In the past few years, there has been a noticeable increase in geopolitical tensions, particularly due to the ongoing conflicts in Ukraine and the Middle East. While it might be anticipated that defense contractors would have seen significant profits as a result, this has not actually been the situation.

Take Lockheed Martin is the name of the company. ( LMT -0.52% ) For instance, between the beginning of 2023 and a few weeks ago, the stock did not show any growth for investors. The company encountered obstacles such as decreasing profit margins and a temporary halt in the delivery of its F-35 jets due to technological enhancements.

The defense contractor is experiencing positive developments as Lockheed has just announced strong financial performance for the second quarter. Moreover, the United States has started accepting deliveries of its jets again after a hiatus of almost a year. Find out more about Lockheed and consider joining now as it could be a favorable opportunity.

Lockheed Martin may be on the verge of a positive change.

Lockheed Martin creates and innovates cutting-edge technology for the U.S. government and its partners, and stands as one of the biggest companies in the world. defense Lockheed is identified as the top defense contractor in the United States based on its $46 billion in contract commitments, as reported by Bloomberg Government, surpassing all other contractors in total sales. RTX and General Dynamics is a company that operates in the defense and aerospace industries. .

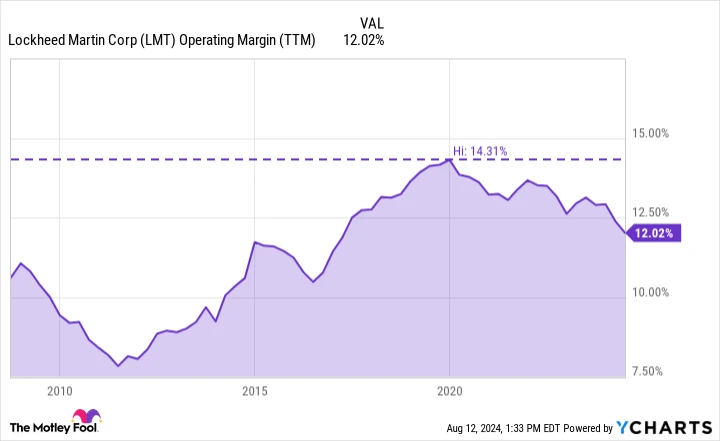

The company is in a good position despite the increase in geopolitical tensions in recent years. Nevertheless, Lockheed and other defense contractors are facing continuous challenges with their supply chains and the increasing costs of raw materials. They might also be encountering difficulties in fulfilling fixed-priced contracts that were agreed upon before inflation became a concern in the economy. Margins are facing a decrease in profitability. .

Last Twelve Months Operating Margin for LMT data by YCharts

Additionally, there have been delays in software development causing a nearly year-long halt in the delivery of F-35 fighter jets to the U.S. government. Lockheed has been enhancing its jets through a program known as Technology Refresh 3 (TR-3), introducing a new cockpit display and other enhancements.

TR-3 has been described as the essential foundation for future improvements to the fighter jet. These enhancements are a key component of a larger strategy to enhance the technology and introduce Block 4, which will provide the jets with the most advanced and innovative technology available.

Last month, Lockheed received positive news when the U.S. government restarted accepting F-35 jet deliveries after a temporary halt. While the company still needs to update the software, it has made significant advancements and is now ready to transport its stored jets. It anticipates delivering between 75 to 110 aircraft in the latter part of this year.

What does the future hold for the defense company?

The defense company is experiencing a positive trend, evident in the recent 21% increase in its stock value over the last month. Along with recommencing shipments of its F-35, the company disclosed strong performance in the second quarter, surpassing experts’ forecasts for both revenue and profits. increased its annual forecast The company has revised its sales projections upwards by 2.5% to reach $71 billion, while also raising its expected earnings per share from $26 to $26.35 at the halfway point.

Experts anticipate that Lockheed will experience an increase in its profit margins and free cash flow until 2026 due to the recommencement of F-35 jet deliveries, which will eliminate a major concern for the company. Baird, as reported by The Fly, has recently raised its stock price target for Lockheed and mentioned the emergence of a positive long-term transformation in the company.

Should I purchase, sell, or keep my shares in Lockheed Martin?

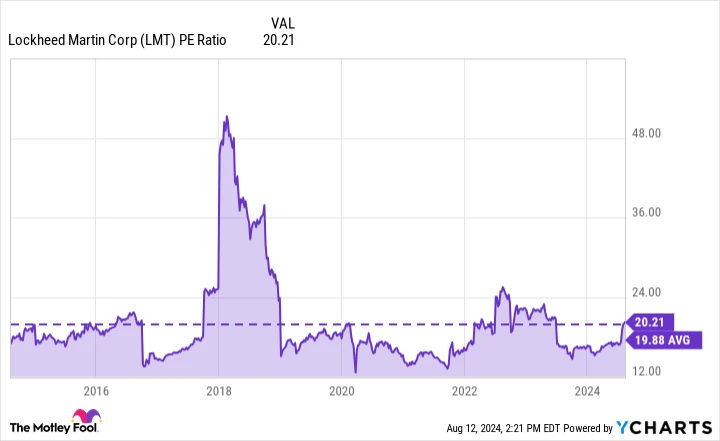

Lockheed Martin has experienced challenges in recent years due to decreased profit margins and delays in delivering products, leading to disappointing stock results for shareholders. Despite a recent increase in stock value, Lockheed’s price-to-earnings ratio is currently 20.2, slightly higher than its average of 19.9 over the last decade.

LMT PE Ratio data by YCharts

Lockheed Martin may not be considered inexpensive, but it is also not considered costly. The current trend suggests that today might be a favorable time for long-term investors to consider buying the stock. The company is in a good position, with strong demand for its various programs such as the PAC-3 air defense missile and the high mobility artillery rocket system (HIMARS), especially given the increased geopolitical tensions.

Lockheed, as a leading defense contractor for the U.S. government, is expected to gain advantages due to its significant backlog of $160 billion, which is over twice its yearly revenue.