Charles Schwab ( SCHW 0.19% ) has faced challenges in recent years due to interest rates reaching levels not seen in decades, which have impacted the business. The financial services firm, which has depended significantly on inexpensive deposits to support its operations, has encountered a reduction in bank deposits and has had to reconsider its business strategy.

In the second-quarter earnings call, CEO Walt Bettinger announced plans to downsize the bank over the coming years. Here’s the reasoning behind this decision and its implications for the future of the business.

Contents

- 1 Charles Schwab has depended on inexpensive sources of funding.

- 2 The rapid sorting of client cash was hastened by the Federal Reserve’s aggressive interest rate policy.

- 3 Here’s what Schwab has planned for the future

- 4 Should you purchase, sell, or retain your shares in Charles Schwab?

- 5 Consider the following before purchasing shares in Charles Schwab:

Charles Schwab has depended on inexpensive sources of funding.

Bettinger stated that Charles Schwab plans to transfer extra deposits to external banks, a strategy intended to lower the “capital intensity” of its banking operations. This decision is also expected to enhance the company’s liquidity, addressing the challenges it has faced with deposit withdrawals since the Federal Reserve started significantly increasing interest rates.

This decision is probably the smartest one by Schwab. Throughout the 2010s, the financial services firm significantly depended on inexpensive deposits, which enabled it to outperform peers with an exceptional return on equity (ROE) The company’s affordable business strategy worked well because interest rates remained low for several years after the Great Recession.

This affordable deposit model has faced difficulties when interest rates increase. Starting in 2017, the Federal Reserve slowly started to increase its benchmark federal funds rate. Although these rate increases were less aggressive than the central bank’s actions in recent years, Charles Schwab encountered an issue with deposit withdrawals, known as “client cash sorting.”

Customers opted to capitalize on opportunities rather than leaving their deposits in bank accounts with low interest rates. savings account with a high interest rate accounts, certificates of deposit, or other relatively secure investments that offer a reasonable return.

Photo credit: Getty Images.

The rapid sorting of client cash was hastened by the Federal Reserve’s aggressive interest rate policy.

issue of Schwab’s client cash sorting, which was only a minor concern in 2017, became more significant when the Federal Reserve started increasing interest rates in 2022. The the issue expanded significantly In a little more than a year, the federal funds rate increased from almost zero to 5%, making high-yield savings accounts and other interest-related products very appealing to investors.

The most challenging period was between August 2022 and April 2023, during which Schwab’s average bank account deposit balances decreased by $49.8 billion Since the beginning of the Federal Reserve’s cycle of increasing interest rates, there has been a 33% decrease. Even though the rate of withdrawal has substantially slowed, Schwab’s bank is still experiencing a loss of deposits. In this year alone, deposits in Schwab’s bank accounts have decreased by an additional $10.3 billion, bringing the total to $85.1 billion.

Due to declining deposits, Schwab had to turn to more expensive funding options, such as retail certificates of deposit and loans from the Federal Home Loan Bank, to maintain sufficient liquidity in case customers kept withdrawing money from their accounts. Consequently, these increased costs have reduced Schwab’s net interest margins, negatively impacting the business in recent quarters.

Here’s what Schwab has planned for the future

Charles Schwab’s decision to reduce the size of its bank is expected to take several years to fully implement as it aims to carry out its strategy across the cycle of interest rates Consequently, numerous analysts have reduced their forecasts for Schwab’s profits and net interest income for the coming years. The Fly reports that experts at Banc of America observed that the change represents a complete reversal in Schwab’s strategy focused on banking.

Schwab’s decision is likely to impact its growth and profits in the coming years. Nonetheless, I believe it’s a wise choice for the future of the company. There is a the risk of inflation over an extended period and interest rates will stay elevated.

Significant structural shifts have been occurring over the past few years. A shift away from globalization towards more protectionist measures, increasing fiscal responsibilities and government deficits, along with escalating geopolitical tensions, could all contribute to sustained inflationary pressures. Should this occur, it is unlikely that inflation and interest rates will return to the low levels experienced during the 2010s.

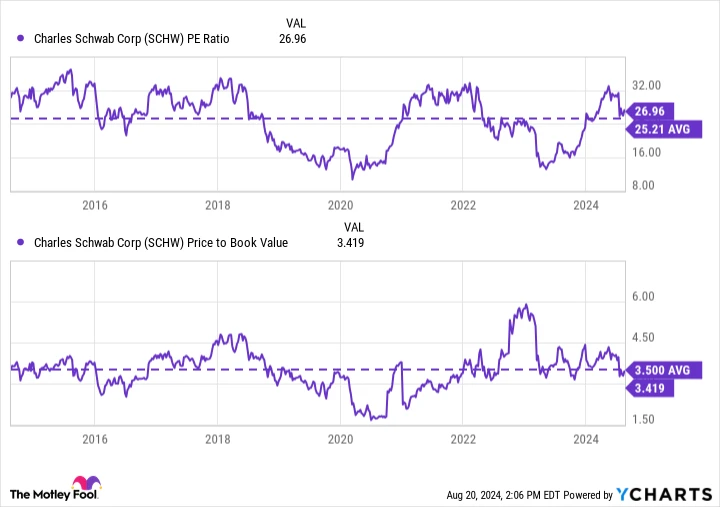

Charles Schwab may experience increased volatility and reduced returns in the coming years as it restructures its business. The stock is currently valued around its 10-year averages in terms of price-to-earnings and price-to-book value, indicating that it isn’t a bargain. If you’re already an investor, it’s advisable to hold onto your shares, but there doesn’t seem to be an urgent reason for new investors to purchase shares at this moment.

SCHW PE Ratio data by YCharts

It’s beneficial for Schwab that the leadership recognizes that past strategies might not be effective in the future and is implementing necessary measures to mitigate this risk moving forward. This process will require time and may alter certain facets of the business, making it important to monitor these developments closely over the upcoming quarters.

The Foolish Investor Stock Advisor the analyst team has just discovered what they consider to be the 10 best stocks for investors to purchase at this time… and Charles Schwab wasn’t included in the list. The ten stocks that were selected have the potential to yield substantial returns in the upcoming years.

Consider when Nvidia created this list onIf you had put $1,000 into an investment following our advice on April 15, 2005, you would possess $792,725 !*

It’s important to mention Stock Advisor the overall average return is765% — significantly outperforming the market compared to 165% for the S&P 500. Make sure you check out the newest top 10 list.

*Performance of Stock Advisor as of August 22, 2024