Since the start of 2023, technology stocks have provided investors with impressive returns, showing a 69% increase in value. Technology companies listed on the Nasdaq-100. During this timeframe, there has been a significant increase in the index, largely driven by the pivotal contribution of artificial intelligence (AI).

Both large and small technology firms have been reaping the rewards of integrating AI into their operations. Super Micro Computer is a company that specializes in manufacturing computer hardware components. ( SMCI 0.34% ) and Taiwan Semiconductor Manufacturing Corporation is a leading semiconductor foundry company. ( TSM 0.33% ) Both have experienced a positive boost due to the widespread use of AI.

Nevertheless, the surging increase in stocks related to technology The momentum has slowed down recently. The Nasdaq-100 Technology Sector has experienced an 11% decline in the last month due to various reasons, including growing worries about a potential economic downturn in the U.S. triggered by a disappointing employment report, and concerns that artificial intelligence may not meet expectations in the future.

However, the latest financial reports from the aforementioned companies tell a different story. These technology companies show that investment in AI infrastructure remains strong, so it might be a wise decision to invest in the stocks of these AI firms following the recent market decline. Now, let’s examine the factors behind this recommendation.

The TSMC stock is currently too appealing to overlook.

The semiconductor industry has been significantly propelled by AI. It is projected that the market for AI chips will experience a substantial annual growth rate of 38% in the upcoming decade, resulting in an annual revenue of $514 billion by 2033. Taiwan Semiconductor Manufacturing, commonly referred to as TSMC, presents a prime investment avenue for individuals looking to benefit from this trend.

TSMC is a manufacturing company that produces chips for semiconductor companies that do not have their own manufacturing facilities. Nvidia and AMD Additionally, it produces semiconductor chips for companies that manufacture electronic devices. Apple , and even Intel Despite having its own production capabilities, the company has chosen to outsource the manufacturing of advanced chips to TSMC. This decision is likely to benefit TSMC as the demand for AI technology grows across various sectors including data centers, smartphones, and personal computers.

TSMC’s expansion has been speeding up due to the strong request for its cutting-edge chips from the mentioned clients. The leading foundry company based in Taiwan disclosed a 33% rise in revenue compared to the previous year, reaching $20.8 billion in the second quarter of 2024. This represented a notable increase compared to the 13% growth reported in the first quarter by TSMC.

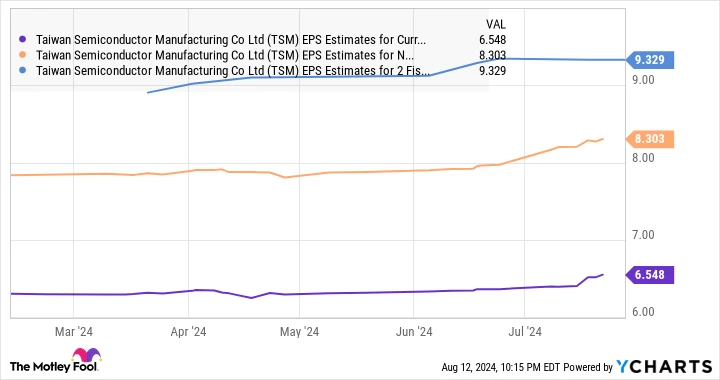

TSMC predicts that its revenue for the third quarter will be around $22.8 billion, marking a 32% increase compared to the previous year. This strong growth indicates that there is a steady demand for the company’s chips. Despite a 15% decrease in TSMC stock value over the past month, this presents a good chance for investors to buy at a lower price. Analysts have recently raised their earnings forecasts for TSMC, adding to the attractiveness of investing in the company.

Projected TSM earnings per share for the ongoing fiscal year. data by YCharts

Additionally, TSMC is currently being traded at a price 29 times its earnings from the past, offering a small reduction compared to the standard price. Nasdaq-100 The index’s price-to-earnings ratio is 31, which is often used as a benchmark for technology stocks. Purchasing this would be considered… AI stock Currently, it seems like an obvious choice due to its impressive growth and appealing valuation.

The rapid expansion of Supermicro can be attributed to the increasing need for AI server services.

TSMC’s chips, designed for handling AI tasks in data centers, require installation on server racks, leading to a significant increase in demand for Supermicro’s products over the last year.

Supermicro produces server and storage products, and it has been making progress in the AI server sector by providing modular solutions that enable data center managers to lower their energy expenses. The company’s revenue for the fiscal year 2024, which just ended, increased significantly compared to the previous year, reaching $14.9 billion, more than double the $7.1 billion recorded in the prior year.

Nevertheless, the stock of Supermicro dropped by 20% within one trading day After failing to meet the earnings expectations set by Wall Street due to its shrinking profit margins, the company has been actively investing in expanding its production capabilities to keep up with the increasing need for AI servers. GAAP The gross margin decreased to 14.2% in fiscal year 2024 from 18.1% in the previous year.

The company is increasing its manufacturing capability at various sites worldwide to increase the production of liquid-cooled servers, which are becoming more popular in AI data centers for their ability to lower power usage and enhance performance. According to Mordor Intelligence, liquid-cooled data centers are projected to grow by 23% annually until 2029.

Currently, Supermicro is making the correct decision by prioritizing the expansion of its capacity. This strategic move is essential for the company to seize a larger portion of the rapidly growing market. Additionally, the AI server market is projected to experience a 30% annual growth rate until 2033, and Supermicro is advancing at a rate that surpasses the industry’s average growth.

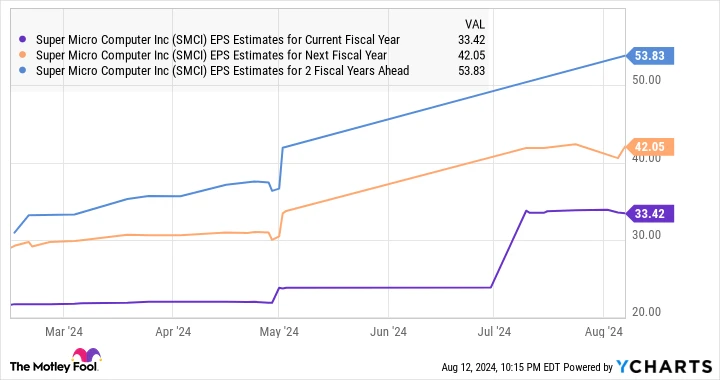

This indicates that the company is increasing its presence in the AI server market, which is why they are willing to compromise on profits in the short term in order to capitalize on the long-term potential. Supermicro’s management is confident that their profit margins will recover to their usual levels by the conclusion of fiscal year 2025. Analysts are optimistic about the company’s future earnings growth after a significant 87% increase in earnings to $22.09 per share in fiscal year 2024.

Projected earnings per share (EPS) figures for the ongoing fiscal year by SMCI. data by YCharts

The key point to note is that Supermicro’s current trading multiple is 24 times the previous year’s earnings and 13 times the earnings. future earnings — a significant reduction in the Nasdaq-100 index. Investors are advised to think about including this rapidly expanding company in their investment portfolios while it is still undervalued.