to opportunistic investors. The question remains: should they proceed given the current uncertainties?

Evaluating the Allegations

Skepticism Toward Hindenburg’s Claims

Investors should consider that Hindenburg Research, as a short-seller, stands to gain from a decline in Supermicro’s stock price. This raises questions about the validity of their allegations, especially given the firm’s history of inaccuracies. However, it’s noteworthy that in August 2020, Supermicro faced charges from the Securities and Exchange Commission (SEC) for accounting violations, involving premature revenue recognition and understated expenses over a three-year period.

Recovery and Growth

Despite past challenges, Supermicro has made a remarkable recovery, driven by the rise of artificial intelligence (AI) as a catalyst. In fiscal 2024, the company’s revenue more than doubled to $14.9 billion, up from $7.1 billion the previous year. Non-GAAP earnings surged to $22.09 per share, from $11.81 per share in fiscal 2023.

Management’s Reassurance

Regarding the delay in the annual filing, management has stated that no material changes are anticipated in the financial results for the fourth quarter or fiscal year 2024. They are optimistic about a “historic” 2025, expecting a record number of orders, a robust backlog of design wins, and strong market positions.

Production and Revenue Projections

Supermicro assures that recent developments will not impact its production capabilities and that it remains on track to fulfill the demand for its AI server solutions. The company forecasts fiscal 2025 revenue between $26 billion and $30 billion, indicating another year of significant growth.

Margin Challenges

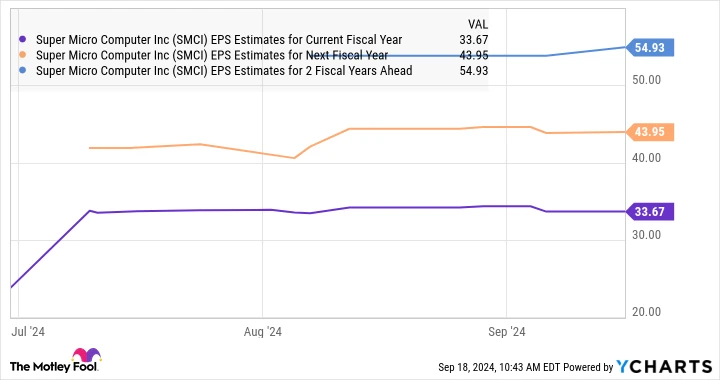

While Supermicro faces margin pressures due to increased investments in expanding capacity for its liquid-cooled server solutions, management remains confident in returning to normal margin levels before the fiscal year concludes. Analysts also project rapid earnings growth for Supermicro, both in the current fiscal year and the years to follow.

Investor Guidance: Caution or Opportunity?

Analyst Reactions

The delay in Supermicro’s annual filing prompted JPMorgan to downgrade the stock from overweight to neutral, reducing its price target from $950 to $500. Barclays also downgraded the stock to equal weight from overweight, citing margin pressures and filing delays. However, JPMorgan’s downgrade was not directly linked to the Hindenburg report but rather to the near-term uncertainty and lack of compelling reasons to buy the stock.

Weighing the Risks and Opportunities

Risk-averse investors might consider waiting for more clarity before investing in this AI-driven stock. Conversely, those with a higher risk tolerance, looking to add a fast-growing company to their portfolios, might see potential in Supermicro. The company appears poised to maintain its impressive growth trajectory, thanks largely to opportunities in the AI server market.

Long-Term Potential

Analysts anticipate Supermicro’s earnings to grow at an annualized rate of 62% over the next five years. If the company can navigate its current challenges, it could prove to be a solid investment, especially given its current valuation.

Conclusion: Should You Invest in Super Micro Computer Now?

Before making a decision to invest in Super Micro Computer, consider this: The Motley Fool’s Stock Advisor analyst team recently highlighted what they believe are the top 10 stocks for investors to buy now, and Super Micro Computer wasn’t on that list. The selected stocks have the potential to deliver substantial returns in the coming years.

For instance, if you had invested $1,000 in NVIDIA when it was recommended on April 15, 2005, your investment would have grown to $710,860 by now. The Stock Advisor service offers a proven blueprint for success, including portfolio building guidance, regular updates from analysts, and two new stock picks each month. Since 2002, the service has more than quadrupled the return of the S&P 500.

Discover the 10 stocks ›

*Stock Advisor returns as of September 17, 2024.