SoundHound AI ( SOUN 1.20% ) Stocks performed well last week following the company’s announcement of strong revenue growth in the second quarter and a significant agreement.

An acquisition that leads to significant change or improvement.

Even though SoundHound had positive Q2 performance, the focus shifted to the acquisition news the company revealed before its earnings report. The company is set to purchase an enterprise. machine intelligence The software company acquired Amelia for $80 million in a combination of cash and equity. Additionally, they agreed to take on Amelia’s debt and may pay additional amounts in the future if specific revenue targets are achieved.

Amelia is recognized for its AI platform that can engage in conversations and generate responses, assisting with tasks like customer service, employee training, and administrative work. The acquisition will enable SoundHound to expand into different sectors such as finance, insurance, retail, and healthcare. The company stated that the agreement will open up various new opportunities to promote and sell additional services, as well as create new ways to generate revenue.

It is estimated that the merged company will make more than $150 million in revenue next year, with Amelia’s contribution being over $45 million. After the agreement, the company will possess $160 million in cash and $39 million in debt on its financial statement.

Meanwhile, in terms of earnings, SoundHound saw a 54% increase in Q2 revenue compared to the previous year, reaching $13.5 million. Despite this growth, the company is still operating at a loss. The adjusted loss per share was $0.04, an improvement from the $0.07 loss per share reported a year ago. EBITDA The company’s loss increased to $13.8 million from $10.1 million. At the same time, its total subscriptions and bookings backlog nearly doubled compared to the previous year, reaching $723 million. This represents revenue that has been committed and is expected to be recognized in the future.

The company made advancements in its two primary sectors: automotive and dining establishments. In the automotive sector, it announced the introduction of five new models. Stellantis Brands have fully launched their AI voice assistant services, which are now available in six out of Stellantis’s 14 brands. SoundHound confirmed that an undisclosed U.S. brand has also implemented this technology. An electric vehicle (EV) The company is preparing to start manufacturing its AI voice assistant for all of its vehicles and has also strengthened its partnership with a European electric vehicle manufacturer.

In the restaurant sector, a deal was made with a major global pizza chain for phone ordering services, and two coffee chains adopted its employee support solution. Additionally, Beef ‘O’ Brady’s, a sports pub with approximately 140 establishments in 21 states, introduced SoundHound’s AI voice ordering system in all its locations.

The company anticipates that its revenue for the full year of 2024 will exceed $80 million and is projected to increase to more than $150 million the following year.

Credit: Getty Images.

Has the opportunity to purchase the stock expired?

SoundHound’s stocks have experienced a volatile journey this year. Initially, they surged following reports that Nvidia Invested in the company and saw the stock price increase four times before experiencing a significant drop. Despite this drop, the stock is still up more than 140% since the beginning of the year.

The company has been successful in securing agreements in its main automobile sector and has a significant amount of pending business. Additionally, it is expanding its presence in the restaurant field. By acquiring Amelia, it aims to introduce its technology to different industries, leveraging its AI voice technology for customer service and staff support solutions, an area where it has excelled in the restaurant sector.

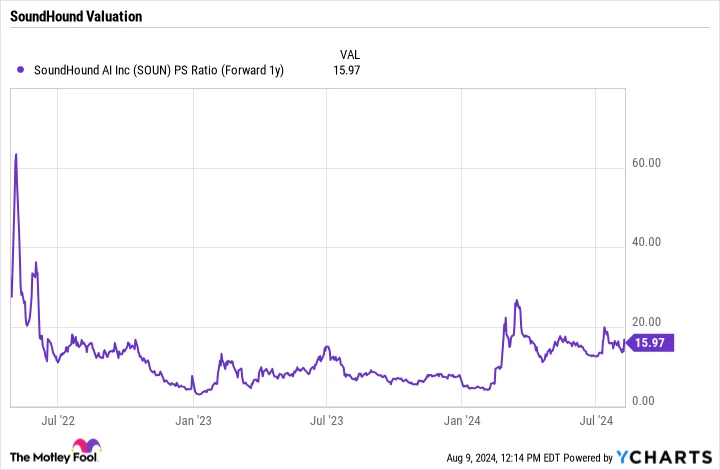

Looking at the valuation, SoundHound is currently being traded at a future price. The price-to-sales ratio (P/S) The ratio is almost 16 times the 2025 analyst estimates, which did not include Amelia’s contribution. According to the company’s 2025 guidance, the multiple decreases to around 12 times.

Data by YCharts .

SoundHound is purchasing Amelia for a price that is less than twice the revenue expected for next year. This highlights the high premium associated with owning SoundHound stock.

SoundHound still shows great potential, but due to its high valuation and limited history of success, it is considered a risky investment.