Investing in companies that disrupt industries and achieve exponential growth can be thrilling, but not every investment needs to be a grand slam. Foundational stocks, or “role players,” can serve as the cornerstone of a robust investment portfolio. Companies like American Electric Power (-0.06%), Carrier Global (2.31%), and WM (0.11%) may lack the flashy appeal of high-growth stocks, yet they possess the potential to steadily grow earnings and provide long-term value to shareholders.

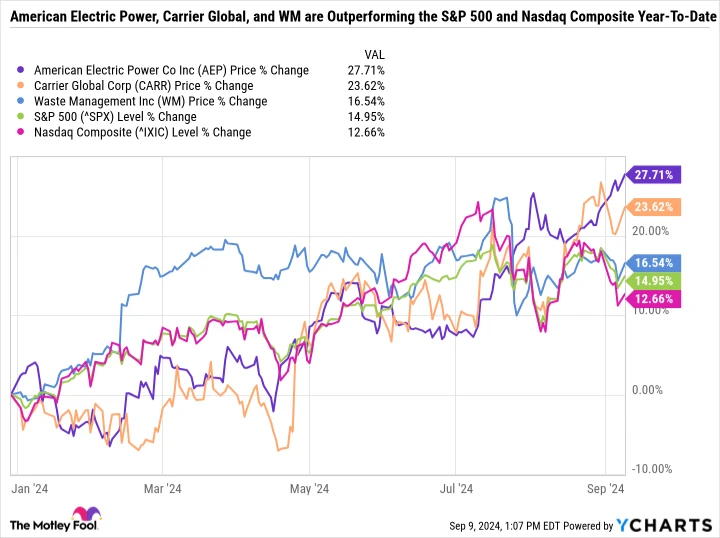

Here’s why contributors to fool.com believe these three dividend stocks are surpassing the S&P 500 and Nasdaq Composite in 2024 and why they might still be appealing investments today.

Contents

A Valuable Pick for Income Investors: American Electric Power

Scott Levine (American Electric Power): Since the beginning of the year, shares of American Electric Power, an electric utility stock, have surged by over 27%, outperforming both the S&P 500 and the Nasdaq Composite.

According to AEP data from YCharts, the stock has had a strong performance in 2024. The 3.4% forward-yielding dividend has attracted investors’ interest, potentially driving shares even higher in the months ahead.

American Electric Power’s robust performance in 2024 has clearly motivated investors to buy. For instance, the utility reported significant growth in its funds from operations (FFO) for the 12 months ending June 30, reaching $6.39 billion, an 11.5% increase from $5.74 billion for the 12 months ending December 31, 2023.

Management’s optimistic outlook has also bolstered investor confidence. The company projects operating earnings per share between $5.53 and $5.73 for 2024. Achieving the midpoint of this guidance would reflect a 7.2% increase over 2023. Investors should pay close attention to this metric, as the company targets a payout ratio of 60% to 70% of operating earnings from 2024 through 2028.

Despite its rise in 2024, the stock still appears undervalued, trading at 8.5 times operating cash flow compared to the industry average of 9.5.

Carrier Global’s Strategic Restructuring Yields Rewards

Lee Samaha (Carrier Global): Spun off from United Technologies in 2020, Carrier Global has continued the legacy of increasing dividends. As part of a large conglomerate that included elevators, defense, and aerospace products, Carrier was constrained in the rapidly evolving heating, ventilation, and air-conditioning (HVAC) sector.

The HVAC industry is leading the charge toward energy-efficient, sustainable buildings with digital technology enhancements. With its newfound independence in 2020, CEO Dave Gitlin focused on growth opportunities while shedding non-core businesses and restructuring the company.

Carrier is now well-positioned as an HVAC company. Key divestitures include the Chubb fire & security business for $3.1 billion in 2022, the global access solutions business to Honeywell for $4.95 billion in June 2024, and the industrial fire detection and suppression business for $1.425 billion in July. Recently, the company announced the sale of its commercial and residential fire detection business for $3 billion.

Amid these divestments, Carrier acquired Viessmann Climate Solutions, a European climate technologies company, for $12 billion in early 2024. This move bolsters Carrier’s global presence in heat pumps, a more efficient technology than boilers.

With the European Union targeting the installation of an additional 30 million heat pumps from 2020 to 2030, there’s a substantial growth opportunity for Viessmann (Carrier). Carrier’s HVAC solutions enhance building efficiency, promising years of growth ahead.

WM’s Stock Pullback Presents a Buying Opportunity

Daniel Foelber (WM): Formerly known as Waste Management, WM has dropped about 8% from its peak in July, yet it continues to outperform the S&P 500 and Nasdaq Composite this year.

In its second-quarter 2024 results, WM achieved a 30% adjusted operating margin for earnings before interest, taxes, depreciation, and amortization (EBITDA), a first in its history. Cost optimization and price hikes have bolstered free cash flow (FCF) and expanded margins.

This strong cash flow allows WM to invest in sustainability projects like recycling and renewable natural gas (RNG). Methane from decomposing landfill material can be captured, treated, and converted into pipeline-quality natural gas, offering a sustainable alternative to fossil fuel extraction, though the industry relies heavily on subsidies.

WM’s extensive landfill network positions it well for long-term growth in RNG. Nevertheless, even without it, WM remains a highly reliable business, resilient to economic downturns.

Serving commercial, industrial, and residential clients, WM benefits from economic growth, which boosts waste removal demand. During recessions, long-term contracts shield it from declining demand. This dependable business model makes WM an excellent choice for risk-averse investors.

WM’s dividend yield stands at 1.4%, which might not seem impressive initially. However, this low yield reflects the strong stock performance rather than a lack of dividend growth. Over the past decade, WM has doubled its dividend and reduced its share count by over 12% through stock buybacks.

Despite a 33.1 price-to-earnings ratio making WM not exactly cheap, the stock’s pullback may be attributed to valuation concerns, weak volume growth, and reliance on price hikes.

Nonetheless, WM has numerous qualities that make it a reliable dividend stock regardless of economic conditions. It’s a worthy consideration for investors today.

Should You Invest $1,000 in American Electric Power Now?

Before purchasing American Electric Power shares, consider this: The Motley Fool Stock Advisor’s analyst team recently identified what they consider the 10 best stocks for investors to buy now, and American Electric Power didn’t make the list. The selected 10 stocks could yield substantial returns in the coming years.

Remember when Nvidia appeared on this list on April 15, 2005? If you had invested $1,000 then, your investment would now be worth $716,375!*

It’s important to note that Stock Advisor’s total average return is 741% — a significant outperformance compared to the 162% return of the S&P 500. Don’t miss out on the latest top 10 list.

See the 10 stocks

*Stock Advisor returns as of September 9, 2024