Contents

- 1 SoundHound AI’s Wild Ride in 2024

- 2 Company Overview: SoundHound AI’s Growth and Market Position

- 3 Should Investors Consider SoundHound AI?

- 4 Justifying the Valuation: SoundHound AI’s Impressive Growth

- 5 Future Outlook: Potential Upside for SoundHound Stock

- 6 Seizing the Opportunity: A Second Chance for Investors

SoundHound AI’s Wild Ride in 2024

SoundHound AI has experienced a tumultuous 2024, with its stock soaring in the first quarter to a 52-week peak by mid-March, only to plummet by 45% afterward. This volatility has left investors questioning the reasons behind such drastic changes.

Company Overview: SoundHound AI’s Growth and Market Position

SoundHound AI is renowned for its specialization in voice artificial intelligence (AI) solutions for enterprises. The company has consistently demonstrated remarkable growth, reporting strong quarterly performances. Recently, SoundHound has taken strategic initiatives to solidify its presence in the burgeoning voice AI solutions market. At first glance, the stock’s sharp decline might seem perplexing, given the company’s solid growth trajectory. However, the high valuation of the stock might have triggered investor concerns.

Valuation Concerns

Earlier in the year, SoundHound’s stock was trading at more than 40 times its sales. Even after a significant pullback, it still commands a valuation of 24 times sales. This premium valuation may have prompted some investors to reassess their positions.

Should Investors Consider SoundHound AI?

With its robust growth yet high valuation, is SoundHound AI an appealing choice for growth-focused portfolios? What lies ahead for investors over the next three years with SoundHound stock? Let’s delve deeper into the company’s prospects.

Justifying the Valuation: SoundHound AI’s Impressive Growth

Despite its smaller size, SoundHound AI has shown impressive growth. In the first half of 2024, the company reported $25 million in revenue and an adjusted loss per share of $0.23, slightly improving from $0.25 per share the previous year. The management projects a minimum of $80 million in revenue by year-end, signaling accelerated growth in the latter half of the year.

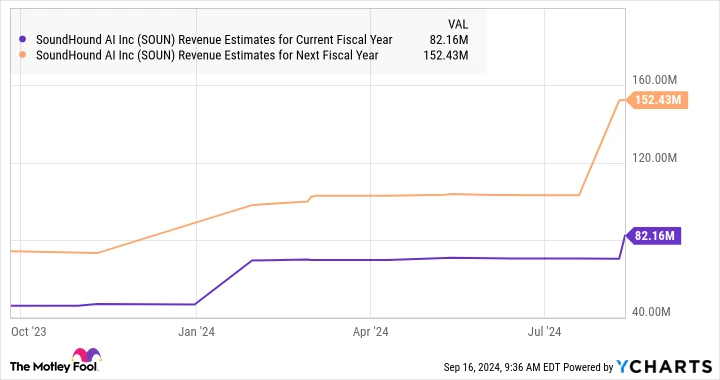

Looking ahead, SoundHound anticipates 2025 revenue to reach at least $150 million, an 87% increase from 2024. In 2023, the company achieved a 47% revenue increase, ending the year with $46 million. This accelerating growth indicates strong market traction for SoundHound’s voice AI products.

Expanding Customer Base

SoundHound has been steadily expanding its customer base across the automotive and hospitality sectors. Notable clients include six brands from automaker Stellantis, which utilize SoundHound’s generative AI voice assistants. An unnamed U.S. electric vehicle (EV) manufacturer is also set to deploy these assistants fleet-wide. Additionally, Stellantis plans to launch SoundHound’s solutions in Latin America, while a European EV maker is enhancing its collaboration with the company. Several quick-service restaurants have also adopted SoundHound’s voice ordering systems.

Strategic Acquisition

To bolster its position in customer service, SoundHound acquired Amelia, an enterprise AI software provider, for $80 million. This acquisition expands SoundHound’s reach to top global banks and Fortune 500 companies, serving approximately 200 marquee customers. This move aligns with the projected 28% compound annual growth rate in the voice assistant AI market, expected to generate $32 billion in annual revenue by 2033. As a result, SoundHound’s robust revenue growth could persist beyond 2025.

Future Outlook: Potential Upside for SoundHound Stock

SoundHound forecasts its 2025 revenue to surpass $150 million, though analysts predict an even higher figure.

Revenue Growth Projections

Based on 2023’s $46 million revenue, SoundHound is on track for a 78% increase this year, with an additional 85% growth anticipated in 2025. Should the company sustain a 50% growth rate in 2026, revenue could reach $228 million within three years.

Revenue Pipeline and Market Cap Potential

SoundHound’s management cites a revenue pipeline of $723 million, with its cumulative subscriptions and bookings backlog doubling year-over-year in the last quarter. This backlog surpasses the combined revenue forecasts for 2024 and 2025 and exceeds the estimated 2026 revenue. If SoundHound achieves $228 million in 2026 revenue and trades at a valuation of 12 times sales, its market capitalization could rise to $2.74 billion, representing a 57% increase from current levels.

These projections suggest that SoundHound’s AI stock could offer substantial returns over the next three years, even if it trades at a lower sales multiple than currently. Risk-tolerant investors might find SoundHound appealing after its recent decline, given its impressive growth and substantial backlog.

Seizing the Opportunity: A Second Chance for Investors

Do you ever feel like you’ve missed out on investing in the most successful stocks? If so, pay attention.

Occasionally, our expert analysts issue a “Double Down” stock recommendation for companies poised for significant growth. If you’re concerned about missing your chance to invest, now might be the perfect time to act before it’s too late. The numbers speak for themselves:

– Nvidia: A $1,000 investment when we doubled down in 2009 would now be worth $302,792!*

– Apple: A $1,000 investment when we doubled down in 2008 would now be worth $40,922!*

– Netflix: A $1,000 investment when we doubled down in 2004 would now be worth $375,616!*

Currently, we’re issuing “Double Down” alerts for three remarkable companies, and opportunities like this may not come around again soon.

Explore 3 “Double Down” stocks ›

*Stock Advisor returns as of 09/18/2024