During a period when numerous businesses are mentioning difficulties with consumer spending or tough overall economic conditions, On Holding ( ONON 3.39% ) has been a notable exception. Stocks of the high-performance footwear and athletic apparel company have increased by almost 60% this year, driven by outstanding operational trends and financial performance.

Investors have plenty of reasons to be excited, but can the upward trend in On Holding stock continue? Here’s the information you should consider.

Contents

A summary of On Holding’s earnings for the second quarter of 2024.

On Holding has had a remarkable beginning to the year, pursuing a strategy of global expansion. During the second quarter, the company achieved a net sales increase of 29.4% compared to the same quarter last year, measured on a constant currency basis. This growth was driven by robust performance in both its direct-to-consumer and wholesale channels.

The company is experiencing significant growth for its brand globally. Although the Asia-Pacific region currently accounts for only 10% of the total business, sales in the second quarter increased by 84.7% compared to the previous year, when adjusted for currency fluctuations, indicating a significant increase in customer recognition in countries such as China and Japan. Additionally, sales in the Americas region saw a strong increase of 24.6%.

In the earnings conference call, management highlighted that the worldwide demand is outpacing supply, a favorable situation for many businesses. On Holding is leveraging this situation to implement premium pricing and boost profitability. The increase in both sales volumes and operational efficiency led to the adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) margin rising to 16% in Q2, up from 14.1% the previous year.

On Holding is reaffirming its annual projection for “a minimum of 30% net sales growth when accounting for constant currency,” and remains optimistic about the future. Although the company experienced outstanding results in the second quarter, short-term inventory limitations are currently the sole factor preventing an even more robust forecast.

Photo credit: Getty Images.

The initial phases of a major opportunity

The appeal of investing in On Holding begins with the perception that the company is at the beginning of a significant shift toward becoming a well-known global fitness and lifestyle brand. Be it their reputation for high-quality products or their unique designs, it is evident that On Holding is resonating with consumers.

The company is expected to achieve around $2.7 billion in sales this year, which is a notable amount, yet remains small when compared to the $51 billion in sales from a competitor. Nike or possibly $10 billion by Lululemon Athletica is a company that specializes in athletic apparel and accessories. Over the past year, it’s notable that On Holding has experienced success, especially as Nike and Lululemon are facing challenges in reigniting their growth.

There is a possibility that On Holding will capture a growing share of the global footwear market, and apparel market serves as a significant platform for the company.

Remember that many categories within On Holding remain largely unexplored. At present, shoe sales account for 96% of the business, while clothing and accessories constitute only a small portion. The company’s potential to attract new customers in different markets and expand its product range instills some confidence in its growth prospects.

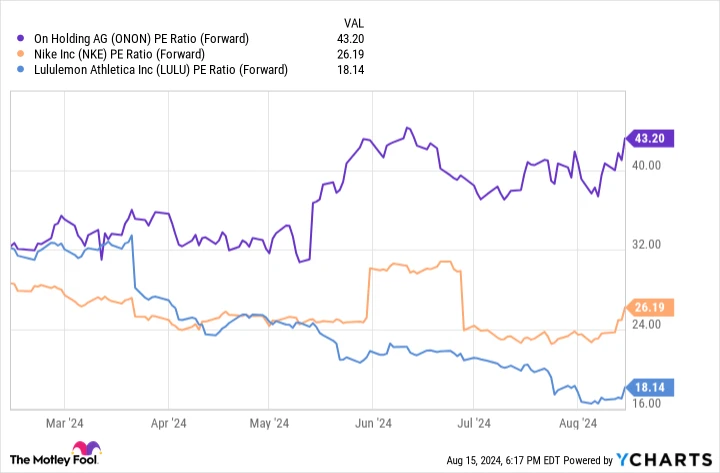

On Holding shares are currently valued with a forward price-to-earnings (P/E) ratio of 43, based on the average Wall Street projection of $1.01 for their 2024 earnings-per-share (EPS).

Although this level is considered a premium when compared to similar entities like Nike With a price-to-earnings ratio of 26, or even Lululemon’s 18, one could argue that the difference is warranted due to On Holding’s robust earnings growth. Looking ahead to 2025 and beyond, the company has significant potential to expand into its valuation, providing a boost for the stock.

ONON Forward Price-to-Earnings Ratio data by YCharts.

I remain optimistic about On Holding’s stock.

On Holding’s recent results have strengthened the optimistic outlook for the stock. Assuming the macroeconomic environment stays stable, I think there’s a strong possibility that On Holding’s shares will keep rising.

In the coming quarters, it will be important to keep an eye on the trends in profit margins and sales growth across different regions. For investors focused on the long term, On Holding stock could be a valuable component of a diversified investment portfolio.

Make sure you seize this second opportunity for a potentially profitable venture.

Do you ever feel like you missed out on investing in the most profitable stocks? If so, you’ll be interested in this.

Sometimes, our specialist team of analysts releases a “Increase Investment” stock suggestions for businesses that appear to be on the verge of significant growth. If you’re concerned that you’ve already missed the opportunity to invest, now is the ideal moment to purchase before it’s too late. The statistics are clear:

- Amazon: if you put $1,000 into the investment when we increased our commitment in 2010, you would possess $20,146 !*

- Apple: if you had put in $1,000 when we increased our investment in 2008, you would possess $42,850 !*

- Netflix: if you had invested $1,000 when we increased our commitment in 2004, you would possess $376,717 !*

Currently, we’re sending out “Double Down” alerts for three remarkable companies, and opportunities like this might not come around again for a while.

Take a look at three stocks to “Double Down” on.

*As of the latest update, Stock Advisor’s performance results are 08/21/2024