I’m passionate about growth stocks—discovering them, investing in them, and holding onto them for the long haul. When approached correctly, this investment strategy can yield substantial returns and lay a solid foundation for financial security. Let’s delve into two stocks that I believe are well-positioned for sustained growth in the coming years.

Spotify Technology

Sometimes, the most promising stocks are right in front of you—or, in Spotify Technology’s (0.37%) case, in your ears. In 2024 alone, Spotify’s stock has surged over 71%, making it a standout performer in the stock market. Although Spotify isn’t listed on Wall Street per se, being a European company headquartered in Luxembourg, it’s not included in the S&P 500, the Nasdaq-100, or the Dow Jones Industrial Average. However, if it were, its performance would rank it among the top contenders in each index. It would be fifth in the S&P 500, second only to Nvidia on the Nasdaq-100, and lead the Dow Jones.

Spotify’s impressive stock performance can be attributed to several critical factors:

1. The popularity of its streaming platform

2. Efficient cost management

3. Robust revenue growth

In its latest quarter, which ended on June 30, Spotify reported having 626 million monthly active users (MAUs), a 14% increase compared to the previous year. With such a vast user base, Spotify is able to generate significant revenue—$4.1 billion in its most recent quarter, marking a 20% year-over-year increase.

While these user and revenue figures are impressive, what truly propelled the stock upward this year is the company’s enhanced profitability.

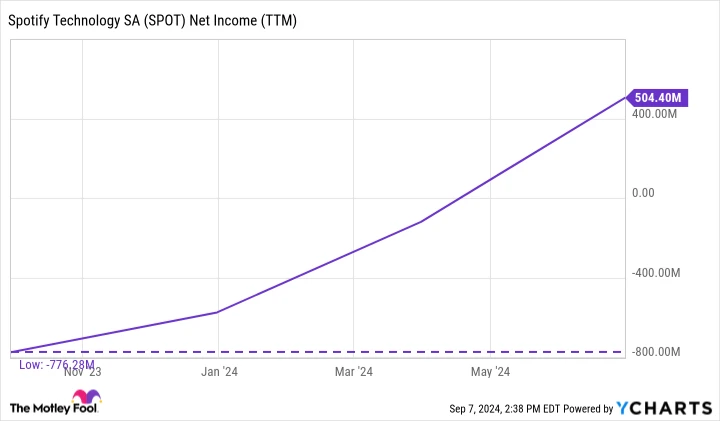

According to YCharts, Spotify’s net income over the past 12 months soared to $505 million, a remarkable turnaround from the $776 million annual loss reported in 2023. By streamlining operations and concentrating on its core music streaming business, CEO Daniel Ek has positioned Spotify on a path to success—something investors should definitely pay attention to.

Visa

Next, let’s look at Visa (-0.47%). At first glance, Visa might seem mundane, but there is value in simplicity—often, a lot of it. To appreciate why Visa is such an excellent stock, it’s essential to understand its business model: Visa isn’t a bank or a credit card issuer; it’s a payment processor.

Visa grants access to its payment network to card issuers, such as banks and credit unions, which then distribute Visa-branded credit and debit cards to their customers. Whenever these consumers use their cards at numerous merchants globally, Visa earns a transaction fee. To understate it, these fees accumulate significantly.

In its latest quarter (third quarter of 2024, ending June 30), Visa reported $8.9 billion in total revenue from processing nearly $4 trillion in transactions across its network. To put this into context, Visa processed approximately $133 billion in transactions daily during this period. That’s equivalent to every individual on Earth processing $17 daily through Visa’s network.

This not only translates into incredible revenue for Visa but also substantial profits. Thanks to its asset-light business model, a large portion of its revenue is converted into profit. The company reported $4.9 billion in net income for the latest quarter, a 17% increase compared to the previous year.

Admittedly, Visa faces its own challenges. One such issue is the recent rejection of Visa and Mastercard’s proposed $30 billion settlement in a lawsuit filed by merchants concerning the companies’ swipe fee practices. Although the lawsuit remains unresolved and settlement costs may rise, I’m not overly concerned. Ultimately, everyone—consumers, merchants, and card issuers—benefits from Visa’s reliable payment network.

Moreover, as previously noted, Visa possesses the profits and cash flow needed to endure an even larger multibillion-dollar settlement. In the interim, the company continues to enhance shareholder value. For instance, in its most recent quarter, the company repurchased $4.5 billion of its own shares.

Given all of these factors, along with its solid 10% revenue growth rate, I am pleased to hold Visa shares now and for many years to come.

Don’t Miss This Second Chance at a Potentially Lucrative Opportunity

Ever feel like you’ve missed the opportunity to invest in the most successful stocks? Here’s something you should know about.

Occasionally, our team of expert analysts issues a “Double Down” stock recommendation for companies they believe are on the verge of significant growth. If you’re concerned that you’ve already missed your chance to invest, now is the ideal time to buy before it’s too late. The numbers speak for themselves:

– Nvidia: A $1,000 investment when we doubled down in 2009 would now be worth $276,036!*

– Apple: A $1,000 investment when we doubled down in 2008 would now be worth $41,791!*

– Netflix: A $1,000 investment when we doubled down in 2004 would now be worth $364,248!*

Currently, we’re issuing “Double Down” alerts for three remarkable companies, and opportunities like this may not come around often.

See 3 “Double Down” stocks ›

*Stock Advisor returns as of 09/10/2024