Today, high-volatility stocks and companies expected to gain from reduced interest rates performed well as the market foresees a potential rate cut by the Federal Reserve in September. The possibility of lower interest rates, coupled with indications that the economy may not experience a severe recession, contributed to the positive performance.

Shares of Tesla ( TSLA -2.22% ) increased by up to 5.6% today, Lucid ( LCID -1.30% ) increased by 6.2% Quantumscape ( QS -1.04% ) Increased by 6.4%, the shares saw gains of 5.4%, 5.9%, and 6.3% at the close of the day.

The relationship between inflation and interest rates

Today, the producer price index (PPI), a wholesale inflation indicator, was published, revealing a 0.1% rise in July, lower than the predicted 0.2%. Compared to last year, the PPI only increased by 2.2%, a significant drop from the 2.7% surge seen in June.

This situation is under close observation as the consumer price index (CPI), which is a significant gauge of inflation, will be released tomorrow. Should the CPI meet or fall below the anticipated 0.2% rise from the previous month, it is probable that the Federal Reserve would be able to lower interest rates as inflation would be deemed manageable.

The Federal Reserve has the responsibility of managing both inflation and employment levels, with traders anticipating a potential interest rate cut in September as a result. Bloomberg reported a 6-point decrease in the 10-year U.S. government bond yield. basis points As of today, the value has decreased by 33 basis points over the last month.

Pricing and the electric vehicle narrative

Higher interest rates compared to several years ago are acting as a barrier to major purchases such as cars and houses. Elon Musk, the CEO of Tesla, has acknowledged this as a challenge to the company’s expansion, and this holds some validity.

Investors believe that the decreased interest rates will lead to increased interest in electric vehicles.

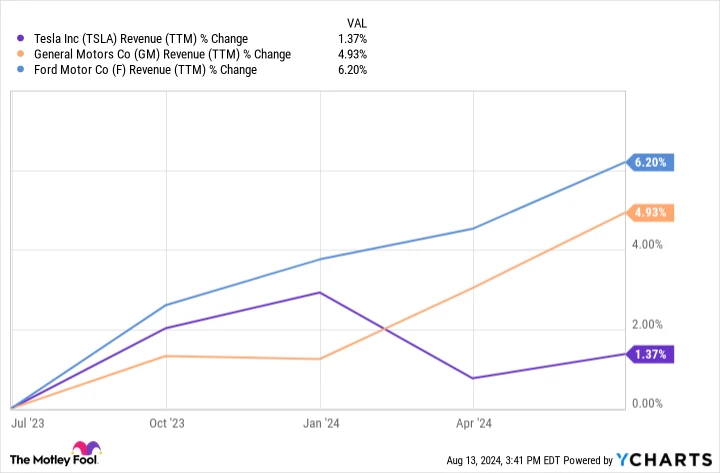

This theory fails to consider that purchasing decisions are influenced by factors beyond just interest rates. For instance, despite high interest rates, sales have risen at Ford and General Motors in the past year while they have declined at Tesla. Does this mean that electric vehicle buyers are more sensitive to interest rates than truck buyers?

Tesla’s revenue over the trailing twelve months. data by YCharts.

With Tesla’s shares currently trading at values that are 10 to 20 times higher than those of its Detroit competitors, the recent actions seem even more illogical.

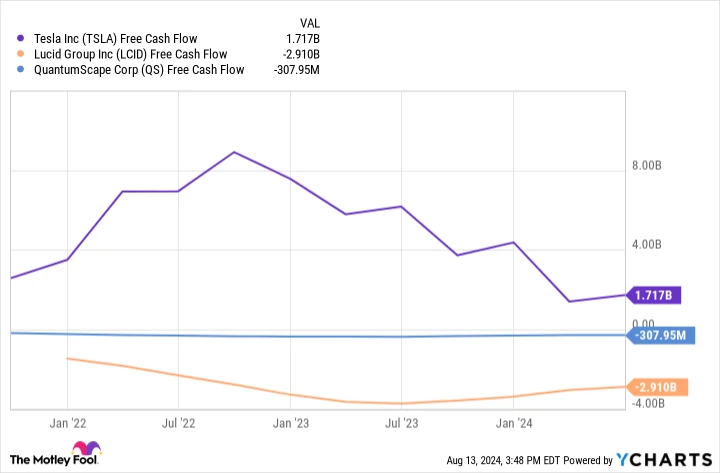

Upon analyzing the free cash flow of the three companies, it appears that heightened competition and declining demand for electric vehicles pose more significant challenges than merely interest rates.

Tesla’s free cash flow data by YCharts.

Reducing the interest rate for a car loan does not alter the competitive environment within the industry.

A brief moment of rebound

Both Lucid and Quantumscape are considered high-risk stocks until they can expand their production capabilities and demonstrate profitability. Additionally, Tesla must prove its ability to boost sales without compromising its product pricing.

I believe that decreased interest rates do not address the underlying issues in the current EV market, which is why I am choosing to avoid investing in it at this time. The stocks appear too volatile to consider purchasing.