Contents

The Informed Investor’s Toolkit

As a savvy investor, you’re likely already familiar with the essentials: reviewing quarterly reports from your portfolio companies and tuning in to earnings calls for management insights. But if you’re eager for even deeper understanding, attending investor conference presentations can offer valuable perspectives.

Snowflake’s Strategic Shift

On September 12th, Snowflake (-3.29%) made waves at the Goldman Sachs Communacopia + Technology Conference. During this event, CFO Mike Scarpelli delivered a statement that has resonated deeply with investors, including myself, prompting a reevaluation of Snowflake as a potential investment.

Embracing the AI Wave

The burgeoning trend of artificial intelligence (AI) cannot be ignored, and Snowflake is fully embracing it. Initially branding itself as “The Data Cloud company” in its fiscal Q2 2022 report, Snowflake’s recent fiscal Q2 2025 report now positions it as “The AI Data Cloud company.” This shift underscores the widespread effort among tech companies to assert their AI prowess. Yet, many, Snowflake included, are rapidly investing in AI to remain competitive, rather than having been longstanding leaders. Part of this investment involves acquiring costly graphics processing units (GPUs) essential for AI workloads, which has impacted Snowflake’s profit margins.

A New Approach to GPU Investments

In a surprising turn during the conference, Scarpelli candidly remarked: “I’m not going to buy any more GPUs until I see the revenue to support it.” These 16 words struck a chord as they reflect a prudent, revenue-driven approach to investment, deviating from the typical aggressive AI spending.

The Implications for Investors

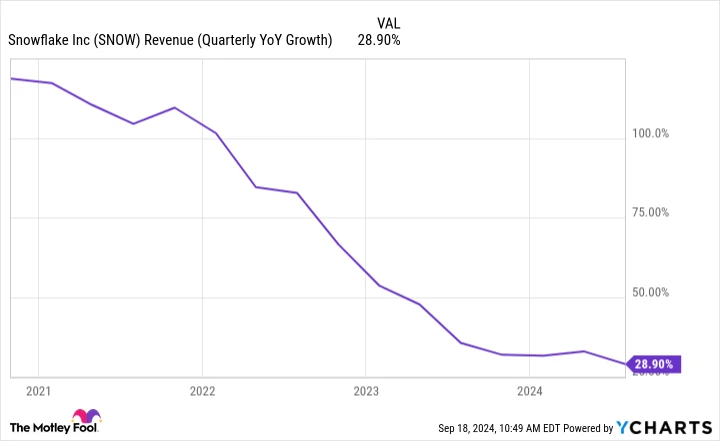

Throughout my investment journey, I’ve witnessed stocks with valuations exceeding 100 times sales and market caps soaring past $100 billion. Snowflake, shortly after its IPO, fit this rare profile due to its impressive growth and profit margins. Investors were banking on AI as a growth catalyst, given Snowflake’s data-centric operations. However, the anticipated AI-driven growth hasn’t materialized as expected. While the company continues to grow, its rate has decelerated, and AI infrastructure costs have pressured profit forecasts.

Recent figures illustrate this: Snowflake initially projected 22% growth in product revenue for fiscal 2025, coupled with a 6% operating margin and a 29% adjusted free cash flow margin. By Q2, these numbers adjusted to a 26% growth forecast, a 3% operating margin, and a 26% free cash flow margin. Despite the upward revision in revenue expectations, Scarpelli’s statement clarifies that AI is not yet a significant revenue driver, though it is inflating expenses due to GPU purchases—a potential reason for Warren Buffett’s company divesting its Snowflake shares.

Investing in companies with rising expenses and stagnant revenue is typically risky. Thus, Scarpelli’s cautious stance on further GPU purchases until they contribute to growth is a welcome strategic shift.

Rethinking Snowflake as an Investment

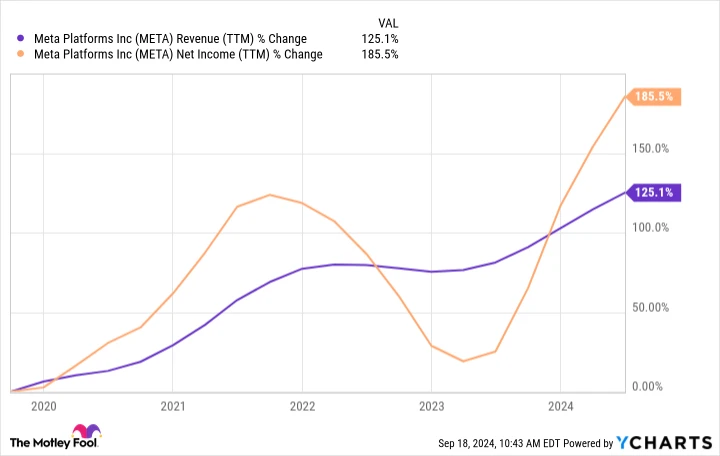

Companies that pursue indiscriminate spending on the latest trends often face financial pitfalls. However, those that rigorously evaluate expenses and require tangible returns can yield positive outcomes for shareholders. A recent example is Meta Platforms, which, after declaring 2023 its “year of efficiency,” saw profits soar without sacrificing growth.

Since the start of 2023, Meta Platforms’ stock has quadrupled as it prioritized justifiable spending, leading to increased profitability and stock performance.

Could Snowflake be on a similar trajectory? It’s early to tell, but the CFO’s demand for ROI in AI investments signals a positive shift towards efficiency. With Snowflake’s stock trading at 11 times sales—its lowest valuation yet—if the company maintains its growth while managing expenses, brighter days may lie ahead.

Should You Invest in Snowflake Now?

Before making a $1,000 investment in Snowflake, consider this:

The Motley Fool Stock Advisor’s analyst team recently highlighted what they believe are the top 10 stocks for investors right now, and Snowflake didn’t make the list. These 10 stocks have the potential for substantial returns in the coming years.

To illustrate, Nvidia was recommended on April 15, 2005, and a $1,000 investment at that time would now be worth $710,860!*

Stock Advisor provides a strategic roadmap for investors, complete with portfolio-building guidance, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the S&P 500’s return.*

Explore the top 10 stocks ›

*Stock Advisor returns as of September 17, 2024