Recently, there has been a decline in the performance of major technology stocks as investors express worries regarding the potential returns on investments in artificial intelligence (AI) and the possibility of overinflated valuations. The looming threat of an economic downturn is also contributing to the downward pressure on the markets.

A majority of the stocks in the “Magnificent Seven” are not meeting expectations. S&P 500 and the increase of 9% it has experienced this year. Meanwhile, stocks of Nvidia , Meta Platforms , and Alphabet Some stocks have increased by over 10% this year, while the rest are falling behind. The two stocks that are performing the worst are in the bottom rankings. Seven impressive individuals are Microsoft ( MSFT 0.83% ) and Tesla ( TSLA 0.58% ) .

Would it be advisable to include these stocks in your investment portfolio at the present moment?

1. Microsoft

Microsoft has been one of the major players in the industry. AI stocks In recent years, the company has made significant investments in OpenAI and has incorporated AI features into its Office suite, which has led to increased ownership. With high expectations from investors, the computer manufacturer surpassed projections in its latest quarterly report, although some investors may have anticipated even greater results.

Revenue for the quarter ending June 30 reached $64.7 billion, showing a 15% increase compared to the previous year. This exceeded analysts’ expectations of $64.4 billion. Additionally, the adjusted earnings per share were $2.95, slightly surpassing analysts’ anticipated per-share profit of $2.93.

Microsoft is a highly successful company with significant opportunities in the field of artificial intelligence. However, as one of the most valuable companies globally trading at 34 times its recent profits, it faces high expectations. Simply meeting earnings may not be enough for Microsoft to sustain its current high market value. While its 7% gains this year are decent, further growth may be necessary for the company to continue to perform well. The introduction of new AI-powered PCs will be a crucial factor in determining Microsoft’s future success.

Ultimately, Microsoft remains a promising investment due to its significant potential for growth in areas such as personal computers, gaming, and cloud services. Despite the company’s high valuation, its strong business performance suggests that as it expands, its profits will also increase, enhancing its overall value. For investors seeking a long-term investment opportunity, Microsoft is worth considering as a valuable addition to their portfolio.

2. Tesla

Tesla is the least successful stock among the Magnificent Seven. Without a recent increase in its value, it would be experiencing a much steeper decline than the current 20%. This highlights the significant challenges faced by the electric vehicle manufacturer this year.

The interest from consumers in Tesla’s electric vehicles has decreased compared to previous times, partly due to economic challenges and an increase in competitors. Tesla has lowered its prices in reaction to rival electric vehicle manufacturers providing more affordable options.

Tesla faces a challenge as it requires increased prices to maintain its profit margins. If the margins are not high, it will impact the company’s financial performance. A lower bottom line results in a higher stock price. The ratio of a company’s stock price to its earnings per share. Historically, investors have been willing to pay extra for Tesla’s shares due to the company’s strong performance. However, with the current challenges in achieving growth, justifying this premium has become more difficult.

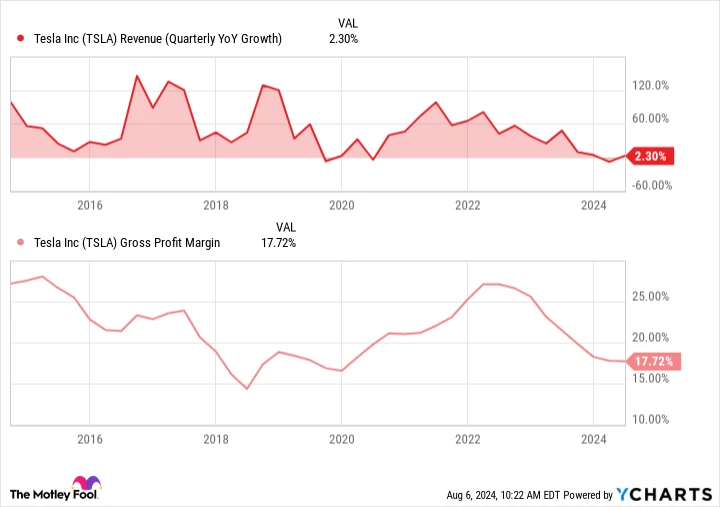

The company has been experiencing a decline in both profit margins and growth rates over the past few quarters, causing concern among investors.

Quarterly Year-over-Year Growth in Tesla’s Revenue data by YCharts

Tesla may not be as attractive of an investment as Amazon. The stock is currently trading at a higher price-to-earnings ratio of 55 and faces increasing competition that may hinder its financial performance in the near future. Due to the uncertainties surrounding Tesla’s prospects, it may be wise for investors to refrain from purchasing the stock at this time.