Company selling energy drinks Monster Beverage Corporation is a legendary figure in the investment industry; individuals who have held onto their investments for an extended period of time have experienced significant financial gains, despite occasional fluctuations in stock prices. Investors are optimistic about Celsius Holdings is a company that produces a range of beverages. ( CELH -0.63% ) Another energy drink company, which has increased in value by over 21,000% in the last ten years, still has the potential to generate significant profits.

Nevertheless, the stock has declined by more than 60% this year, leading investors to doubt if Celsius’s peak investment years have already passed.

Therefore, the decision for investors to buy, sell, or hold the stock can be easily determined by the clear facts available.

The peak growth period for Celsius has passed, but that is not a concern.

Celsius specializes in selling energy drinks targeted towards active individuals who prioritize their health. Their products are free from sugar and instead contain extra vitamins and natural supplements.

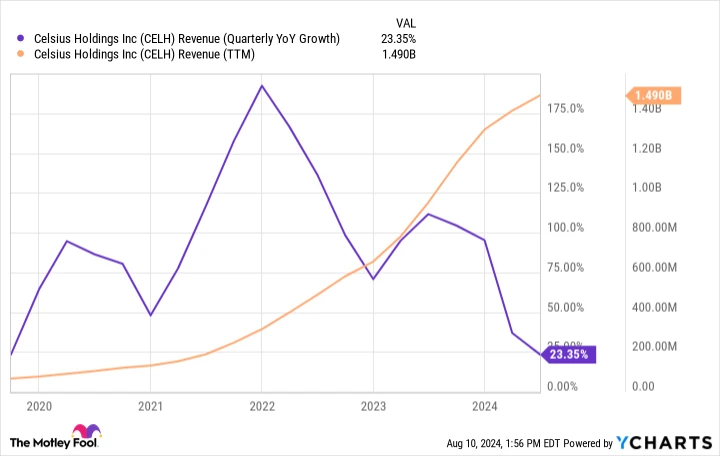

The company has been established for a considerable period, but its brand experienced a significant surge in popularity during the pandemic. Subsequently, in the middle of 2022, a beverage giant became involved. PepsiCo PepsiCo made a strategic investment of $500 million, which involved providing distribution support to significantly expand Celsius’s presence in retail stores and other sales channels. This boost from PepsiCo led to a peak year-over-year revenue growth of more than 175%.

The rate of growth is decreasing over time. It is challenging to match the high growth achieved in the previous year, especially considering that Celsius has now grown significantly and is nearing $1.5 billion in annual revenue.

Quarterly revenue growth of CELH compared to the same quarter in the previous year. data by YCharts

The decrease in the rate of growth is probably the reason for the decline in the stock price from its highest point. But that’s OK The company’s performance in the second quarter indicates that it is performing well. Statistics indicate that Celsius accounted for 46.5% of the total growth in the American energy drink industry this year, marking its highest contribution to date. This means that Celsius is expanding at a quicker rate than the overall energy drink market by capturing market share from its competitors.

Moreover, Celsius is in the initial stages of expanding its presence in global markets, a move that has the potential to boost overall company growth as it develops further in the United States. To illustrate, sales from regions outside of North America accounted for less than 5% of the total sales in the second quarter. Celsius recently entered the Canadian market in January, followed by launches in the United Kingdom and Ireland in April. The company intends to introduce its products in Australia and France by the end of the year.

Although the era of achieving triple-digit revenue growth rates may be over, Celsius is still poised for significant expansion in the future.

Are companies planning to buy back their own shares?

Celsius has achieved a significant level of profitability and has ample funds to expand its global presence. The company has earned $246 million in revenue. free cash flow In the last year, there has been a rise in Celsius temperature. debt-free The company’s balance sheet shows a cash position exceeding $900 million, which accounts for more than 10% of its total assets. market cap .

This places the company in a thrilling position.

Management may soon need to make a decision regarding how to handle the increasing amount of cash it has accumulated. One possible choice could be buying back shares By reducing the number of shares outstanding, the earnings per share are increased. Share buybacks typically contribute to boosting a company’s stock price in the long run. It is important to note that Celsius is experiencing significant sales growth, which, when combined with share repurchases, has the potential to generate substantial profits.

Should you purchase, trade, or retain Celsius stock?

Celsius is likely transitioning from being a young company to reaching a stage where it is growing and making profits, enabling it to distribute its earnings to investors.

Currently, investors can use the company’s earnings as a basis for determining the stock’s value. Presently, Celsius is valued at 37 times its projected earnings for 2024. Additionally, analysts anticipate that Celsius will experience a 31% annual growth in earnings over the next three to five years.

If Celsius can sustain a growth rate of 20% or higher in annual sales over the next few years, the outlook appears promising. With a 29% year-over-year increase in sales across the company in the first half of 2024, there is a strong sales momentum. Additionally, the company’s growing impact on the energy drink market’s overall expansion should reassure investors about the demand for the Celsius brand among consumers.

If the current trend persists and Celsius performs as anticipated, the drop in the stock price has made it attractive. Investors with a long-term perspective should find it reasonable to pay 37 times the company’s earnings for a business that is increasing its earnings by more than 30% each year. PEG ratio With a ratio of only 1.2, this is comfortably below my desired threshold of 1.5 or lower for top-notch stocks.

Occasionally, certain stocks fall out of favor and are sold off by the market. When this happens, it can be seen as a chance to purchase Celsius at a discounted price, which could be advantageous for investors looking at the long-term perspective.